Daily technical highlights – (MNRB, SKPRES)

kiasutrader

Publish date: Tue, 01 Jun 2021, 09:39 AM

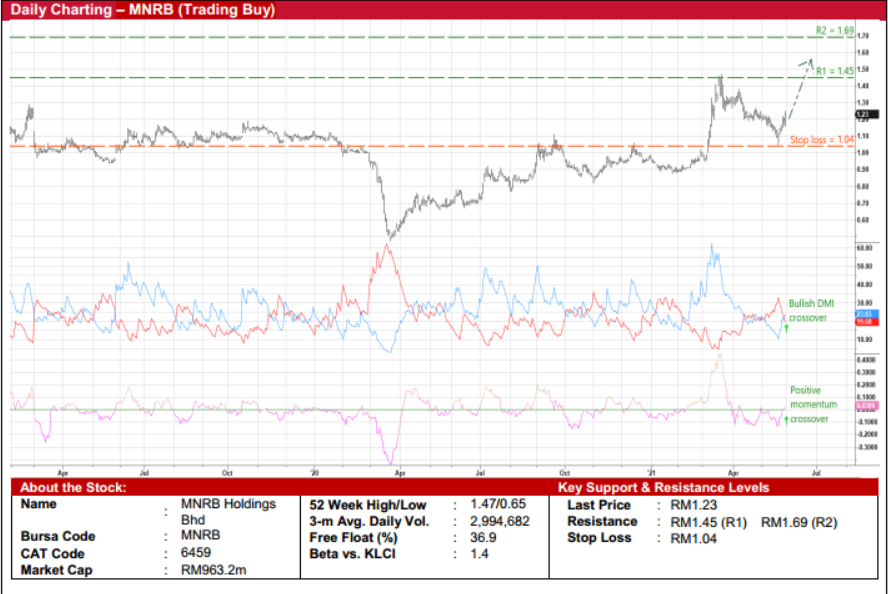

MNRB Holdings Bhd (Trading Buy)

• MNRB is the holding company for Malaysian Reinsurance Bhd (the national reinsurer and a retakaful operator), Takaful Ikhlas Family Bhd (a family takaful operator) and Takaful Ikhlas General Bhd (a general takaful operator).

• The group has just announced a strong set of financial results with net profit coming in at RM49.4m (+28% YoY / +5% QoQ) in 4QFY21, bringing full-year earnings to RM189.5m (+43% YoY) in FY March 2021.

• Based on its latest book value per share of RM3.27 as of end-March 2021, MNRB shares are currently trading at P/BV multiple of 0.38x.

• Technically speaking, following a pullback from a high of RM1.47 on 19 March this year to as low as RM1.05 on 21 May, the stock might have hit a bottom at the recent trough level before staging a subsequent price reversal.

• With positive technical signals emerging from the DMI indicator (as the %K line is on the edge of crossing above the %D line) and the momentum indicator (which is starting to climb over the zero-line), the share price will likely continue its upward trajectory ahead.

• On the way up, the stock is expected to challenge our resistance targets of RM1.45 (R1; 18% upside potential) and RM1.69 (R2; 37% upside potential).

• Our stop loss price is pegged at RM1.04 (representing a 15% downside risk).

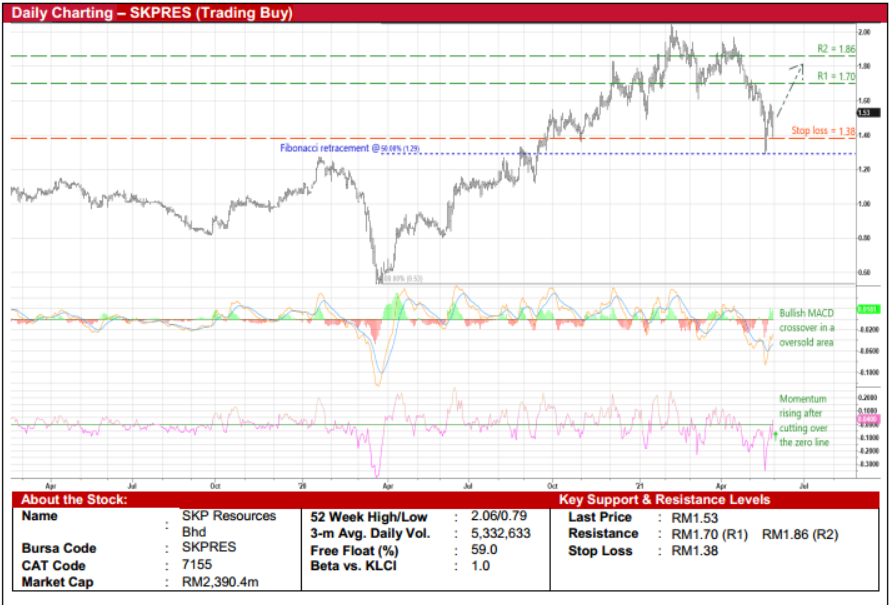

SKP Resources Bhd (Trading Buy)

• SKPRES is an electronics manufacturing services (EMS) provider that is principally involved in the manufacturing of plastic products and fabrication of moulds.

• The group saw a net profit jump to RM97.6m (+42% YoY) for the nine-month period ended December 2020, lifted mainly by strong demand from existing key customers as well as improvement in operational efficiencies and cost control measures.

• For the full-year ended March 2021, consensus is projecting SKPRES to make net profit of RM124.6m before increasing further to RM163.4m in FY March 2022. This translates to forward PERs of 19.2x this year and 14.6x next year, respectively.

• The group is also in a financially steady position with net cash & cash equivalents of RM165.6m (or 10.6 sen per share) as of end-December last year.

• On the chart, the stock – which jumped 5.5% to close at RM1.53 yesterday – is on track to resume its uptrend after slipping from a recent high of RM1.97 in mid-April.

• Following the recent bounce-off from the 50% Fibonacci retracement line, and on the back of the bullish technical signals as exhibited by the MACD line crossing above the signal line in an oversold area as well as the momentum indicator’s upward bias after overcoming the zero-line, SKPRES’ share price is expected to ride on the renewed strength to climb towards our resistance thresholds of RM1.70 (R1; 11% upside potential) and RM1.86 (R2; 22% upside potential).

• We have pegged our stop loss price at RM1.38 (or 10% downside risk).

Source: Kenanga Research - 1 Jun 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024