Kenanga Research & Investment

Daily Technical Highlights – (SAMCHEM, OCNCASH)

kiasutrader

Publish date: Fri, 09 Apr 2021, 09:47 AM

Samchem Holdings Bhd (Trading Buy)

- SAMCHEM is a company that distributes a variety of chemicals for different applications (i.e personal care, household care & cleaning, automotive lubricants and agriculture).

- The group stands to benefit from a recovery in the global economy as demand picks up for its well-diversified chemical portfolios.

- QoQ, the group’s revenue increased to RM304.6m (+5.5% QoQ) in 4QFY20 following the resumption of business activities and the launch of different new chemicals. Its net income increased in tandem to RM18m (+89% QoQ) due to better cost control effect.

- Chart-wise, the stock has retraced from its all-time high of RM1.54 on 24th February this year while finding support at its 30-day SMA. The stock formed a bullish candlestick yesterday, indicating a resumption of buying interest.

- Should the buying momentum persist, our overhead resistance levels are set at RM1.65 (R1; +13% upside potential) and RM1.70 (R2; +16% upside potential) based on our Fibonacci projections.

- Meanwhile, our stop loss is pegged at RM1.30 (-11% downside risk)

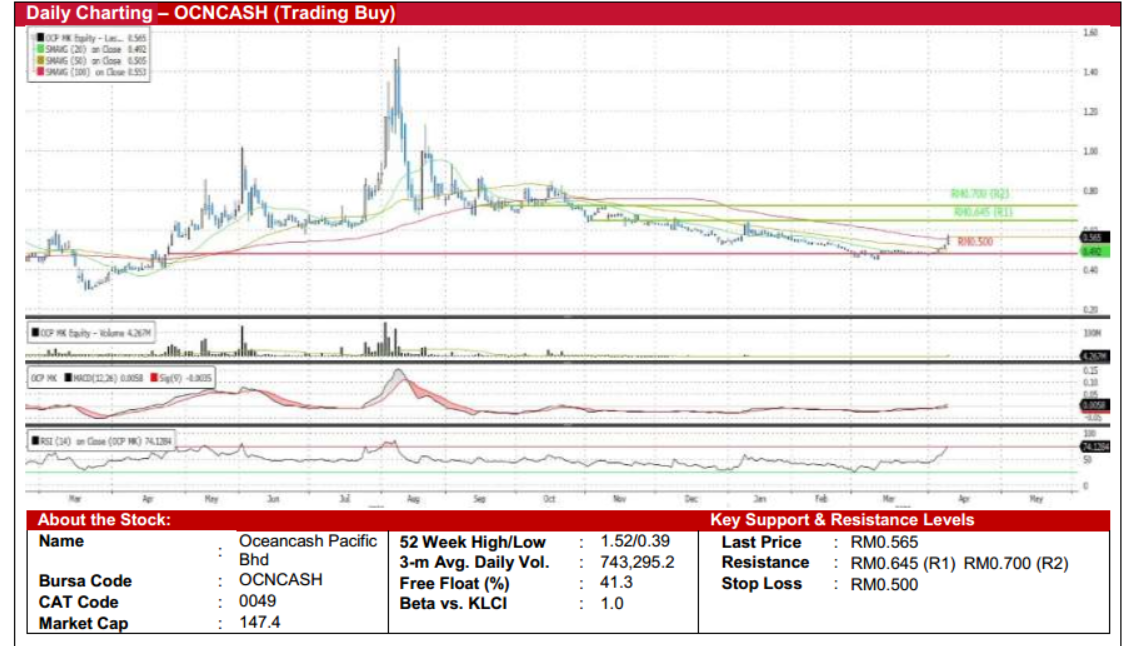

Oceancash Pacific Berhad (Trading Buy)

- OCNCASH has three business segments, namely insulation, hygiene and investment holding, with a global presence.

- Despite the roll-out of Covid-19 vaccines globally, we continue to see strong demand for Personal Protective Equipment (PPE) as it would take time to implement the vaccination programs globally. With that, the group is poised to benefit from this development as it produces the key material used in the production of PPE products.

- QoQ, the group’s revenue remained relatively unchanged at RM21.3m in 4QFY20 amid a relatively stable business environment. Meanwhile, due to better cost control measures, the group’s net income increased to RM1.5m (+64% QoQ) in 4QFY20.

- Chart-wise, the stock has been treading below its key 50-day SMA since early January this year. But a trend reversal could have occurred following the emergence of a bullish candlestick that has pierced through both the 50-day and 100-day key SMAs while finding support at the 20-day SMA. Coupled with an uptick in the RSI and given the above average trading volumes of late, we thus believe the stock could resume its uptrend ahead.

- With that, our key resistance levels are plotted at RM0.645 (R1; +14% upside potential) and RM0.70 (R2; +24% upside potential).

- Meanwhile, our stop loss is pegged at RM0.50 (12% downside risk)

Source: Kenanga Research - 9 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments