Daily technical highlights – (MUHIBAH, LCTITAN)

kiasutrader

Publish date: Wed, 29 Sep 2021, 08:57 AM

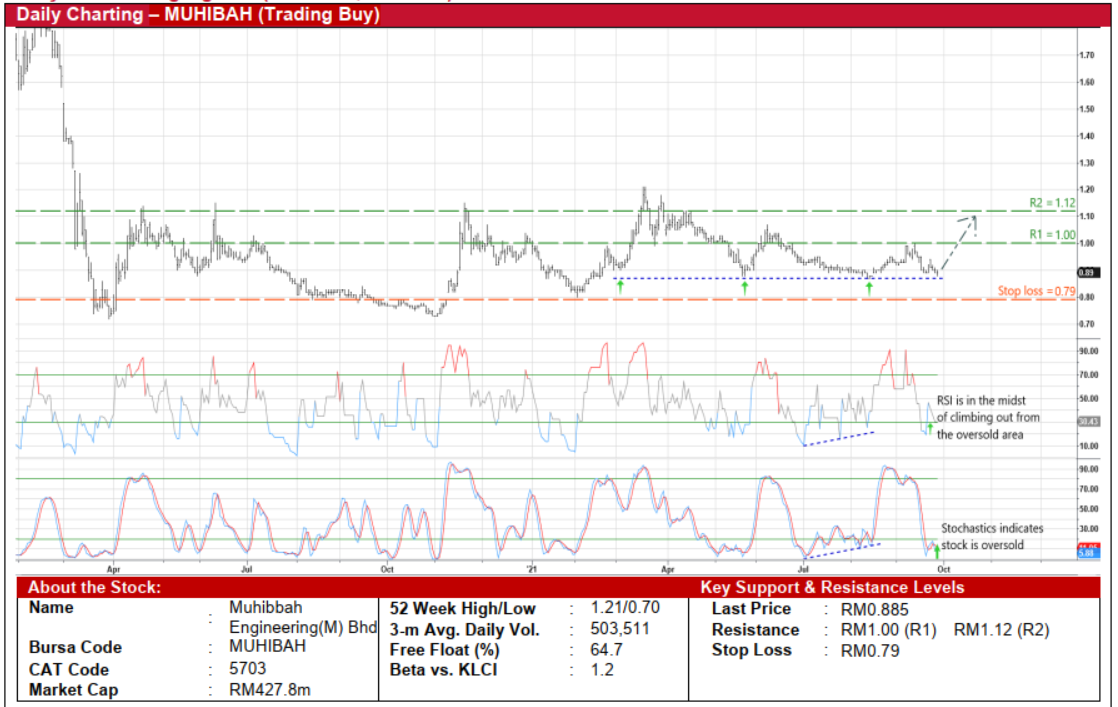

Muhibbah Engineering (M) Bhd (Trading Buy)

• MUHIBAH – which owns an effective 21% stake in three airport concessions in Cambodia (namely in Phnom Penh, Siem Reap and Sihanoukville) – is a proxy to the resumption of international travelling. Based on the latest news reports, Cambodia could be reopening its borders as soon as November as the country has already achieved a full vaccination rate of 66% (as of early this week) while the number of new daily Covid-19 infections (down from a peak of 1,130 cases end-June to 839 on Monday) has been brought under control.

• In addition, as an engineering construction company and integrated solutions provider for maritime, oil & gas and infrastructure projects, MUHIBAH is the substantial shareholder of Main Market-listed Favelle Favco (whose share price has risen 12% YTD to RM2.36 currently). Based on its 58.6% equity stake, MUHIBAH’s share of Favelle Favco (a manufacturer of specialised offshore oil & gas pedestal cranes as well as tower cranes)’s market cap works out to be RM308.2m. This already accounts for slightly more than two-thirds of its own market cap of RM427.8m as the stock is set to play catch-up ahead.

• Earnings-wise, the group made net profit of RM5.3m (+4% YoY) in 1QFY21. It will be releasing its second quarter results ended June 2021 by tomorrow. Consensus is currently forecasting the group will log net earnings of RM7.2m in FY21 before recovering to RM36.8m in FY22, which imply forward PERs of 59.4x this year and 11.6x next year, respectively.

• From a charting perspective, the stock is now hovering near a steady support line (at RM0.87) that stretches back to March this year. This presents a timely trading opportunity to long MUHIBAH shares.

