Daily Technical Highlights – (FPGROUP, KIMLUN)

kiasutrader

Publish date: Thu, 15 Apr 2021, 09:28 AM

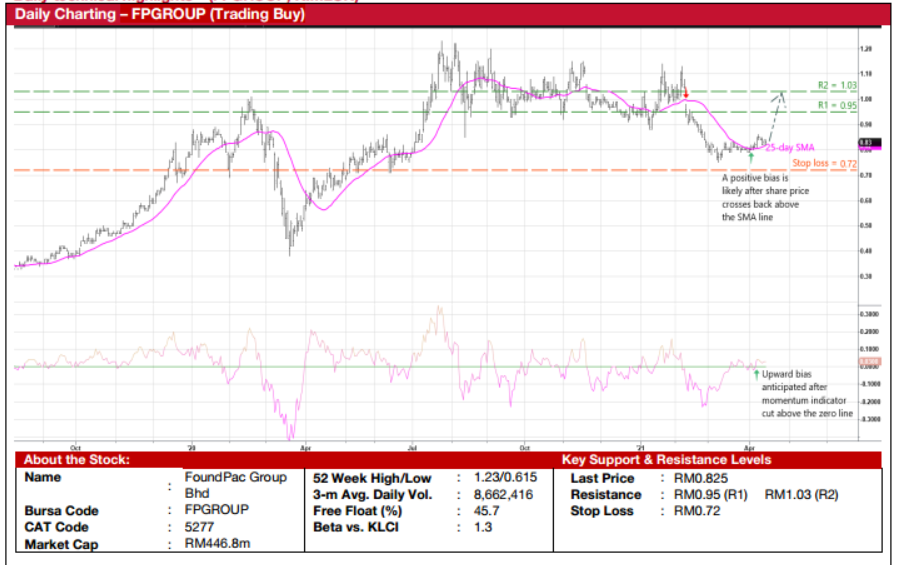

FoundPac Group Bhd (Trading Buy)

• FPGROUP – which is principally involved in the manufacturing and sale of precision engineering parts (namely stiffeners, test sockets, hand lids & related accessories) and laser stencils – offers exposure to the high-growth technology industry.

• The Group’s customer base consists of mainly large multinational semiconductor manufacturers, outsourced semiconductor assembly and test companies (OSATs) and printed circuit board (PCB) design houses.

• In the most recent first half results ended December 2020, its bottomline came in at RM5.1m (-42% YoY) dragged by margin erosions and lower sales. Prior to this, FPGROUP had been raking in annual net earnings ranging between RM7.5m to RM16.4m over the last five financial years.

• Still, the Group remains financially sound with a debt-free balance sheet that is backed by cash holdings of RM55.5m (or 10.2 sen per share) as of end-December last year.

• From a charting perspective, after falling from a high of RM1.13 in February this year to as low as RM0.745 one month later, a trend reversal could be on the cards as the share price has crossed back above the 25-day SMA recently.

• Coupled with the climb above the zero-line by the momentum indicator, the stock is expected to shift higher ahead, possibly challenging our immediate resistance target of RM0.95 (R1). Beyond R1, FPGROUP shares could attempt to close the gap that was opened in February this year by moving towards our second resistance threshold of RM1.03 (R2). This represents upside potentials of 15% and 25%, respectively.

• Our stop loss price is set at RM0.72 (or 13% downside risk).

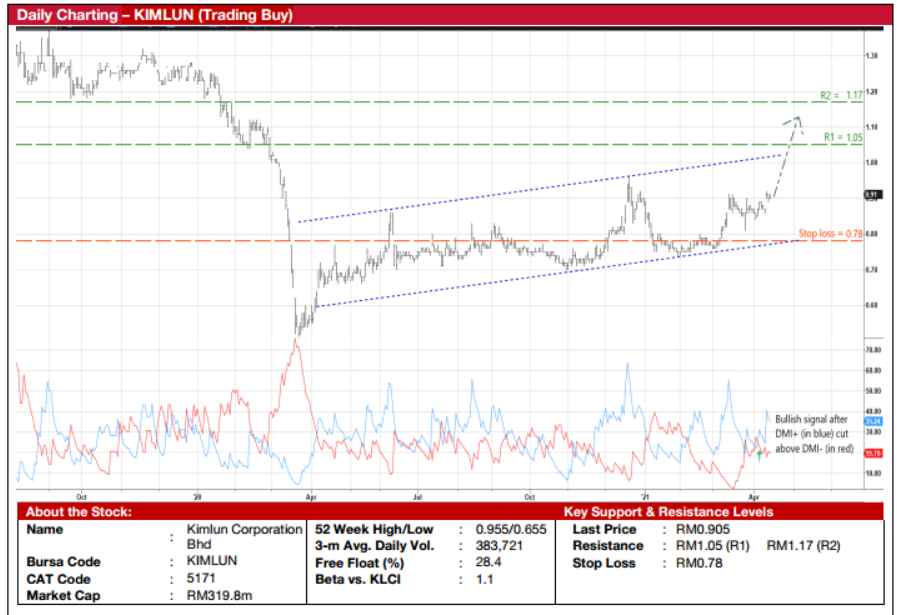

Kimlun Corporation Bhd (Trading Buy)

• KIMLUN’s core businesses are in: (i) construction & engineering services with exposure in both the infrastructure and building segments, (ii) manufacturing & trading of precast concrete products (such as segmental box girders and tunnel lining segments) and quarry products, and (iii) property development in Johor and Selangor.

• Given its niche in customising precast concrete products for industrial building systems (IBS), the Group is a potential beneficiary of the impending implementation of Mass Rapid Transit Line 3 (MRT3) amid news reports stating that the government would be emphasising the use of the IBS construction method for the project. KIMLUN is already an existing supplier of precast concrete products for MRT Line 2.

• After posting net profit of RM8.0m (-86% YoY) in FY December 2020 (which was hit by the Covid-19 disruptions), consensus is projecting the Group’s bottomline to rebound strongly to RM41.3m for FY21 and RM44.5m for FY22, to be underpinned by existing orderbooks of RM1.1b (for the construction division) and RM0.3b (for the manufacturing division). This translates to undemanding forward PERs of 7.7x this year and 7.2x next year, respectively.

• On the chart, the stock is currently moving inside an ascending price channel that stretches back to early April last year.

• With the DMI Plus crossing over the DMI Minus which has triggered a bullish technical signal, KIMLUN shares could be on the way to test the upper part of the price channel. An extension of the upward trajectory will likely lift the stock towards our resistance thresholds of RM1.05 (R1; 16% upside potential) and RM1.17 (R2; 29% upside potential).

• We have pegged our stop loss price at RM0.78 (or 14% downside risk from the last traded price of RM0.905).

Source: Kenanga Research - 15 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024