Kenanga Research & Investment

Daily technical highlights – (JHM, POS)

kiasutrader

Publish date: Tue, 15 Jun 2021, 10:27 AM

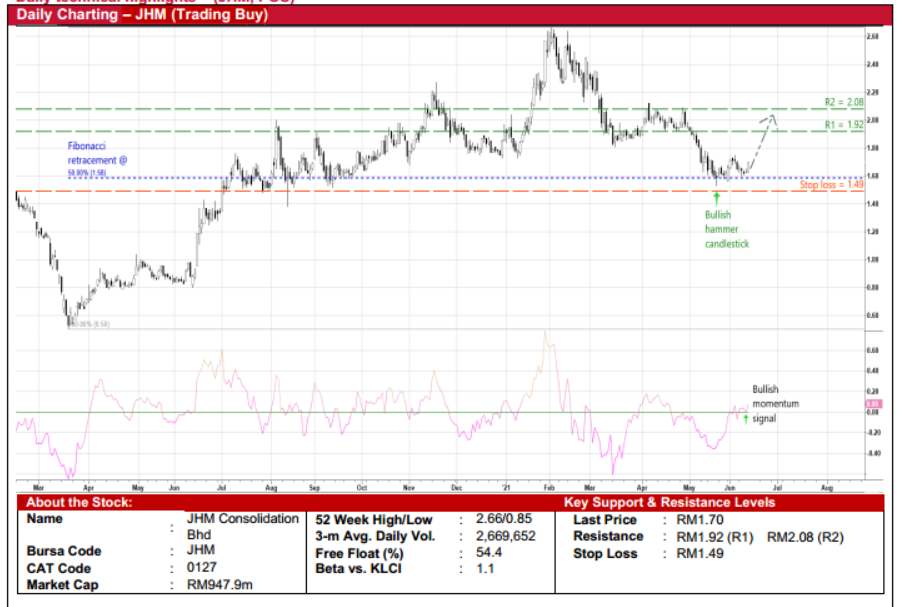

JHM Consolidation Bhd (Trading Buy)

- JHM is a proxy to rising global car sales (which translates to increased demand for automotive LED lighting modules) and therolling out of 5G technology (which requires various electronic components).

- The group’s business operation is segregated into 2 key segments: (a) electronics business unit, which is involved in themanufacture and assembly of surface mount technology of automotive rear, interior and front headlamp lighting (for theautomotive industry) and motor controller (for the industrial sector), and (b) mechanical business unit, which provides onestop solutions from fabrication of tooling, design to final assembly and test of LED lighting modules/applications,microelectronic components as well as precision mechanical parts.

- After registering net profit of RM21.4m (-30% YoY) in FY December 2020, consensus is forecasting JHM to post stronger netearnings of RM47.6m in FY21 and RM58.6m in FY22. This represents forward PERs of 19.9x this year and 16.2x next year,respectively.

- Technically speaking, after seeing a correction from a peak of RM2.66 at the beginning of February this year, the stock hassubsequently bounced off the 50% Fibonacci retracement line, which suggests a trend reversal could be underway.

- An upward movement in the share price is now anticipated following the rising momentum indicator (which has just climbedover the zero-line) and the recent appearance of a bullish hammer candlestick.

- On the way up, JHM shares – which jumped 4.3% yesterday – could advance towards our resistance thresholds of RM1.92(R1; 13% upside potential) and RM2.08 (R2; 22% upside potential).

- We have placed our stop loss price at RM1.49 (or 12% downside risk).

Pos Malaysia Bhd (Trading Buy)

- Bouncing off a double-bottom pattern, POS shares could be in the midst of staging a technical rebound after sliding from ahigh of RM1.24 at the end of December last year.

- The positive technical bias is also triggered by the bullish signals arising from the crossing of the DMI Plus over the DMIMinus indicator and the sighting of a hammer candlestick.

- Riding on the upward momentum, the stock could climb towards our resistance thresholds of RM0.94 (R1; 12% upsidepotential) and RM1.04 (R2; 24% upside potential).

- Our stop loss price is set at RM0.75 (or 11% downside risk from yesterday’s close of RM0.84).

- Fundamentally, POS’ business activities consist of: (a) postal (namely domestic & international mailing and parcel deliveryservice, bill payments, financial services, postal services and government services in post offices), (b) logistics (offering totallogistics and inventory solutions), (c) aviation (as a licensed independent ground handler that provides a comprehensiverange of services for commercial, passenger and cargo airlines), and (d) others (such as gold centre & Islamic microfinancingservices and as a licensed digital certificate authority).

- While the group’s bottomline was in the red (with net loss of RM308.0m in FY December 2020), 1QFY21’s net loss hasnarrowed to RM46.8m (versus 1QFY20’s -RM49.2m and 4QFY20’s -RM232.3m), as its overall performance since last yearwas hit by Covid-19 related business disruptions, lumpy impairment charges and cost-cutting expenses.

- Going forward, consensus is projecting POS to remain loss-making – with net loss of RM65.8m in FY21 – before turningaround with net profit of RM16.1m in FY22.

Source: Kenanga Research - 15 Jun 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments