Kenanga Research & Investment

Daily technical highlights – (SAMCHEM, AHEALTH)

kiasutrader

Publish date: Tue, 22 Jun 2021, 09:28 AM

Samchem Holdings Bhd (Trading Buy)

- SAMCHEM is a leading industrial chemicals and lubricants distributor in Malaysia and South East Asia, supplyingapproximately 500 different petrochemicals and services to more than 7,000 clients from industries such as automotive,paints & inks, oil & gas and agriculture across the region.

- The group’s bottomline saw a 71% YoY jump to RM40.6m in FY December 2020, lifted by higher gross profit margins andlower finance costs.

- The robust earnings momentum continued in 1QFY21 with its net profit coming in at RM19.0m (+338% YoY / +5% QoQ) onthe back of revenue of RM330.7m (+28% YoY / +9% QoQ).

- After trading on an ex-entitlement basis for a 1-for-1 bonus issue last Thursday, SAMCHEM’s share price has since pulledback 6.7% to close at RM0.83 yesterday, which presents a timely opportunity for investors to accumulate the shares.

- From a charting perspective, the stock remains in an uptrend pattern, supported by an ascending trendline that stretches backto March last year.

- With the share price now crossing back above the lower Bollinger Band after slipping below it earlier on, the stock is expectedto resume the upward trajectory ahead.

- On the way up, SAMCHEM shares will probably advance towards our resistance thresholds of RM0.94 (R1; 13% upsidepotential) and RM1.03 (R2; 24% upside potential).

- We have placed our stop loss price at RM0.73 (which represents a downside risk of 12%).

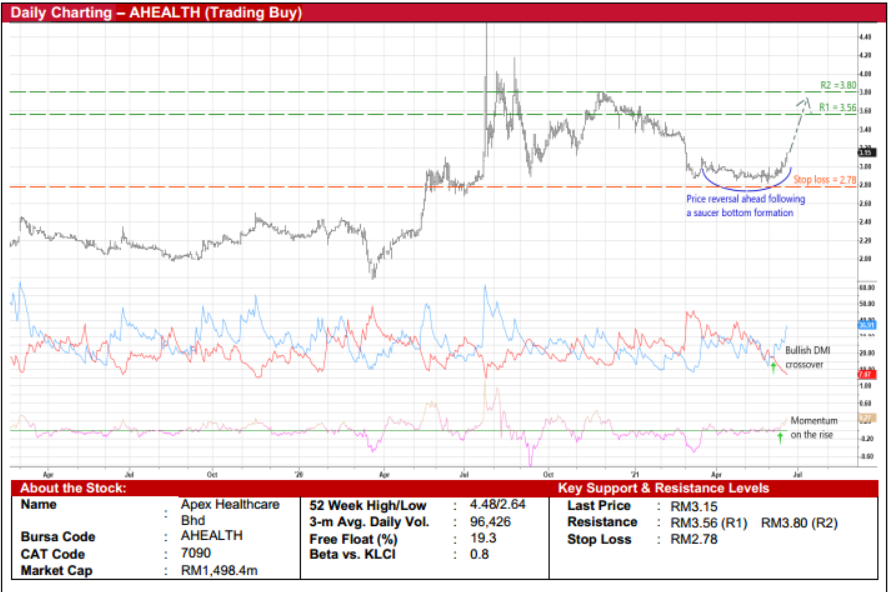

Apex Healthcare Bhd (Trading Buy)

- A proxy to the pharmaceutical healthcare sector, AHEALTH is involved in the manufacturing and distribution ofpharmaceuticals, over-the-counter consumer healthcare products, diagnostics and orthopaedic devices with a geographicalpresence in Malaysia, Singapore, Vietnam and Myanmar.

- After posting net profit of RM56.0m (+6% YoY) in FY December 2020, the group’s bottomline came in at RM11.9m (-17%YoY) in 1QFY21 while its balance sheet remains healthy with net cash holdings of RM155.5m (or 32.7 sen per share) as ofend-March 2021.

- Going forward, AHEALTH is projected to make net earnings of RM55.6m for FY21 and RM64.7m for FY22 based onconsensus estimates. This implies forward PERs of 26.9x this year and 23.2x next year, respectively.

- On the chart, the share price could be on the way to scale higher levels after emerging from a rounding bottom pattern.

- The positive technical stance is further supported by bullish signals arising from the DMI Plus crossing over the DMI Minusand the increasing momentum indicator after cutting above the zero line.

- With that, the stock could climb to challenge our resistance thresholds of RM3.56 (R1; 13% upside potential) and RM3.80(R2; 21% upside potential).

- Our stop loss price is pegged at RM2.78 (or 12% downside risk from the last traded price of RM3.15).

Source: Kenanga Research - 22 Jun 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - MALAYSIAN RESOURCES CORPORATION BHD (MRCB)

Created by kiasutrader | Nov 28, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments