Daily Technical Highlights – (HSSEB, EITA)

kiasutrader

Publish date: Wed, 14 Apr 2021, 09:41 AM

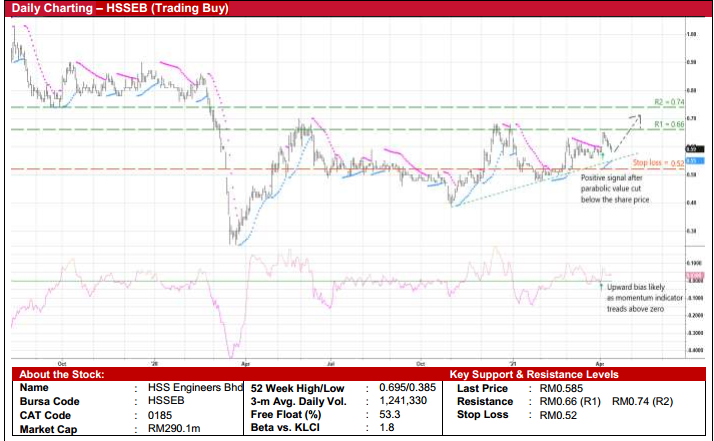

HSS Engineers Bhd (Trading Buy)

• As the largest listed engineering consultancy group in Malaysia specialising in the provision of engineering and project management services (such as engineering design, construction supervision, project management, environmental services and building information modelling services), HSSEB is a proxy to the pipeline of infrastructure projects to be implemented by the government.

• This includes the rolling out of the Mass Rapid Transit Line 3 with latest media reports saying that tenders for the Circle Line project are scheduled to be called as early as August this year. Given its previous role as the independent consulting engineer for MRT Line 1 and Line 2, HSSEB is in a steady position to get involved in MRT Line 3 too.

• Fundamentally, after seeing a net profit jump to RM10.6m in FY December 2020 (from RM1.2m in FY19), consensus is anticipating the Group to register higher net earnings of RM15.0m for FY21 and RM18.5m for FY22, which is backed by an existing orderbook of RM443m (as of end-December last year).

• This translates to forward PERs of 19.3x this year and 15.7x next year respectively, compared with its historical mean of 15.7x.

• Technically speaking, following the plotting of higher lows to form a positive sloping trendline since the start of November last year, the stock is still riding on an uptrend currently.

• On the back of the recent crossings by the parabolic value under the share price and the momentum indicator above the zero line, HSSEB shares will probably extend the upward trajectory to climb towards our resistance thresholds of RM0.66 (R1; 13% upside potential) and RM0.74 (R2; 26% upside potential).

• We have pegged our stop loss price at RM0.52 (or 11% downside risk from yesterday’s close of RM0.585).

EITA Resources Bhd (Trading Buy)

• EITA is principally involved in the: (i) design, manufacturing, installation and maintenance of elevator systems, (ii) manufacturing and distribution of electrical & electronic components and equipment, and (iii) design and manufacturing of busduct systems and metal fabricated products.

• The Group is on the road to an earnings recovery with net profit coming in at RM6.0m (flat YoY / +42% QoQ) in the first quarter ended December 2020, after previously reporting full-year net earnings of RM17.3m (-17% YoY) in FY September 2020. Its balance sheet remains healthy with net cash holdings standing at RM29.8m (or 11.5 sen per share) as of end-December last year.

• From a technical perspective, the stock has been treading sideways after tumbling from a peak of RM3.62 in late January this year to a trough of RM0.815 in the beginning of March.

• However, following the emergence of the bullish dragonfly doji candlesticks and the crossing of the momentum indicator above the zero line recently, EITA shares may find renewed strength to break out from its existing consolidation pattern.

• A probable lift could then propel the share price to challenge our resistance targets of RM1.10 (R1) and RM1.25 (R2), which represent upside potentials of 18% and 34%, respectively.

• Our stop loss price is set at RM0.82 (or 12% downside risk).

Source: Kenanga Research - 14 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024