Daily technical highlights – (JAG, HPMT)

kiasutrader

Publish date: Tue, 02 Mar 2021, 08:51 AM

JAG Bhd (Trading Buy)

• JAG is one of Malaysia’s leading total waste management services provider by market share. The Group is also involved in the coin-operated laundry services, property development & software solutions.

• The stock is an indirect proxy to the fast growing electrical and electronic industry in Malaysia given its niche in the recovery and recycling business of e-waste (electrical & electronic wastes). JAG sources for materials or wastes from a supply chain that is backed by electrical & electronic industry players and semiconductor manufacturers in Malaysia, and then extracts and processes the e-wastes into ferrous, non-ferrous and precious metals.

• The bulk of its sales revenue is derived from export markets to countries like China, Japan and Philippines with the commonly traded commodities being copper, tin, silver and gold. Hence, the Group stands to benefit from the ongoing rally in these commodity prices.

• Reflecting the positive impact, JAG reported net profit of RM3.0m (+19% YoY; +22% QoQ) in 4QFY20, taking its full-year earnings to RM9.2m (versus net loss of RM11.9m previously). Assuming annualised earnings of RM12m based on its 4QFY20 result, this translates to an undemanding FY21 PER of 13.5x.

• In addition, the Group plans to develop a proposed solar energy plant capacity of up to 29MWac by leasing 112 acres of land in Perak to participate in a bidding process for the large-scale solar programme by the Malaysian government.

• On the chart, after bouncing up from a recent low of RM0.15 in the beginning of November last year to break past the 100-day SMA line, JAG shares will probably plot higher highs going forward.

• Riding on the uptrend, the stock could swing towards our resistance thresholds of RM0.38 (R1; 21% upside potential) and RM0.43 (R2; 37% upside potential), respectively.

• We have pegged our stop loss price at RM0.25 (or 21% downside risk from its last traded price of RM0.315).

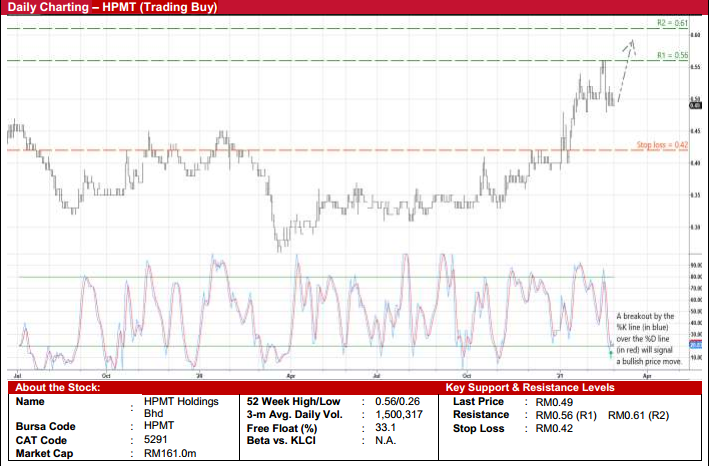

HPMT Holdings Bhd (Trading Buy)

• HPMT is involved in the manufacturing and distribution of cutting tools as well as trading of auxiliary cutting tools, equipment and accessories for metalworking. These cutting tools are part of an engineering function that are used (by the likes of electronic and automotive manufacturers) to support the machining process by performing metal chip removal according to the engineering precision tolerance levels.

• The Group posted stronger net profit of RM3.6m (+53% YoY; +62% QoQ) in 4QFY20, lifting FY Dec 20 earnings to RM8.3m (+6% YoY). Its healthy balance sheet is backed by net cash holdings & fund investments of RM25.6m (or 7.8 sen per share) as of end-Dec last year.

• From a technical perspective, HPMT shares are currently riding an uptrend after plotting higher highs and higher lows since early November last year.

• And with the stochastic indicator showing the %K line is on the verge of cutting above the %D line around the oversold level, the stock is poised to extend its upward trajectory ahead.

• A bullish breakout could then send the share price to challenge our resistance thresholds of RM0.56 (R1; 14% upside potential) and RM0.61 (R2; 24% upside potential).

• Our stop loss price is set at RM0.42 (representing a 14% downside risk).

Source: Kenanga Research - 2 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024