Daily technical highlights – (K1, GAMUDA)

kiasutrader

Publish date: Thu, 10 Jun 2021, 11:45 AM

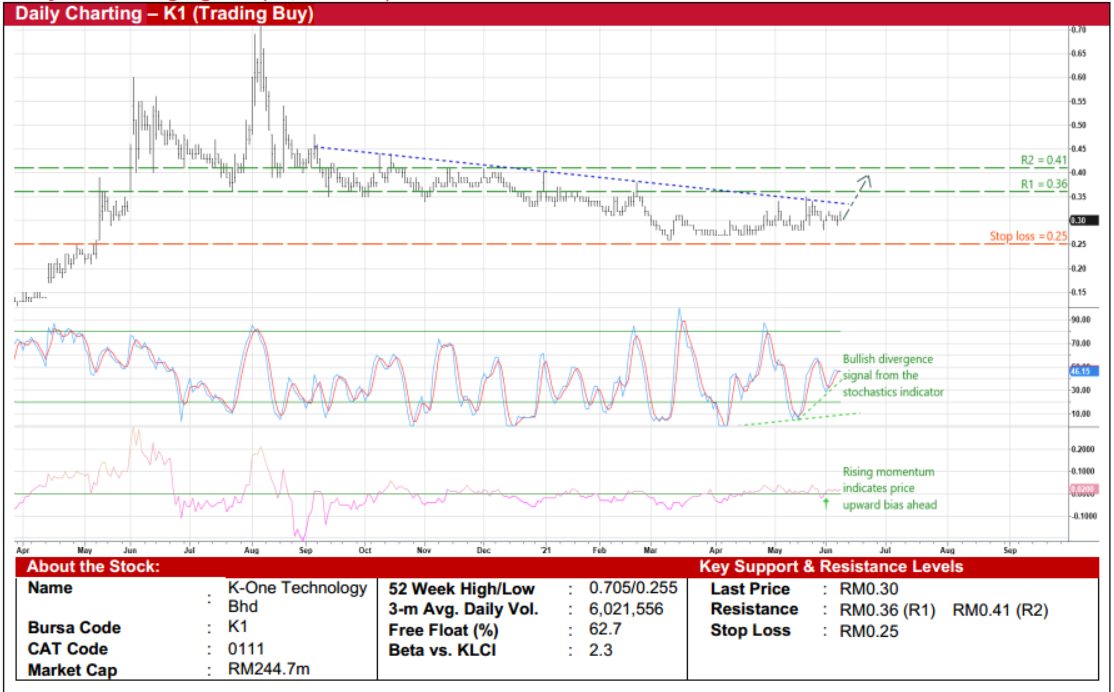

K-One Technology Bhd (Trading Buy)

• K1 is a proxy to the ramping up of vaccination rollouts and mass testing programme in Malaysia as the government strivesto bring the Covid-19 pandemic under control urgently. These measures could boost the sales of its: (i) disposable syringeswith needle (which would be sourced from China and are suitable for inoculation of Covid-19 vaccines) after getting thehealth authority’s approval last Friday, and (ii) nasal/oral swabs and saliva test kits (which are used in Covid-19 testing).

• This comes as the group – which specializes in providing: (i) electronic manufacturing services (EMS) to themedical/healthcare, internet of things (IoT), industrial and consumer electronic industries, and (ii) cloud computing businesscomprising infrastructure as-a-service, platform as-a-service, software & mobile application development services – hasdiversified into the development and manufacturing of its own brand medical devices such as nasal/oral swabs, ventilatorsand syringe safety needle caps.

• After posting net loss of RM8.8m in FY December 2020 (versus FY19’s net earnings of RM6.1m), the group reported netprofit of RM1.2m in 1QFY21 (up from RM0.1m a year ago) with a debt-free balance sheet that is backed by cash holdings ofRM53.8m (6.6 sen per share or approximately one-fifth of the existing share price) as of end-March 2021.

• On the chart, after being locked in a sideways trading pattern since late February this year, K1 shares could attempt to testand overcome a descending trendline (that stretches back to September last year).

• An ensuing share price breakout is probable following the occurrence of a bullish divergence in the stochastics indicator(which has formed rising bottoms in the oversold area while the price continued to move lower) and the rising momentumsignal (after crossing over the zero line).

• With that, the stock could advance towards our resistance targets of RM0.36 (R1; 20% upside potential) and RM0.41 (R2;37% upside potential).

• We have pegged our stop loss price at RM0.25 (or 17% downside risk from yesterday’s close of RM0.30).

