Daily technical highlights – (SCGBHD, PWROOT)

kiasutrader

Publish date: Tue, 21 Sep 2021, 08:52 AM

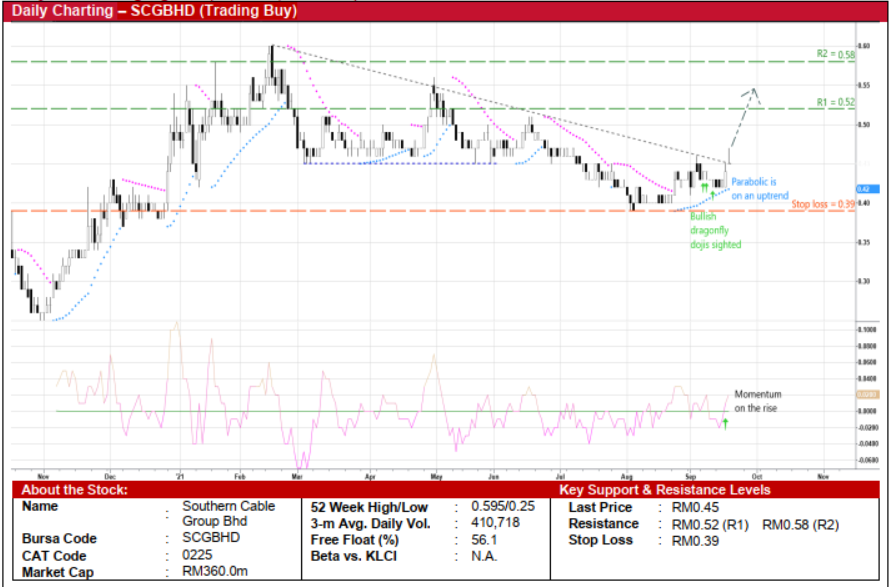

Southern Cable Group Bhd (Trading Buy)

• SCGBHD – which was only listed on the ACE Market in mid-October last year – is on track to transfer its listing status to the Main Market in 4QCY21 after getting the regulatory approval from the Securities Commission last Friday. This is expected to expand the investability of SCGBHD shares to a wider group of investors going forward.

• As a manufacturer of cables and wires that are used for power distribution and transmission, communications as well as control and instrumentation applications, SCGBHD stands to benefit from the recurring capex spending by infrastructure players such as Tenaga Nasional, Telekom Malaysia and Petronas. Most recently in the beginning of September, the group has secured a RM30.4m rectifier systems supply contract from Telekom Malaysia to be carried out over 30 months starting from this month.

• After registering net earnings of RM3.6m in 1QFY21, SCGBHD subsequently announced net profit of RM3.1m in 2QFY21, bringing its bottomline to RM6.7m for the first half ended June 2021.

• From a technical perspective, following a gap-up in the share price on the back of higher-than-average trading volume yesterday, the stock has overcome a negative sloping trendline that stretches back to mid-February this year.

• And the upward trajectory is expected to continue, riding on: (i) the Parabolic SAR’s prevailing positive trend, (ii) the rising momentum indicator, and (iii) the appearance of the bullish dragonfly doji candlesticks recently.

• With that, SCGBHD shares will probably advance towards our resistance thresholds of RM0.52 (R1) and RM0.58 (R2), translating to upside potentials of 16% and 29%, respectively.

• We have pegged our stop loss price at RM0.39 (which represents a 13% downside risk from the last traded price of RM0.45).

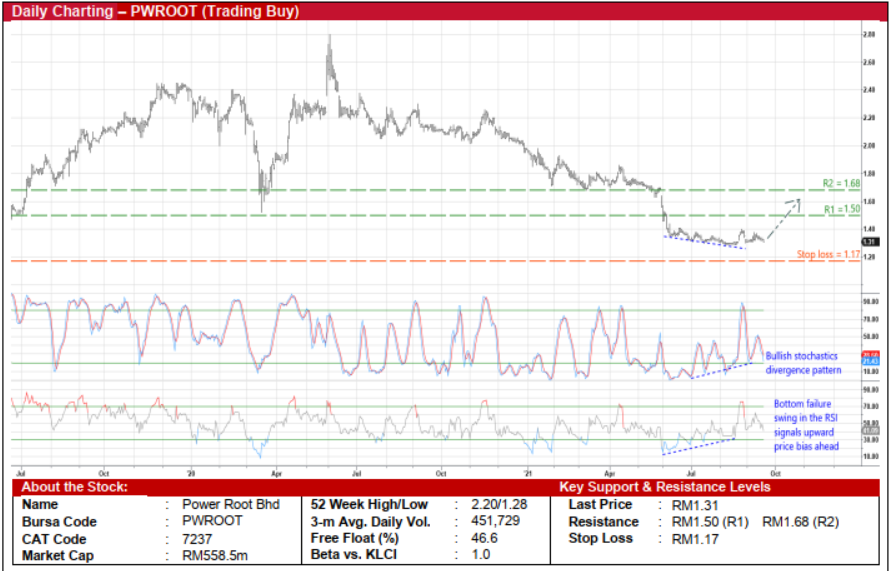

Power Root Bhd (Trading Buy)

• After moving listlessly since early June this year to hover near a 2¼-year low currently, PWROOT shares may stage a price breakout from the sideways trading pattern ahead.

• The positive technical stance is underpinned by: (i) a bullish divergence in the stochastics indicator following the formation of rising bottoms by the %D line in the oversold territory while the stock drifted lower, and (ii) a bottom failure swing in the RSI indicator which has been trending higher in the oversold zone in contrast to the price weakness.

• On the way up, the stock could climb to challenge our resistance targets of RM1.50 (R1; 15% upside potential) and RM1.68 (R2; 28% upside potential).

• Our stop loss price is set at RM1.17 (or 11% downside risk).

• Business-wise, PWROOT is a manufacturer and distributor of beverages specialising in staple drinks (such as coffee, tea, chocolate malt drinks and herbal energy drinks).

• After posting net profit of RM2.0m (-81% YoY) in 1QFY22, as its performance was hit by weak export sales and higher operating costs, consensus is forecasting that the group will make net earnings of RM22.9m in FY March 2022 and RM40.3m in FY March 2023. This translates to forward PERs of 24.3x and 13.9x, respectively.

• With a healthy balance sheet that is backed by net cash holdings of RM87.5m (or 20.5 sen per share) as of end-June this year, PWROOT is expected to reward its shareholders with consensus DPS estimates of 4.9 sen for FY22 and 8.8 sen for FY23, which imply attractive dividend yields of 3.7%-6.7% respectively.

Source: Kenanga Research - 21 Sept 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024