Kenanga Research & Investment

Daily technical highlights – (CYPARK, MYEG)

kiasutrader

Publish date: Wed, 16 Jun 2021, 11:08 AM

Cypark Resources Bhd (Trading Buy)

- After tumbling from a peak of RM1.67 at the beginning of March this year to close at RM1.11 yesterday, CYPARK’s shareprice is poised to stage a technical rebound from an oversold position.

- The stock is anticipated to shift higher ahead according to our trading system, which is built on RSI indicator to trigger buysignals when the RSI value crosses above the oversold level. Using an exit rule of either an 8% profit or 8% stop loss(whichever comes first) from the trigger levels, the back-tested results showed that out of the 35 alerts that have emergedsince 2015, the trading system recorded 26 profitable trades (with ensuing share price gains of 8% or more), whichrepresents an accuracy rate of 74%.

- With the recent appearance of 2 buy signals (in end-May and early June), the trading system is currently indicating thatCYPARK shares could advance to at least RM1.21 – RM1.25 going forward. We have set our resistance thresholds atRM1.24 (R1; 12% upside potential) and RM1.33 (R2; 20% upside potential).

- Our stop loss level is pegged at RM1.00 (or 10% downside risk).

- From a fundamental valuation perspective, after posting net profit of RM15.0m (+3% YoY) in 1QFY21, CYPARK (which isinvolved in the integrated renewable energy, green technology, environmental engineering and construction engineeringbusinesses) is forecasted to make net earnings of RM88.2m for FY October 2021 and RM105.4m for FY October 2022 basedon consensus estimates. This translates to undemanding forward PERs of 6.1x this year and 5.1x next year, respectively.

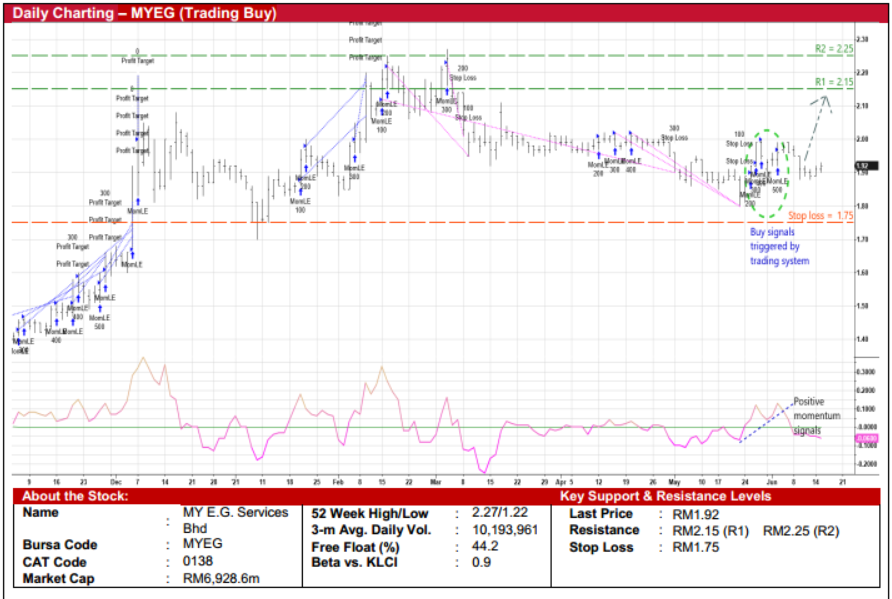

MY E.G. Services Bhd (Trading Buy)

- MYEG shares could break away from an ongoing consolidation pattern after moving sideways since mid-March this year.

- Our trading system – which is designed to generate buy signals when the momentum indicator is above zero and increasing –is anticipating an upward movement in the share price ahead. Using an exit rule of either a 7% profit or 6% stop loss(whichever comes first) from the trigger levels, the back-tested results showed that the trading system has correctly predicted122 out of the 178 buy signals that were triggered since 2015 as profitable trades, which translates to a hit rate of 69%.

- Based on the 5 buy alerts that have appeared since April this year, the trading system is projecting that MYEG’s share pricecould climb to a range of RM2.03 – RM2.15 or higher going forward. On the chart, our resistance thresholds are set atRM2.15 (R1; 12% upside potential) and RM2.25 (R2; 17% upside potential).

- We have placed our stop loss price at RM1.75 (or 9% downside risk from the last traded price of RM1.92).

- On the fundamental front, after posting net profit of RM76.3m (+30% YoY) in 1QFY21, consensus is expecting MYEG – aprovider of electronic government (e-government) services with a presence in Malaysia, Philippines, Bangladesh andIndonesia – to make net earnings of RM323.4m in FY December 2021 and RM349.0m in FY December 2022. This translatesto forward PERs of 21.4x this year and 19.9x next year, respectively.

- The group remains financially strong with net cash holdings of RM200.5m (or 5.6 sen per share) as of end-March this year.

Source: Kenanga Research - 16 Jun 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments