Daily technical highlights – (HEXIND, REX)

kiasutrader

Publish date: Wed, 22 Sep 2021, 09:23 AM

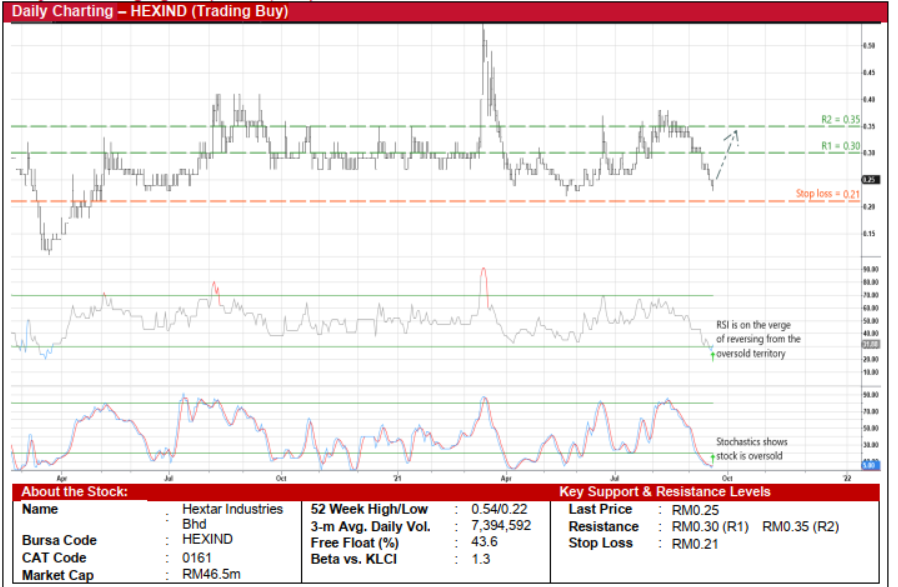

Hextar Industries Bhd (Trading Buy)

• HEXIND is a proxy to the surging fertiliser prices, as fertiliser nutrients such as urea and phosphate are presently trading near their highest price levels since 2012 / 2013.

• In addition to the business of manufacturing and distributing fertiliser products (catering mainly to the oil palm industry) – which contributed RM81.6m or two-thirds of overall revenue in FY August 2020 – the group is involved in the supply and distribution of quarry related products and rental of machinery and equipment.

• For the nine-month financial period ended May 2021, the group made a marginal net profit of RM1.4m, a turnaround from the net loss of RM3.7m posted in the prior corresponding period.

• In terms of corporate developments, HEXIND has completed a 3-into-1 share consolidation exercise in mid-March this year. It is now in the midst of undertaking a 5-for-1 rights issue (at an issue price of RM0.12 per rights share) to raise proceeds of up to RM110.0m (before warrants conversion) for the purpose of debt repayment and working capital requirements.

• The shares – which will be traded ex-right issue on 28 September (next Tuesday) – are currently trading at a theoretical ex right price of RM0.14 (based on yesterday’s close of RM0.25).

• From a charting standpoint, HEXIND shares could stage a technical rebound after sliding from a recent high of RM0.38 in mid-August to a 3-month low currently.

• With both the RSI and stochastics indicators set to climb out from their oversold positions, the stock is expected to ride on the positive momentum to shift higher ahead.

• On the way up, HEXIND shares will probably advance towards our resistance thresholds of RM0.30 (R1; 20% upside potential) and RM0.35 (R2; 40% upside potential).

• We have placed our stop loss price at RM0.21 (representing a 16% downside risk).

Rex Industry Bhd (Trading Buy)

• The existence of a symmetrical triangle formation suggests that REX’s share price is currently in a position to stage a technical breakout from the listless trading pattern since early December last year.

• And following the simultaneous appearance of the bullish dragonfly doji candlesticks as the stock approaches the apex of the triangle, a short-term price rally may be forthcoming.

• Riding on the upward momentum, REX shares could challenge our resistance targets of RM0.27 (R1; 15% upside potential) and RM0.29 (R2; 23% upside potential).

• Our stop loss price is pegged at RM0.20 (or 15% downside risk from the last traded price of RM0.235).

• Business-wise, as a manufacturer of canned food, beverage and confectionary products, REX derives its sales from both the domestic and overseas markets with a 35%:65% split based on FY21’s revenue.

• For the financial year ended June 2021, the group returned to the black with net profit of RM2.6m compared with FY20’s net loss of RM9.5m, as overall performance was lifted by stronger revenue, improved operational efficiency and lower operating expenses.

• Going forward, according to one recent media interview, REX is targeting to double its revenue (of RM160.5m in FY21) over the next three years by introducing new products, expanding its client base and partnering with more large-scale retailers.

Source: Kenanga Research - 22 Sept 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

HEXIND2024-11-22

HEXIND2024-11-22

HEXIND2024-11-22

HEXIND2024-11-22

HEXIND2024-11-22

HEXIND2024-11-21

HEXIND2024-11-21

HEXIND2024-11-21

HEXIND2024-11-20

HEXIND2024-11-20

HEXIND2024-11-20

HEXIND2024-11-20

HEXIND2024-11-20

HEXIND2024-11-20

HEXIND2024-11-15

HEXIND2024-11-15

HEXIND2024-11-15

HEXIND2024-11-15

HEXIND2024-11-15

HEXINDMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024