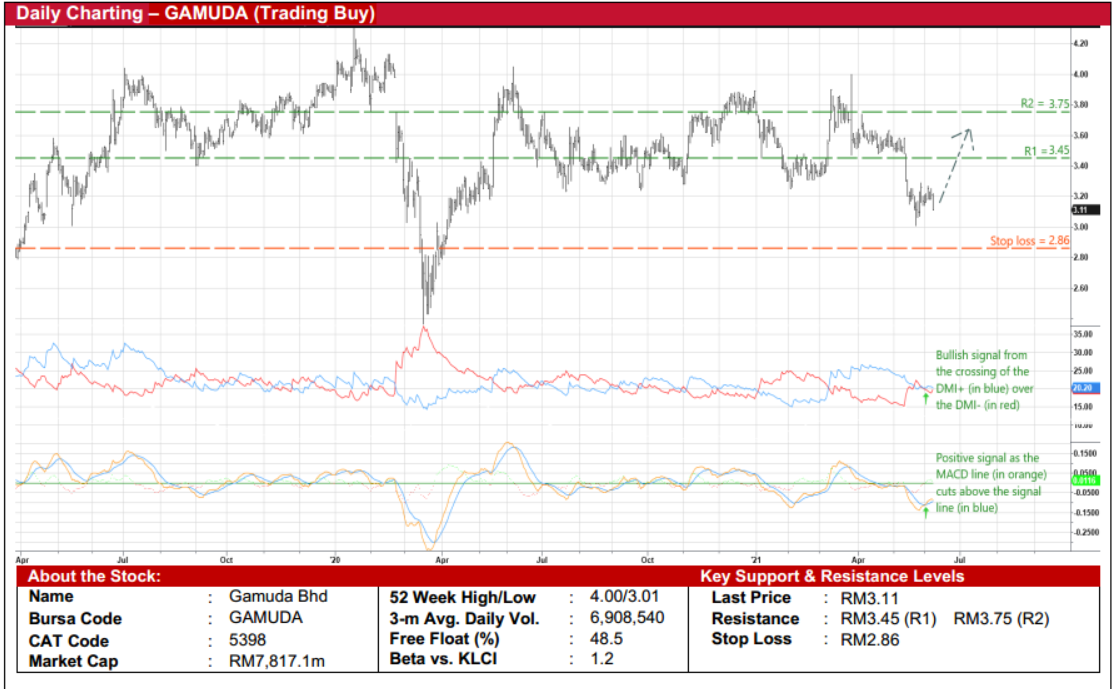

Gamuda Bhd (Trading Buy)

• A technical rebound could be on the horizon for GAMUDA shares following the tumble from a recent high of RM4.00 in lateMarch this year to a 14-month low of RM3.01 in late May.

• After bouncing off the recent trough, its upward trajectory is expected to extend based on the positive signals triggered by thebullish crossings of: (i) the DMI Plus above the DMI Minus, and (ii) the MACD line over the signal line.

• A continuation of the buying interest will likely lift the share price to challenge our resistance targets of RM3.45 (R1) andRM3.75 (R2), which represent upside potentials of 11% and 21%, respectively.

• Our stop loss price is set at RM2.86 (or 8% downside risk).

• On the fundamental front, as Malaysia’s leading engineering, infrastructure and property group, GAMUDA stands to benefitfrom the future rollout of mega construction projects to pump prime the economy.

• Based on consensus estimates, the group – which posted net profit of RM232.4m (-33% YoY) in the first half ended January2021 – is forecasted to make net earnings of RM542.8m in FY July 2021 and RM630.2m in FY July 2022. This translates toforward PERs of 14.4x this year and 12.4x next year, respectively.

Source: Kenanga Research - 10 Jun 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-24

GAMUDA2024-11-23

GAMUDA2024-11-22

GAMUDA2024-11-22

GAMUDA2024-11-22

GAMUDA2024-11-22

GAMUDA2024-11-21

GAMUDA2024-11-21

GAMUDA2024-11-21

GAMUDA2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-18

GAMUDA2024-11-18

GAMUDA2024-11-18

GAMUDA2024-11-18

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-15

GAMUDA2024-11-14

GAMUDA2024-11-14

GAMUDA2024-11-14

GAMUDA2024-11-14

GAMUDA2024-11-14

GAMUDA2024-11-13

GAMUDA2024-11-13

GAMUDA2024-11-13

GAMUDA2024-11-12

GAMUDA2024-11-12

GAMUDA2024-11-12

GAMUDA2024-11-12

GAMUDAMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024