Daily technical highlights – (CYPARK, THPLANT)

kiasutrader

Publish date: Thu, 09 Sep 2021, 09:29 AM

Cypark Resources Bhd (Trading Buy)

• CYPARK has positioned itself strategically as a pioneer developer and provider of green energy solutions. They have successfully completed a wide array of projects that consist of: (i) Renewable Energy, (ii) Landfill Remediation, (iii) Waste Management, and (iv) Contaminated Land and Groundwater Management.

• Amid the challenging economic landscape, the group’s 2QFY21 revenue increased to RM85.9m (+13.5% QoQ) while its net income decreased marginally to RM18.0m (-2.7% QoQ), taking YTD net profit to RM32.9m (-0.3% YoY).

• Consensus is expecting CYPARK to post a net profit of RM75.1m in FY21 and RM75.7m in FY22. This translates to forward PERs of 6.7x and 6.6x, respectively.

• CYPARK’s stock price has pulled back from a high of RM1.67 in early March 2021 to a low of RM0.85 in the middle of July 2021 before recovering partially to close at RM1.00 yesterday, registering a 40.1% decline from the peak.

• Following which, the technical rebound will probably continue as: (i) the stock has been treading around the upper band of the Keltner Channel, and (ii) the ADX indicator is trending upwards.

• With that, we anticipate that the share price may test our resistance targets of RM1.12 (R1) and RM1.23 (R2), which represent upside potentials of 12% and 23%, respectively.

• Our stop loss price has been set at RM0.89, which represents a downside risk of 11%.

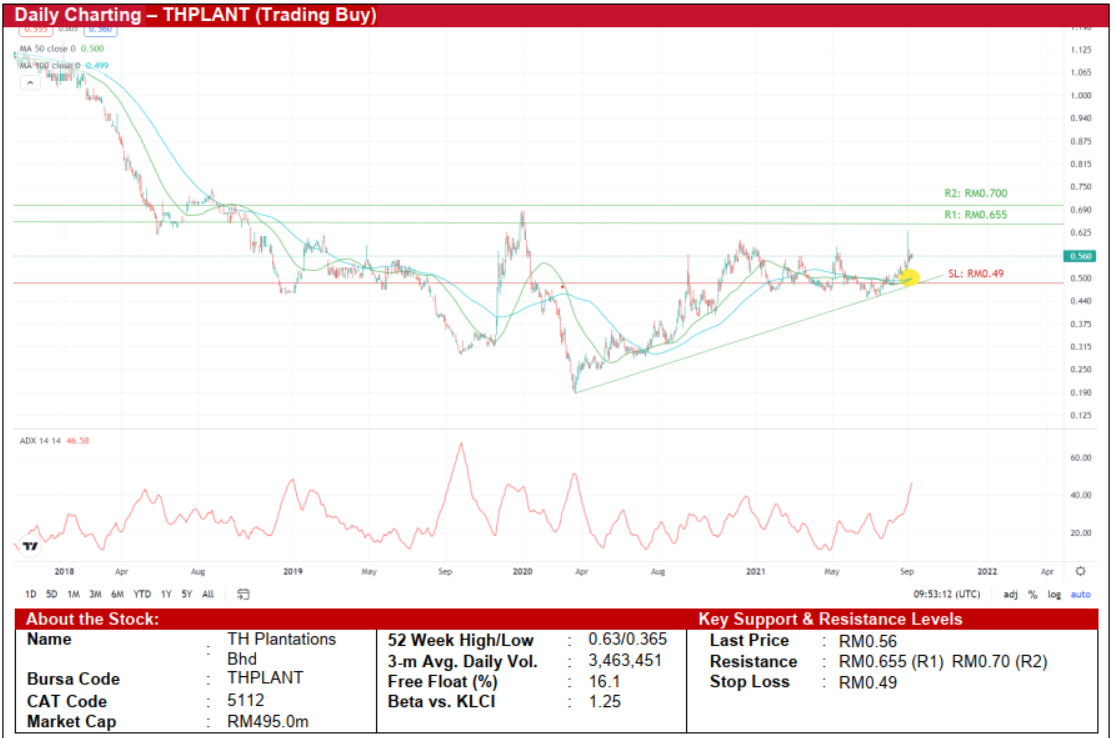

TH Plantations Bhd (Trading Buy)

• From a high of RM1.15 at the end of December 2017 to a bottom of RM0.185 at the end of March 2020, THPLANT’s share price has partially recouped its losses since then to close at RM0.56 yesterday.

• Following the occurrence of a golden-cross (with the 50-day MA just cut above the 100-day MA), a continuation of the upward trajectory is anticipated.

• And with the ADX indicator also trending upwards, THPLANT’s share price could rise to our resistance targets of RM0.655 (R1) and RM0.70 (R2), which represent upside potentials of 17% and 25%, respectively.

• Our stop loss price has been set at RM0.49, which represents a downside risk of 12%.

• THPLANT is involved in the oil palm plantation activity that produces Fresh Fruit Bunches (FFB), Palm Kernel (PK) and Crude Palm Oil (CPO) with plantation estates spanning across Peninsular Malaysia, Sabah and Sarawak.

• On the back of higher CPO prices and improved cost management, the group’s net profit jumped to RM26.6m (+228% QoQ) in 2QFY21, lifting 1HFY21’s bottom-line to RM40.5m (+1,291% YoY).

• Going forward, consensus is expecting THPLANT to report a net profit of RM53.2m in FY21 and RM35.4m in FY22. This translates to forward PERs of 9.3x and 14.0x, respectively.

Source: Kenanga Research - 9 Sept 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024