Daily technical highlights – (ADVCON, 3A)

kiasutrader

Publish date: Thu, 03 Jun 2021, 10:40 AM

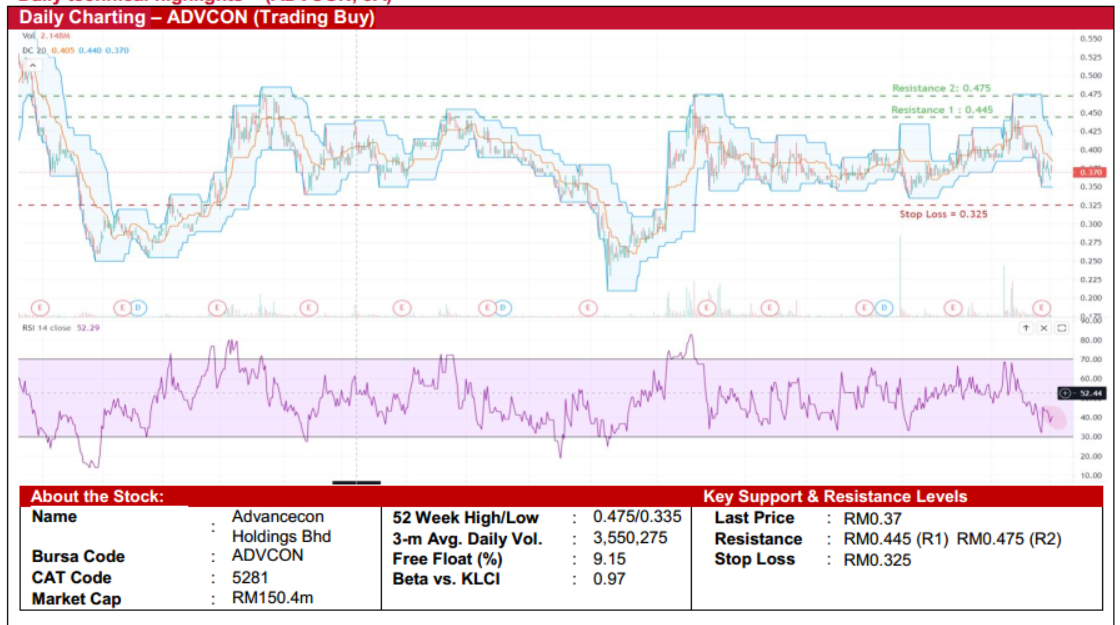

Advancecon Holdings Bhd (Trading Buy)

• ADVCON is a specialized construction firm which is primarily involved in the provision of earthworks and civil engineeringworks such as building works, sewerage systems and water retaining structures. The group is also involved in thedevelopment and operation of power generation from solar renewable energy projects.

• Despite the group reporting a disappointing 1QFY21 results (with net income decreasing to RM1.1m or down 50% QoQ),ADVCON is in a position to capitalize on their strengths and win more projects when economic activities pick up after theCovid-19 pandemic is brought under control.

• In terms of contract wins, the group has recently bagged: (i) a contract worth RM20.2m from Sime Darby Property Bhd toundertake earthworks and other ancillary works for a construction project in Dengkil, Selangor, and (ii) a RM60.0msubcontract pertaining to the ECRL project. Going forward, ADVCON is optimistic of achieving an orderbook of RM1.0b.

• Chart-wise, after pulling back from a recent high of RM0.475 in end-April to close at RM0.37 yesterday, the stock will probablystage a technical rally by overcoming the middle band of the Donchian Channel as the RSI indicator reverses from theoversold area.

• Riding on the positive momentum, the stock could advance towards our first resistance threshold of RM0.445 (R1, whichrepresents an upside potential of 20%) and thereafter challenge the next resistance threshold of RM0.475 (R2, whichrepresents an upside potential of 28%).

• We have pegged our stop loss price at RM0.325 (which translates to a downside risk of 12%).

Three-A Resources Bhd (Trading Buy)

• 3A is a leading food and beverage ingredient manufacturing company with a diversified product portfolio consisting of: (i)Liquid Caramel & Caramel Colour, (ii) Vinegar, (iii) Glucose Syrup, (iv) Soya Protein Sauce, (v) Hydrolysed Vegetable Protein(HVP) Powder and many more items.

• Given its versatile range of ingredients (which are Halal and Kosher certified) that have different functional properties andunique characteristics that can be tailored to customer needs, the group serves businesses of all sizes across a broadspectrum of industries and sectors.

• After posting net profit of RM30.2m (+2.7% YoY) in FY20, consensus is expecting 3A to make net earnings of RM35.0m inFY21 and RM36.4m in FY22, which translate to forward PERs of 12.5x this year and 12.0x next year, respectively.

• Technically speaking, the chart is indicating that 3A shares will likely trend higher ahead based on the positive 50-day CCIsignal (which has just pierced through the +100 upper band) with the bullish momentum further strengthened by the shareprice cutting above the 50-day EMA.

• With that, the stock could climb towards our resistance targets of RM1.01 (R1; 13% upside potential) and RM1.07 (R2; 20%upside potential).

• Our stop loss price is set at RM0.79 (or 11% downside risk from the last traded price of RM0.89).

Source: Kenanga Research - 3 Jun 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024