Daily Technical Highlights – (KAREX, TECFAST)

kiasutrader

Publish date: Tue, 27 Apr 2021, 08:44 AM

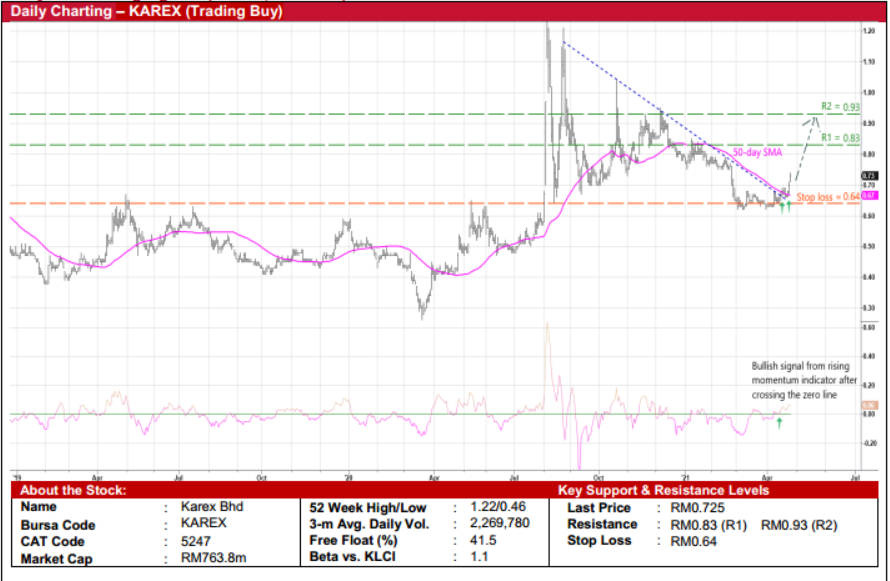

Karex Bhd (Trading Buy)

• KAREX’s principal business activities are in the manufacturing and sale of sexual wellness (namely condoms, personal lubricants & sex toys), medical (such as catheters, probe covers, HIV & pregnancy test kits) and other health related products.

• To broaden its income sources, the group is venturing into the manufacturing and sale of medical gloves via the setting up of a new facility at an existing plant in Thailand. With an initial annual production capacity of 500m gloves and an eventual installed capacity of up to 2.5b gloves, KAREX is on track to commence commercial production of gloves in July/August this year.

• As the soon-to-be-completed glove manufacturing facility is ready to make immediate earnings contributions, this may boost sentiment and lift the share price to play catch up with the ongoing rally in glove stocks following the resurgence of new Covid- 19 infections.

• Fundamentally speaking, after posting a jump in net profit to RM7.2m in the first half ended December 2020 (versus 1HFY20’s marginal net loss of RM0.1m), consensus is forecasting the group to log net earnings of RM13.9m in FY June 2021 and RM22.6m in FY June 2022, which translate to forward PERs of 54.9x this year and 33.8x next year, respectively.

• On the chart, following a sharp fall from a peak of RM1.22 in early August last year, a trend reversal could be on the cards as KAREX shares have just overcome a descending trendline and crossed over the 50-day SMA simultaneously while the rising momentum indicator above the zero-line also signals an upward bias ahead.

• Riding on the renewed strength, the stock will probably bounce up towards our resistance thresholds of RM0.83 (R1; 14% upside potential) and RM0.93 (R2; 28% upside potential).

• Our stop loss price is set at RM0.64 (or 12% downside risk from yesterday’s close of RM0.725).

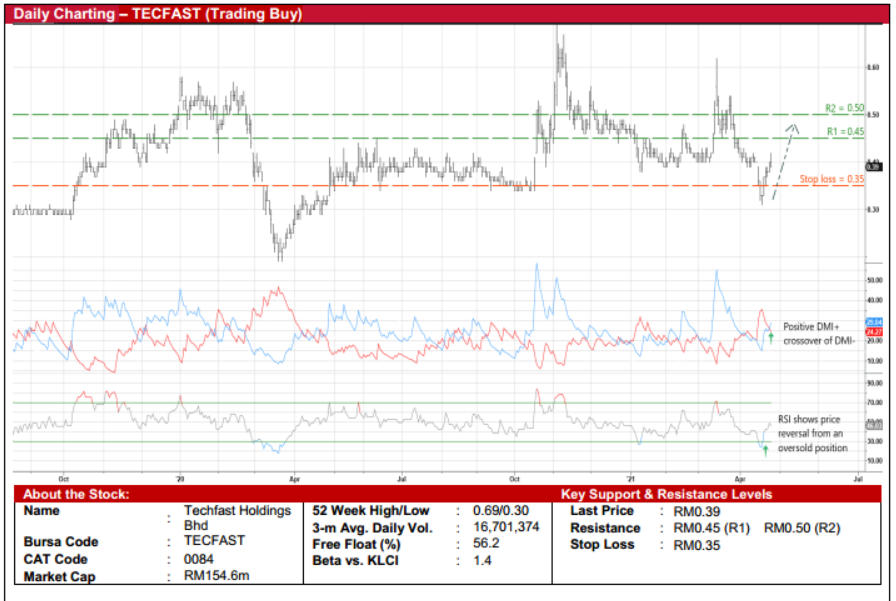

Techfast Holdings Bhd (Trading Buy)

• TECFAST – which is involved in the manufacturing of self-clinching fasteners, electronic hardware and precision turned parts, mould cleaning rubber sheets and LED epoxy encapsulant materials – is venturing into the petroleum trading and oil bunkering business while in the midst of disposing of its fasteners and electronic hardware & precision turned parts segment.

• The new venture is expected to bring in additional income streams to widen its earnings base from existing businesses, which raked in net profit of RM2.1m (-41% YoY) in FY December 2020.

• Following which, the group has recently secured contracts to supply fuels to: (i) Singapore-based Wise Marine Pte Ltd over 3 years (estimated at RM2.2b using prevailing market prices), and (ii) Malaysia-based Huang Fan Sdn Bhd for a period of 45 months (valued at RM540m based on current market prices).

• Technically speaking, the stock has likely bottomed out after rebounding from a trough of RM0.305 last Monday. With the RSI value reversing from an oversold territory and the DMI+ cutting above the DMI- thus triggering bullish technical signals, TECFAST shares could ride on the positive momentum to shift higher ahead.

• On the way up, the share price will probably challenge our resistance targets of RM0.45 (R1) and RM0.50 (R2), which represent upside potentials of 15% and 28%, respectively.

• We have pegged our stop loss price at RM0.35 (or 10% downside risk).

Source: Kenanga Research - 27 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024