Daily technical highlights - (AWC, KPOWER)

kiasutrader

Publish date: Fri, 12 Mar 2021, 09:45 AM

AWC Berhad (Trading Buy)

• AWC provides asset management solutions and engineering services via its four business units: (i) facilities division, (ii) engineering division, (iii) environment division, and (iv) rail division.

• We are optimistic on the group’s concession business via its facilities division given its stable recurring earnings stream. To date, the group has an estimated orderbook worth c.RM957m and expects to tender for more projects (particularly in the engineering, environment and rail segments) going forward.

• QoQ, the group’s revenue increased to RM90.2m (+18% QoQ) in 2QFY21 mainly due to contributions from new projects undertaken in the Middle East region. Meanwhile, its earnings rose in tandem to RM11.2m (+100% QoQ) lifted by higher marginSs amid better cost control.

• Consensus is currently projecting AWC to post net earnings of RM24.6m in FY Jun 21 and RM25.1m in FY Jun 22, which translates to undemanding forward PERs of 8.0x and 7.9x, respectively.

• On its balance sheet, the Group is sitting on net cash holdings & short-term investments of RM99.3m (or 31.5 sen per share) as of end-December 2020.

• Chart-wise, the stock has continued to trend higher following the completion of its mini-saucer pattern. Given that the shortterm key SMAs are still treading above the longer-term key SMAs, we thus expect the uptrend to persist.

• With that, our resistance levels are set at RM0.735 (R1; +18% upside potential) and RM0.800 (R2; +28% upside potential).

• Our stop loss is pegged at RM0.570 (-9% downside risk)

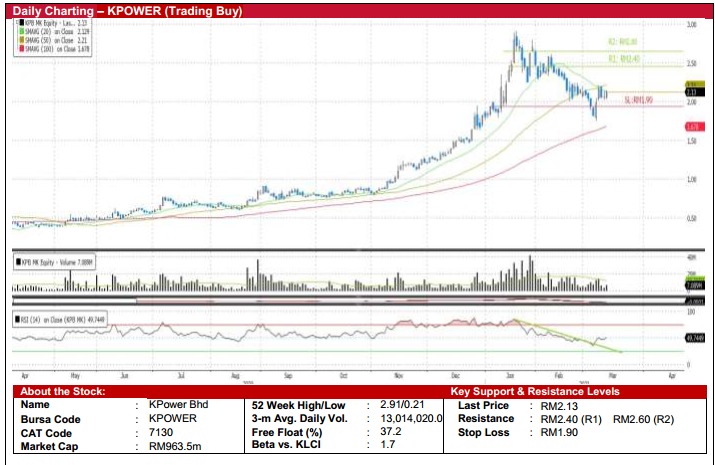

KPower Bhd (Trading Buy)

• KPOWER is a company which operates mainly in the energy and utilities sectors (i.e renewable energy segment).

• The group has reportedly participated in the Large-Scale Solar 4 (LSS4) tender, the outcome of which is expected to be announced in the near-term. In addition, the group has continued to expand its healthcare segment via c.RM72m worth of contracts for the supply of Covid-19 related products in the Indonesian market.

• Overall, the group is aiming to achieve an orderbook target of RM2b by FY21.

• QoQ, the group’s revenue increased to RM90.1m (+58% QoQ) in 2QFY21 lifted by better recognition of EPCC contracts in Laos and Malaysia. Meanwhile, net income increased marginally to RM9.3m (+14% QoQ) due to the aforementioned reason.

• Chart-wise, after retracing from an all-time high of RM2.91 in early January, the stock has recently found support at its 100- day SMA. With the RSI breaking out from its near-term downward sloping trend line, we thus believe the stock could be heading for a trend reversal.

• Our key resistance levels are set at RM2.40 (R1; +13% upside potential) and RM2.60 (R2; +22% upside potential).

• Meanwhile, our stop loss is pegged at RM1.90 (-11% downside risk)

Source: Kenanga Research - 12 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 28, 2024