Daily Technical Highlights – (PESTECH, GCB)

kiasutrader

Publish date: Wed, 19 May 2021, 08:45 AM

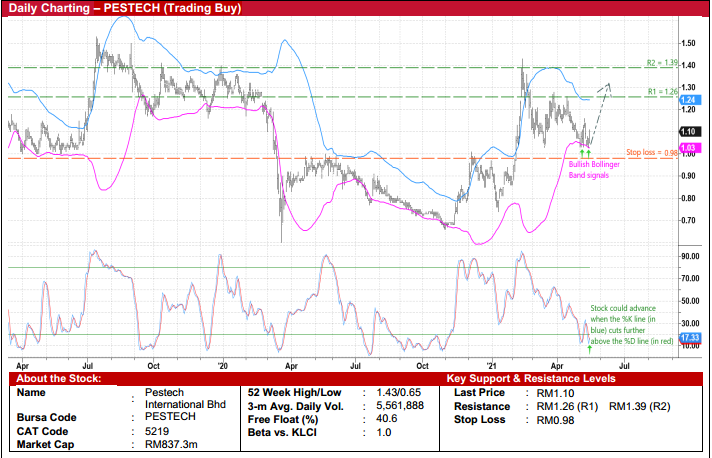

Pestech International Bhd (Trading Buy)

• PESTECH – an integrated electrical power technology company with businesses in power transmission infrastructure, power generation & rail electrification, transmission assets and power products & embedded system software – has just been awarded a contract (valued at RM65m) for the design, manufacture, supply, delivery, installation, testing and commissioning and other related works of Traction Power Supply for the Rapid Transit System (RTS) rail project linking Malaysia and Singapore.

• The stock is presently trading at forward PERs of 11.3x this year and 9.6x next year based on consensus net profit expectations of RM74.3m in FY June 2021 and RM87.4m in FY June 2022, respectively. For the first half ended December 2020, the group reported net earnings of RM23.1m (-16% YoY).

• PESTECH has a presence in Cambodia via its listed subsidiary PESTECH (Cambodia) PLC (whose share price has risen 7.2% since 5 May to KHR3,280 currently representing a market capitalisation equivalent of RM249m, which works out to 28% of PESTECH’s existing market valuation based on its 94.7% stake).

• From a technical standpoint, the stock – which closed up 4.8% yesterday – is poised to shift higher after climbing back above the lower Bollinger Band while the stochastics indicator is turning positive (with the %K line just cut above the %D line in the oversold zone).

• An ensuing bounce up could lift the share price towards our resistance thresholds of RM1.26 (R1; 15% upside potential) and RM1.39 (R2; 26% upside potential).

• Our stop loss price is pegged at RM0.98 (or 11% downside risk).

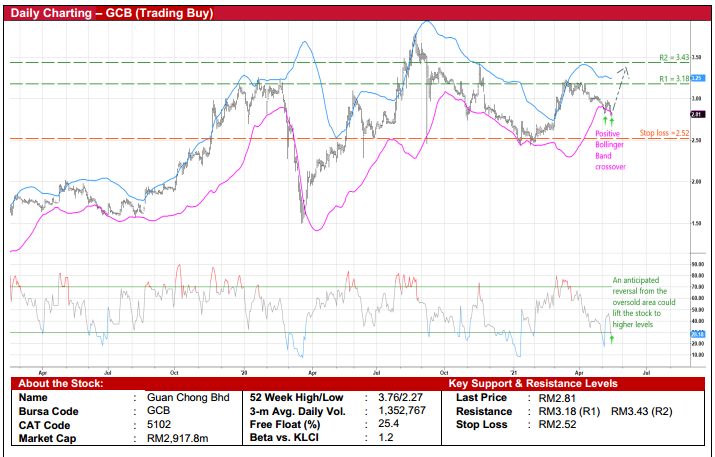

Guan Chong Bhd (Trading Buy)

• GCB – a manufacturer of cocoa-derived food ingredients (namely cocoa mass, cocoa butter, cocoa cake and cocoa powder) – has grown from strength to strength with its annual earnings increasing every year from RM22.8m in FY15 to RM222.7m in FY20 (implying a robust 5-year CAGR of 57.7%).

• After announcing net profit of RM222.7m (+2.2% YoY) in FY December 2020 amid a challenging economic backdrop, consensus is projecting GCB (whose products benefit from relatively resilient demand) to make net earnings of RM237.7m for FY December 2021 and RM291.0m for FY December 2022. This translates to forward PERs of 12.3x this year and 10.0x next year, respectively.

• On the chart, following the price correction from a recent high of RM3.19 in early April, GCB shares are in a position to stage a technical rebound from the RSI oversold territory with the share price on the edge of crossing back above the lower Bollinger Band.

• With that, the stock could advance to challenge our resistance targets of RM3.18 (R1; 13% upside potential) and RM3.43 (R2; 22% upside potential).

• Our stop loss price is set at RM2.52 (or 10% downside risk from yesterday’s close of RM2.81).

Source: Kenanga Research - 19 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024