Daily technical highlights – (HEXZA, JAG)

kiasutrader

Publish date: Wed, 01 Sep 2021, 10:42 AM

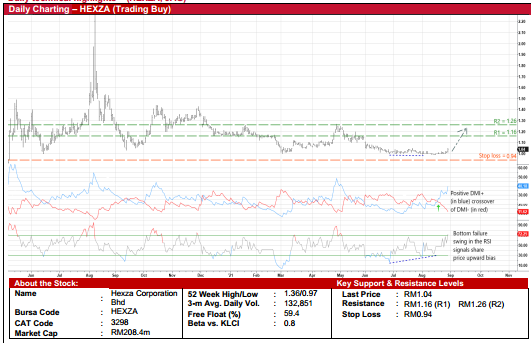

Hexza Corporation Bhd (Trading Buy)

• HEXZA is involved in two principal businesses: (i) the production and sale of ethanol for industrial and potable purposes, and (ii) the manufacture and sale of formaldehyde-based liquid adhesive resins to wood related industries in Sarawak.

• After turning around from a net loss of RM20.0m in FY June 2018 to post net earnings of RM7.8m in FY19 and RM15.5m in FY20, the group’s bottomline came in weaker at RM10.2m in FY21 as its performance was affected by lower sales and margins squeeze amid the Covid-19 pandemic crisis.

• Still, as the largest manufacturer of ethanol in Malaysia and one of the largest producers of resins in East Malaysia, HEXZA is poised to ride on an eventual resumption of economic activities.

• Backed by a debt-free balance sheet with cash & cash equivalents of RM97.0m (48.4 sen per share or slightly less than half of the existing share price) as of end-June 2021, the group is in a financially healthy position to weather through the prevailing challenging economic environment.

• From a charting standpoint, the stock – which rose 3% on higher-than-average volume on Monday – is set to break out from a consolidation pattern after drifting sideways since mid-June this year.

• The bullish technical stance is underpinned by: (i) the DMI Plus crossing over the DMI Minus signal, and (ii) the occurrence of a bottom failure swing (with the RSI indicator plotting rising bottoms in the oversold area while the share price remains flattish).

• Riding on an upward momentum, HEXZA shares could advance towards our resistance thresholds of RM1.16 (R1; 12% upside potential) and RM1.26 (R2; 21% upside potential).

• We have placed our stop loss price at RM0.94 (or 10% downside risk from the last traded price of RM1.04).

JAG Bhd (Trading Buy)

• JAG’s share price pullback – from a recent high of RM0.54 in early May to as low as RM0.295 in late June before recovering partially to close at RM0.35 on Monday – presents a trading opportunity as its uptrend pattern remains intact.

• With the stock currently treading near an ascending trendline (that stretches back to November last year) and the 50-day SMA line, a technical rebound may be in the making.

• The appearance of the bullish dragonfly doji candlestick last Friday also signals a probable upward shift in JAG shares ahead.

• On the way up, the stock could test our resistance targets of RM0.40 (R1; 14% upside potential) and RM0.45 (R2; 29% upside potential).

• Our stop loss price is pegged at RM0.30 (or 14% downside risk).

• Business-wise, JAG is one of Malaysia’s leading total waste management services providers by market share. The group is also involved in coin-operated laundry services, property development & software solutions.

• An indirect proxy to the high growth electrical and electronic industry via its niche in the recovery and recycling business of ewaste (electrical & electronic wastes), JAG sources for scheduled waste from local semiconductor manufacturers, process and/or convert the collected scheduled waste into valuable commodities (such as copper, tin, silver and gold) for resale.

• Hence, the group – which derives the bulk of its revenue from export markets (like China and Japan) – stands to benefit from a rally in these commodity prices.

• After reporting a net profit of RM9.2m in FY December 2020 (versus a net loss of RM11.9m previously), the group’s strong earnings momentum continued with sequential quarterly net earnings coming in at RM5.4m (+252% YoY) in 1QFY21 and RM4.6m (+110% YoY) in 2QFY21.

• Annualizing the 1HFY21 results, JAG’s estimated full-year net earnings of RM20.0m translates to a forward PER of 10.6x this year.

Source: Kenanga Research - 1 Sept 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024