Daily technical highlights – (BPLANT, JOHOTIN)

kiasutrader

Publish date: Tue, 13 Jul 2021, 09:56 AM

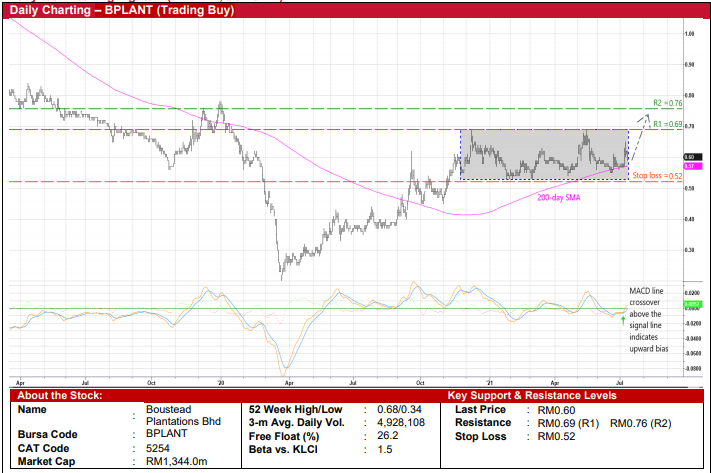

Boustead Plantations Bhd (Trading Buy)

• BPLANT’s share price – which has been moving sideways since late November last year – could attempt to break out from the rectangle pattern soon.

• On the chart, the stock has just bounced off the key 200-day simple moving average line while the MACD indicator has plotted a bullish crossover above the signal line.

• Riding on the positive momentum, the share price will likely climb towards our resistance thresholds of RM0.69 (R1; 15% upside potential) and RM0.76 (R2; 27% upside potential).

• Our stop loss price is pegged at RM0.52 (or a downside risk of 13% from the last traded price of RM0.60).

• BPLANT, which owns 73,500 hectares of plantation land cultivated with oil palm, is a beneficiary of elevated palm oil prices. The spot month forward CPO price is up 29% year-to-date to hover at RM3,863 per MT currently.

• This has lifted the group’s bottomline to RM12.2m in 1QFY21 (reversing from a net loss of RM9.6m previously) as the group achieved higher average CPO selling price of RM3,751 per MT during the quarter (versus RM2,793 per MT in the previous corresponding period).

• In terms of recent news flows, BPLANT is reportedly planning to unlock value by disposing of its plantation assets (comprising two mills and oil palm estates totalling 10,285 hectares) in Sarawak.

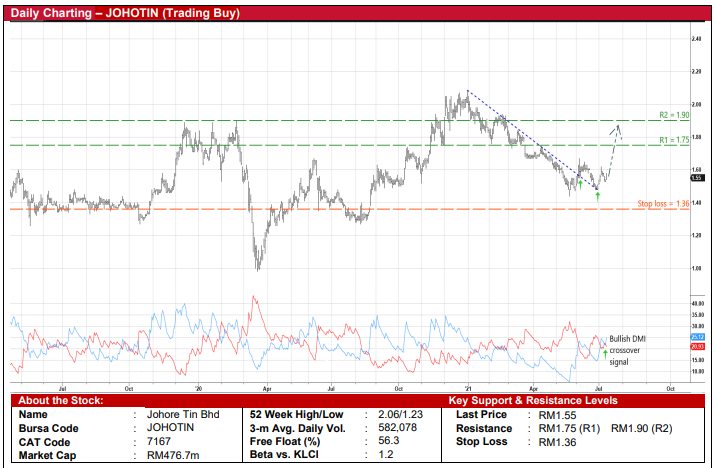

Johore Tin Bhd (Trading Buy)

• After overcoming a descending trendline that stretches back to the end of last year, JOHOTIN shares are in a position to stage a price reversal ahead.

• With the DMI Plus crossing over the DMI Minus to generate a positive technical signal, the stock is expected to shift higher going forward.

• Hence, the share price could advance to challenge our resistance targets of RM1.75 (R1) and RM1.90 (R2), which translate to upside potentials of 13% and 23%, respectively.

• We have set our stop loss price at RM1.36 (representing a 12% downside risk).

• On the fundamental front, JOHOTIN – whose principal activity is in tin cans manufacturing and food & beverage (namely the manufacturing and selling of milk and other related dairy products such as sweetened condensed milk, evaporated milk & milk powder) – has seen its bottomline growing annually in recent years.

• Net profit – which almost doubled from RM25.7m in FY17 to RM47.5m in FY19 – has remained resilient amid the business disruptions triggered by the Covid-19 pandemic last year, coming in at RM39.5m (-17% YoY) for FY December 2020. For 1QFY21, the group’s net earnings rebounded to RM9.5m (up 109% YoY).

• Financially healthy, its balance sheet is backed by net cash holdings of RM60.3m (or 19.6 sen per share) as of end-March this year.

• The company – which has consistently rewarded its shareholders with annual dividend payouts of 42% since FY18 – declared DPS of 5.4 sen in FY20, implying a historical dividend yield of 3.5%.

Source: Kenanga Research - 13 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024