Daily Technical Highlights – (POHKONG, NTPM)

kiasutrader

Publish date: Thu, 06 May 2021, 09:20 AM

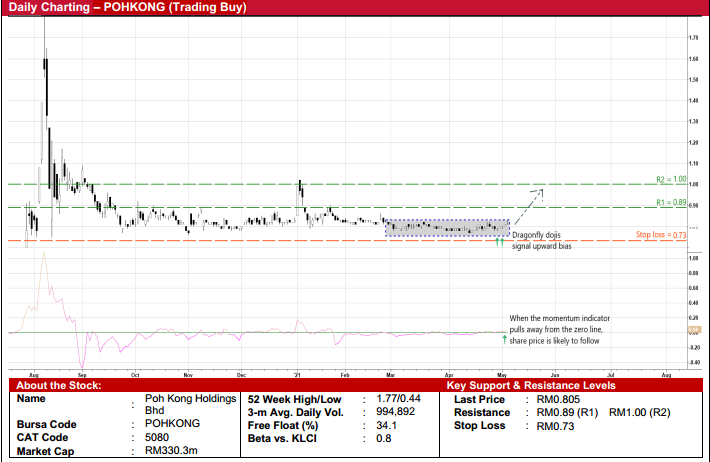

Poh Kong Holdings Bhd (Trading Buy)

• The share price of POHKONG could rise in tandem with its peer TOMEI, whose shares soared as much as 9.0% initially before closing 7.0% higher yesterday following its year-on-year earnings jump of 243% to RM13.8m in the January-March 2021 quarter.

• Just like TOMEI, which saw its quarterly bottomline more than tripled mainly attributable to increased consumers’ demand particularly for yellow gold jewellery, POHKONG (a manufacturer cum retailer of jewellery in gold and gemstones) may announce strong earnings performance too for its latest quarterly results to be released sometime next month. In the most recent quarter ended January 2021, POHKONG made net profit of RM11.4m (+7% YoY).

• Technically speaking, after pulling back from a recent high of RM1.00 in early January this year, the stock has been trapped inside a rectangle formation since the end of February this year, oscillating within a narrow range of between RM0.77 and RM0.82.

• However, with the emergence of dragonfly doji candlesticks lately and the momentum indicator showing signs of overcoming the zero line anytime soon, POHKONG shares may attempt to stage a technical rebound ahead.

• A probable breakout from the rectangle pattern could then push the share price towards our resistance thresholds of RM0.89 (R1; 11% upside potential) and RM1.00 (R2; 24% upside potential).

• Our stop loss price is pegged at RM0.73 (or 9% downside risk from the last traded price of RM0.805).

NTPM Holdings Bhd (Trading Buy)

• As a manufacturer and distributor of tissue paper and personal care products, NTPM is expected to benefit from steady income streams amid the challenging economic backdrop given the relatively resilient demand for its products.

• Reflecting this, the group saw its net earnings coming in at RM14.6m (+2,811% YoY) in 1QFY21, RM13.7m (versus net loss of RM1.4m previously) in 2QFY21 and RM29.7m (+866% YoY) in 3QFY21, taking its cumulative net profit for the nine-month period ended January 2021 to RM58.1m (+2,516% YoY).

• On the chart, with the current share price (@ RM0.60) hovering near the 50% Fibonacci retracement line (@ RM0.58) – a support level that has seen the stock bouncing off it several times since the beginning of March this year – this offers a timely trading opportunity for investors to take a long position in NPTM.

• Riding on the bullish technical signals arising from the recent appearance of numerous dragonfly doji candlesticks and the stochastics indicator (which has bounced up on higher lows with the %K line crossing over the %D line in the oversold area), the stock could be making its way to challenge our resistance targets of RM0.69 (R1; 15% upside potential) and RM0.77 (R2; 28% upside potential).

• We have set our stop loss price at RM0.54 (or 10% downside risk).

Source: Kenanga Research - 6 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024