Daily technical highlights – (EG, STRAITS)

kiasutrader

Publish date: Wed, 11 Aug 2021, 09:48 AM

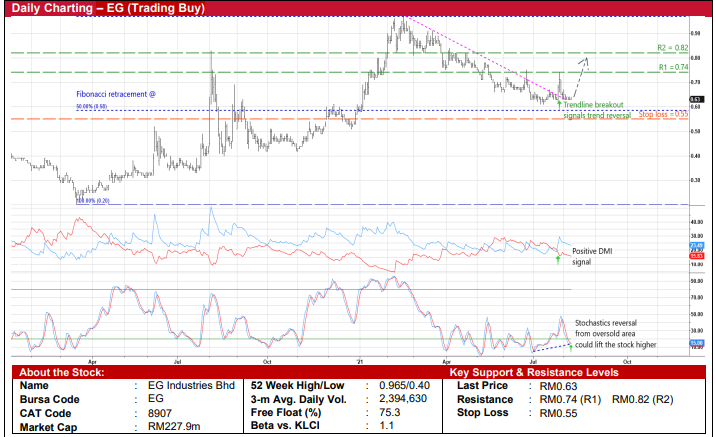

EG Industries Bhd (Trading Buy)

• As a leading Electronic Manufacturing Services (EMS) and vertical integration provider for global brand names of consumer electronic and data storage products for several industries (such as ICT, medical, automotive and telecommunications), EG offers full turnkey solutions for completed final products assembly (box-build), printed circuit board assembly and modular components assembly.

• With its recent product line expansion to manufacture complete box-build 5G routers for US customers, EG has emerged as a proxy to the global 5G network rollouts.

• After posting net loss of RM13.6m in FY June 2020, the group is set to turn around in FY21 following three consecutive quarters of earnings (amounting to RM4.4m in 1Q, RM5.1m in 2Q and RM4.2m in 3Q) in the current financial year.

• On the chart, the stock – which has pulled back from a high of RM0.965 in mid-February this year to as low as RM0.61 one month ago – may stage a trend reversal after bouncing off the 50% Fibonacci retracement line recently.

• In view of the bullish technical signals triggered by the DMI Plus crossover above the DMI Minus and the stochastics indicator (which is poised to climb out from the oversold area after forming two rising bottoms), EG’s share price will likely attempt to pull away further from a descending trendline ahead.

• An anticipated breakout could lift the stock towards our resistance thresholds of RM0.74 (R1; 17% upside potential) and RM0.82 (R2; 30% upside potential).

• We have pegged our stop loss price at RM0.55 (or 13% downside risk from its last traded price of RM0.63).

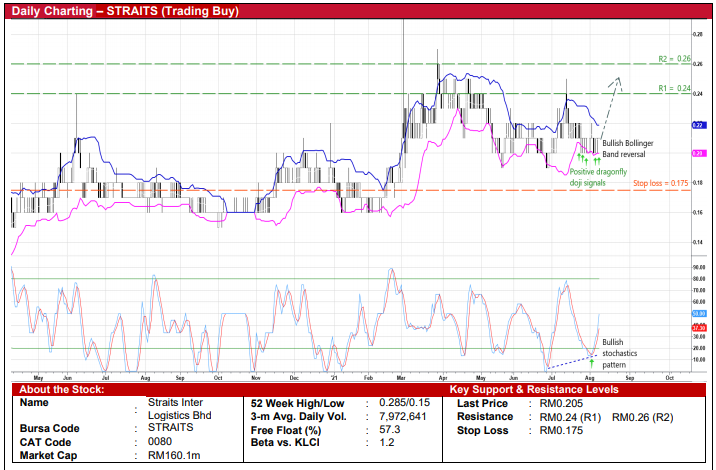

Straits Inter Logistics Bhd (Trading Buy)

• STRAITS’ business portfolio comprises: (i) oil trading & bunkering services, (ii) inland transportation & logistics services, (iii) port operation & facility management services, and (iv) vessel management services.

• Despite the challenging economic environment due to the Covid-19 pandemic, the group has remained profitable, posting net profit of RM2.8m (-60% YoY) in FY December 2020 that was followed by net earnings of RM0.7m (-31% YoY) in 1QFY21.

• In terms of recent corporate development, the group has received approval in July to develop an integrated offshore ship-toship (STS) LNG and LPG energy transhipment hub in Labuan. The STS hub – which is earmarked to be STRAITS’ flagship energy project – is expected to commence operation in 4Q 2021.

• On the chart, the share price may be making its way to scale higher levels ahead based on the positive technical signals triggered by: (i) the %K line cutting above the %D line in the oversold territory for the stochastics indicator, (ii) the stock’s crossing back above the lower Bollinger Band after slipping below it earlier, and (iii) the appearance of successive dragonfly doji candlesticks lately.

• Riding on the strengthening momentum, STRAITS shares could climb towards our resistance thresholds of RM0.24 (R1; 17% upside potential) and RM0.26 (R2; 27% upside potential).

• Our stop loss price is set at RM0.175 (representing a 15% downside risk).

Source: Kenanga Research - 11 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024