Daily technical highlights – (VELESTO, PADINI)

kiasutrader

Publish date: Thu, 08 Jul 2021, 09:33 AM

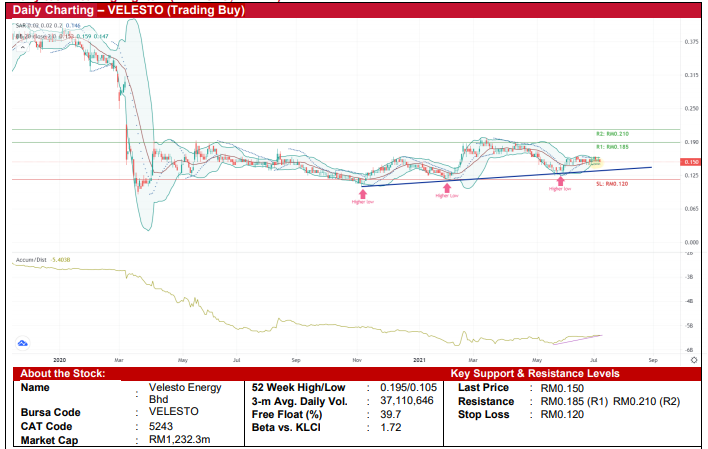

Velesto Energy Bhd (Trading Buy)

• Brent crude oil is currently trading at around USD75.61 / barrel at the time of writing this report (+47.9% YTD). The current spike in Brent crude oil could be attributed to 2 factors, namely; (i) markets being optimistic about the post pandemic economic recovery and (ii) the current state of chaos within the OPEC members due to disagreements about increasing the output of oil hindered progress, thus causing traders to place bullish bets on the commodity.

• In the quest for a short-term trade within the commodity sector, we have found that VELESTO, a company which operates within the subsector of the Oil and Gas industry to be a fair play due to the bullish signals that the chart presents.

• From the beginning of November 2020, VELESTO has been trending upwards as seen by the formation of higher lows.

• The Parabolic SAR indicator which is below the price (highlighted in yellow) and the uptrend of the A/D indicator as observed from June further strengthens our bullish outlook of VELESTO.

• This is further justified by observing VELESTO trading around the middle of the Bollinger Band.

• With that, the stock could advance to challenge our resistance targets of RM0.185 (R1; 23% upside potential) and RM0.210 (R2; 40% upside potential).

• Our stop loss price is set at RM0.120 (or 20% downside risk from yesterday’s close of RM0.150)

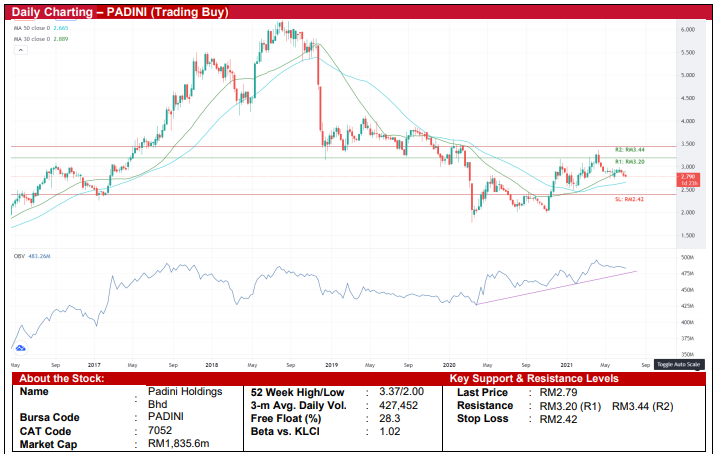

Padini Holdings Berhad (Trading Buy)

• PADINI is a clothing company that serves various demographics of the society as it constantly strives “To Be The Best Fashion Company Ever” and “To Exceed Customers’ Expectation”, an economic moat that has proven to enable the firm to be competitive in a challenging environment with the rise of new in-house brands and selling channels.

• The group’s 3QFY21 revenue had decreased to RM 262.9m (-24% QoQ) while its net profit decreased in tandem to RM12.2m (-26% QoQ). This took the YTD net profit to RM43.5m (-51%) compared to the preceding period.

• Consensus is expecting PADINI to post a net profit of RM108.3m in FY22 and RM140.9m in FY23. This translates to forward PERs of 16.9x and 13.0x, respectively.

• From a technical perspective, the 30-day Moving Average has crossed the 50-day Moving Average which indicates a strong buying interest.

• In addition, the rising OBV indicator reflects positive volume pressure that could further push PADINI to challenge our resistance thresholds of RM3.20 (R1) and RM3.44 (R2), which represent upside potentials of 14% and 23%, respectively.

• On the downside, we have pegged our stop loss price at RM2.42 which represents a downside risk of 13%.

Source: Kenanga Research - 8 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024