Daily technical highlights – (SYSCORP, JFTECH)

kiasutrader

Publish date: Thu, 22 Jul 2021, 10:15 AM

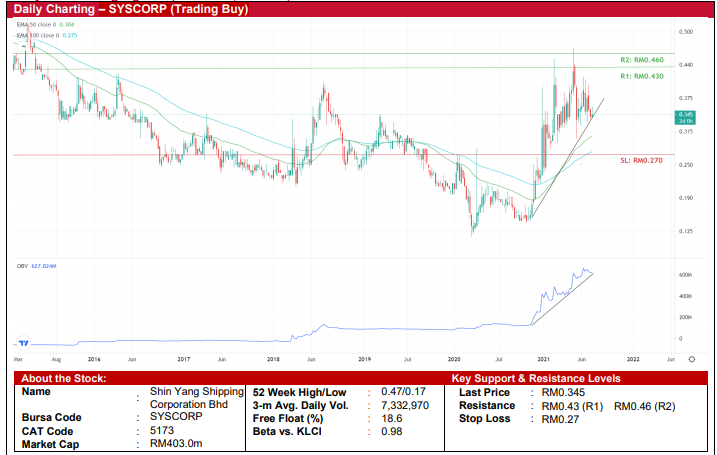

Shin Yang Shipping Corporation Bhd (Trading Buy)

• SYSCORP has strategically positioned itself as an integrated shipping and shipbuilding operator, which also includes ship repair and forwarding agencies as its core businesses.

• SYSCORP’s shipbuilding yards cover an area of approximately 280 acres with an annual capacity to construct 40 vessels. Its facilities enable the group to undertake modifications of vessels in a timely manner to meet industry requirements and trends, catering to a wide segment of customers.

• The group is expected to benefit from increased demand for shipping services in tandem with the resumption of global economic activities. In addition, industry reports have indicated that shipping freight rates – which are hovering at around USD6,000 per FEU so far in 2HCY21 (+300% YoY) – are expected to stay elevated, thus benefitting shipping players like SYSCORP.

• Reflecting the improved fundamentals, SYSCORP reported a net profit of RM4.1m in 3QFY21 versus a net loss of RM83.1m in the preceding quarter.

• Chart-wise, SYSCORP has been riding an uptrend from a low of RM0.15 (in mid-November 2020) to peak at RM0.47 (in the beginning of May 2021), as tracked by the ascending trendline. Since then, the stock has retraced to close at RM0.345 yesterday, registering a YTD return of 13.1%.

• We believe a resumption of the upward trajectory will occur as the 50-day EMA has crossed above the 100-day EMA while the OBV indicator is rising at the same time.

• With that, the stock could challenge our resistance thresholds of RM0.43 (R1; 25% upside potential) and RM0.46 (R2; 33% upside potential).

• We have pegged our stop loss price at RM0.27 (or 22% downside risk).

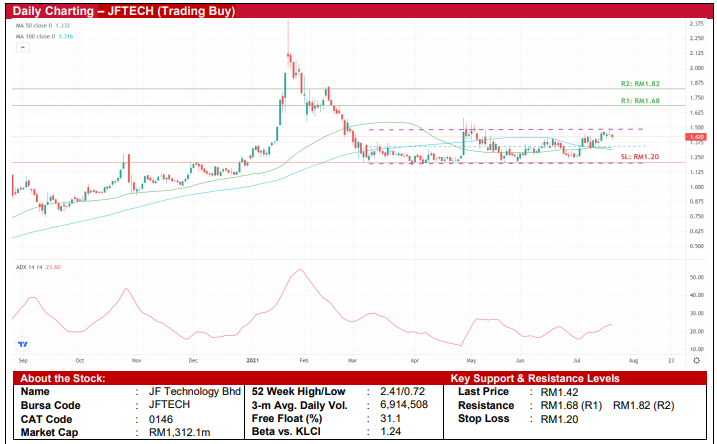

JF Technology Bhd (Trading Buy)

• Technically speaking, JFTECH’s share price has been treading within a narrow range since the beginning of March 2021, plotting a sideways channel along the way.

• The stock has just seen a Golden Cross (whereby the 50-day MA has cut above the 100-day MA), signaling an upward bias in the stock price ahead.

• With the shares continuing to tread above the Golden Cross level, and on the back of the rising ADX indicator, we expect the buying interest to persist to lift the stock higher.

• Therefore, we project the share price could challenge our resistance targets of RM1.68 (R1; 18% upside potential) and RM1.82 (R2; 28% upside potential).

• Our stop loss price is pegged at RM1.20 (or 15% downside risk).

• JFTECH has positioned itself as a leading innovator and manufacturer of high-performance test contacting solutions for global integrated circuit makers.

• The group is currently in a growing phase with its manufacturing plant expansion in China ready to begin production in 4QCY21, which would cater to the rising demand from its Chinese customers.

• JFTECH reported net earnings of RM3.5m (+110% QoQ) in 3QFY21, driven mainly by stronger sales (from exports to China) and lower operating cost, taking YTD net profit to RM7.6m (+145% YoY).

Source: Kenanga Research - 22 Jul 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024