Daily technical highlights - (STAR, SEM)

kiasutrader

Publish date: Wed, 07 Apr 2021, 10:05 AM

Star Media Group Bhd (Trading Buy)

• With the impending closing down of the loss-making dimsum entertainment (a subscription video-on-demand service which had reportedly incurred investment costs of approximately RM100m over the past four years) in September this year, the earnings outlook for STAR – a media group with a presence in print & digital publication, radio and event & exhibition businesses – is expected to improve going forward.

• This, in turn, is expected to boost the investment appeal of STAR shares as the Group’s net cash holdings & short-term deposits of RM353.2m (or 48.7 sen per share) as of end-December last year is presently more than the existing market value of the listed company (at RM304.4m).

• On the chart, following a multi-year downtrend which saw the share price plummeting from a high of RM2.35 in July 2016, a trend reversal may be in the offing.

• After staging a recent bounce-up from a low of RM0.34 in end-February to break away from both the 50-day and 100-day SMA lines, the stock is in a position to extend its upward trajectory ahead.

• The positive technical outlook is backed by: (i) the stochastic indicator showing the %K line crossing above the %D line in the oversold zone, and (ii) the appearance of the bullish dragonfly doji candlestick recently.

• As such, STAR’s share price will probably climb towards our resistance thresholds of RM0.48 (R1; 14% upside potential) and RM0.54 (R2; 29% upside potential).

• We have pegged our stop loss price at RM0.38 (representing a 10% downside risk)

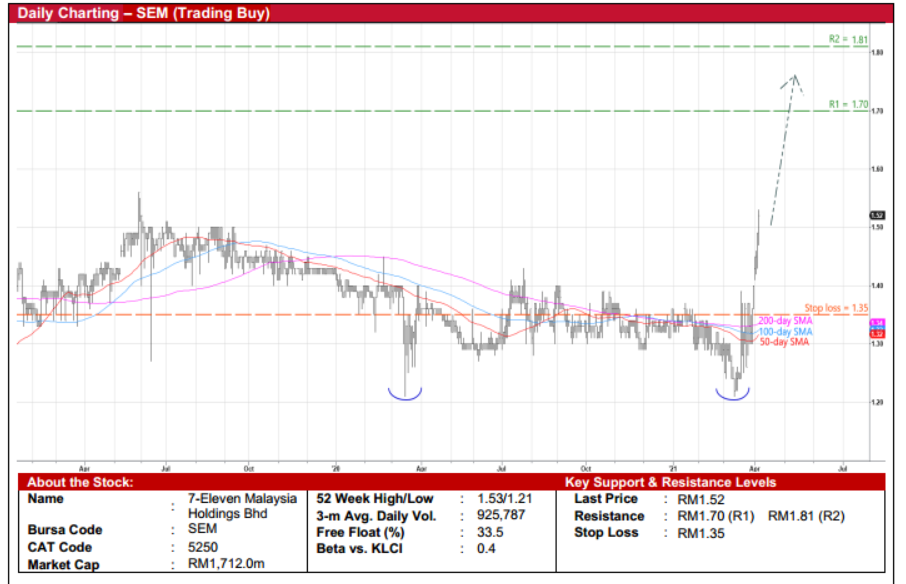

7-Eleven Malaysia Holdings Bhd (Trading Buy)

• Owned by tycoon Tan Sri Vincent Tan, SEM’s principal business activities are in: (i) the operation and franchising of convenience stores under the ‘7-Eleven’ brand name (with more than 2,400 outlets nationwide), and (ii) the operation of retail pharmaceutical chain (with more than 100 pharmacy stores under the ‘CARiNG’ brand name).

• After posting net profit of RM29.8m (-45% YoY) in FY December 2020, consensus is currently forecasting the Group’s bottomline to rebound strongly to RM61.4m in FY21 and RM69.7m in FY22, which translate to forward PERs of 28x this year and 25x next year.

• From a charting perspective, the stock has bounced off a double-bottom pattern in mid-March this year to break past the key 50-day, 100-day and 200-day SMA lines.

• With the momentum still on the upside, SEM’s share price could plot higher highs ahead, possibly challenging our resistance targets of RM1.70 (R1) and RM1.81 (R2) along the way. This represents upside potentials of 12% and 19%, respectively.

• Our stop loss price is set at RM1.35 (or 11% downside risk from the last traded price of RM1.52)

Source: Kenanga Research - 7 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024