Daily Technical Highlights – (HIL, FPGROUP)

kiasutrader

Publish date: Wed, 08 Sep 2021, 08:59 AM

HIL Industries Bhd (Trading Buy)

• As a one-stop engineering plastics solution provider, HIL’s plastic component products are widely used in the automotive,consumer electronics and information technology (IT) industries. The group is also involved in the property developmentbusiness. Each segment contributed almost equally to the overall revenue (of RM163.0m) last year.

• With approximately 80% of the plastics manufacturing division’s turnover coming from the automotive sector, HIL (whosecustomers include Perodua, Proton, Toyota and Honda) offers indirect exposure to the local car sales industry, which is expected to play catch up with pent-up demand as the economy reopens progressively.

• After registering net profit of RM24.6m (+14% YoY) in FY December 2020, the group’s growth momentum continued in1QFY21 with net earnings standing at RM6.2m (+50% YoY).

• HIL is financially sound with zero borrowings and cash holdings of RM101.0m (which translates to 30.4 sen per share ornearly one-third of the existing share price) as of end-March this year.

• On the chart, following a surge to as high as RM1.10 last Friday before pulling back in the subsequent days to close atRM0.97 yesterday, the stock has overcome a descending price channel that stretches back to late February this year.

• And after piercing through the 150-day SMA line, the share price run-up is expected to persist riding, on the bullish crossoversby both the momentum and MACD indicators.

• With that, HIL shares will probably advance towards our resistance thresholds of RM1.10 (R1; 13% upside potential) andRM1.20 (R2; 24% upside potential).

• We have pegged our stop loss level at RM0.85 (representing a 12% downside risk).

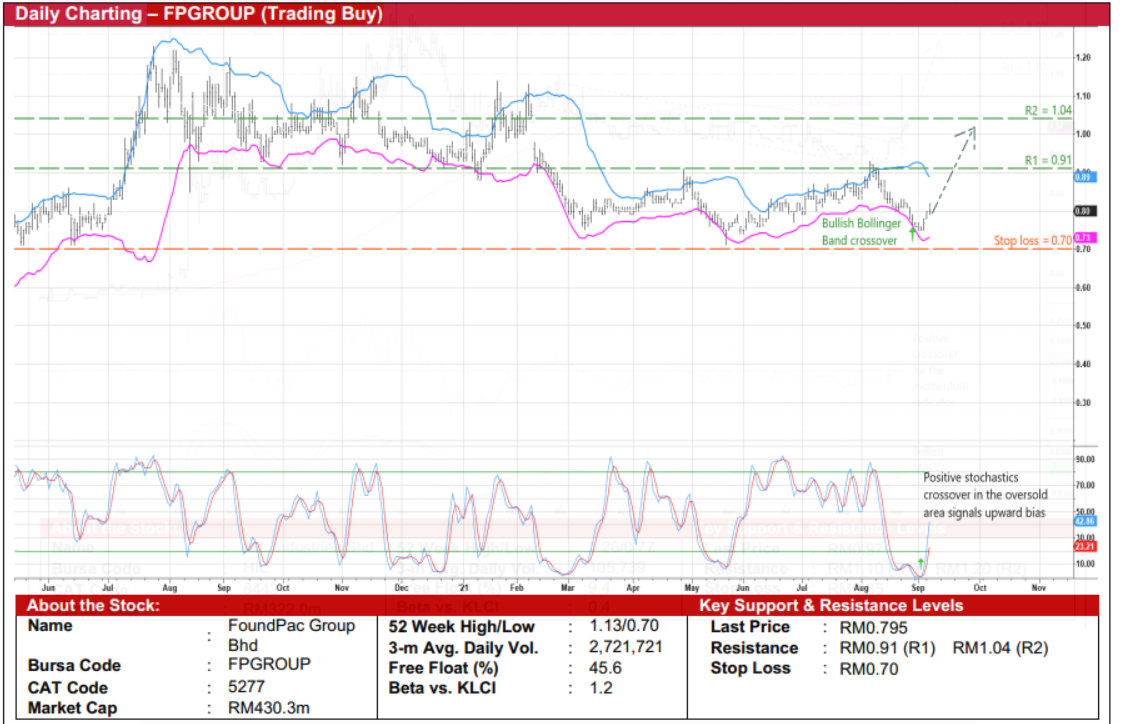

FoundPac Group Bhd (Trading Buy)

• A technical rebound could be underway for FPGROUP shares after sliding from a recent high of RM0.925 in early August toRM0.795 currently.

• From a charting standpoint, the stock is anticipated to shift higher on account of the positive technical signals arising from: (i)the share price crossing back above the lower Bollinger Band, and (ii) the stochastics indicator with the %K line cutting overthe %D line in the oversold zone.

• Riding on the strengthening momentum, the stock could climb towards our resistance thresholds of RM0.91 (R1; 14% upsidepotential) and RM1.04 (R2; 31% upside potential).

• Our stop loss price is set at RM0.70 (or 12% downside risk).

• Business-wise, FPGROUP is principally involved in the manufacturing and sale of precision engineering parts (namelystiffeners, test sockets, hand lids & related accessories) and laser stencils.

• With a customer base consisting of primarily large multinational semiconductor manufacturers, outsourced semiconductor assembly and test companies (OSATs) and printed circuit board (PCB) design houses, FPGROUP is a proxy to the highgrowth technology industry.

• Over the years, the group has been profitable with its bottomline fluctuating between RM7.5m and RM16.4m from FY16 toFY20. In the latest FY ended June 2021, its net profit came in at RM11.6m (-27% YoY).

• And given a debt-free balance sheet that is backed by cash holdings of RM56.2m (or 10.4 sen per share) as of end-June this year, FPGROUP is in a financially steady position to weather through the prevailing challenging

Source: Kenanga Research - 8 Sept 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024