Daily Technical Highlights – (FREIGHT, WCT)

kiasutrader

Publish date: Fri, 23 Apr 2021, 09:17 AM

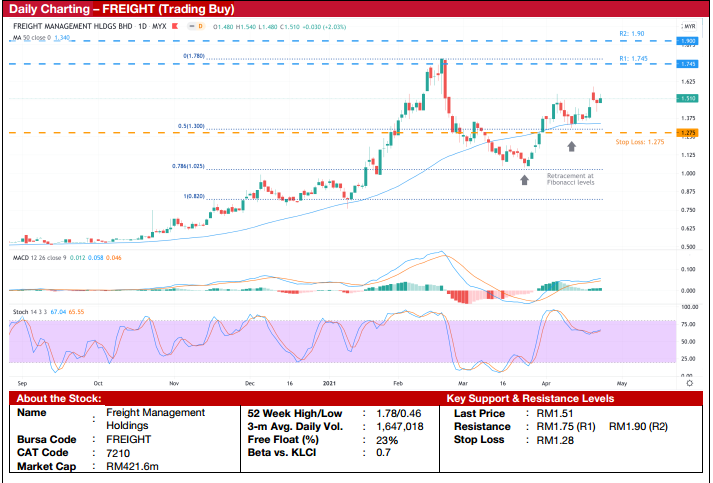

Freight Management Holdings Berhad (Trading Buy)

• FREIGHT provides freight and warehousing services on an international scale, comprising sea, air & rail freight services, warehousing & distribution, customs brokerage, road transportation and project management.

• In the second half of 2020, the Group has benefited from a surge in sea and air freight rates, allowing them to raise their rates on their customers. Hence, in the 6-month period ended Dec 2020 (1HFY21), the Group’s net profit rose 39% YoY to RM12m.

• Moving forward, the Group stands to benefit from an anticipated recovery in global trade flows, which should continue to drive volume growth. Consensus is expecting FREIGHT to make net profit of RM24m in FY21 and RM27m in FY22. These translate to forward PERs of 17.6x and 15.6x, respectively.

• Technically speaking, between Jan and March 2021, the stock has rallied, corrected and subsequently found support at the Fibonacci 78.6% retracement level. The stock then rebounded to continue its upward journey in late-March with a recent bullish hammer candlestick indicating further upside to the stock.

• On numerous occasions, the stock has found support on the 50-day SMA.

• With the %K line currently hovering above the %D line, the stochastic indicator also shows that the upward momentum could continue.

• With the MACD line treading above the signal line and heading upwards, an anticipated upward movement in the share price could challenge our resistance levels of RM1.75 (R1; 16% upside potential) and RM1.90 (R2; 26% upside potential).

• We have pegged our stop loss price at RM1.28 (15% downside risk).

WCT Holdings Berhad (Trading Buy)

• WCT provides civil engineering services, specializing in earthworks, highway construction and related infrastructure works. The Group is also involved in property investment and development, as well as trades building materials.

• Recently, the Group guided it is targeting RM2b worth of orderbook replenishments backed by a tender-book of RM10b. The potential contract wins will largely come from East Malaysia (i.e. Sabah) amid the eventual roll-out of contracts such as: (i) Pan Borneo highway and (ii) Sabah-Sarawak link road. It may also be involved in the upcoming tender exercise for the MRT Line 3 project.

• Moving forward, consensus estimates WCT’s book value per share of RM2.25 and RM2.28 at the end of FY21 and FY22, respectively. These translate into forward price-to-book value (PBV) of 0.24x for both FY21 and FY22, which are below our research team’s fundamental fair value assumption of 0.3x PBV.

• Technically speaking, since the sharp price crash in March 2020, the stock has formed higher lows into resistance, which suggests buying activity at increasingly higher prices.

• After having tested the resistance of RM0.60 at least thrice along the way, the stock has failed to break above the resistance level in its most recent attempt in March 2021. However, with the subsequent price correction finding support on the 50-day SMA, we believe the stock could rebound to once again re-test this resistance barrier.

• The stochastic indicator shows that the stock has been oversold and is poised to ride on an upward momentum, as the %K line starts to point upwards.

• Bouncing off the 50-day SMA, the share price could re-test the resistance level of RM0.60 (R1; 11% upside potential). Should the stock finally break above R1, we have identified the next resistance level at RM0.64 (R2; 19% upside potential).

• We have pegged our stop loss price at RM0.48 (11% downside risk).

Source: Kenanga Research - 23 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024