• With both the RSI and stochastics indicators on their way to climb out from the oversold positions, a technical breakout from an ongoing consolidation pattern could be forthcoming.

• On the way up, the share price is expected to advance towards our resistance thresholds of RM1.00 (R1; 13% upside potential) and RM1.12 (R2; 27% upside potential).

• We have pegged our stop loss price at RM0.79 (or 11% downside risk from the last traded price of RM0.885).

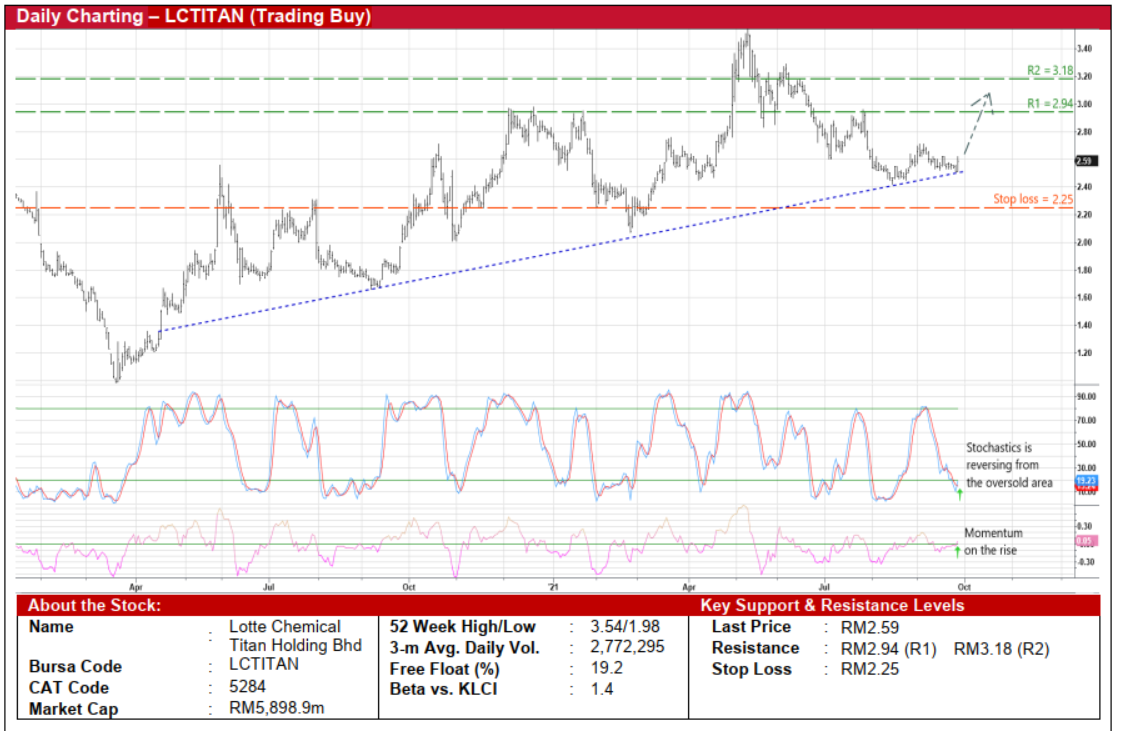

Lotte Chemical Titan Holding Bhd (Trading Buy)

• Bouncing off an ascending trendline that stretches back to mid-April last year, LCTITAN shares – which rose 3.2% to RM2.59 yesterday on heavier-than-average trading volume – are poised to resume the upward trajectory ahead.

• This comes as the stock is expected to shift higher following the positive technical signals triggered by: (i) the momentum indicator crossing over the zero-line, and (ii) the stochastics indicator reversing from an oversold territory as the %K line has just cut above the %D line.

• With that, the share price could be making its way to challenge our resistance targets of RM2.94 (R1; 14% upside potential) and RM3.18 (R2; 23% upside potential).

• Our stop loss price is placed at RM2.25 (representing a 13% downside risk).

• Fundamentally speaking, LCTITAN is organised into two business units, namely: (i) the manufacture and sale of polyolefin products, and (ii) the manufacture and sale of olefins and derivative products.

• The group reported a jump in net profit to RM382.3m in 2QFY21 (up from 2QFY20’s RM88.7m), bringing its first half earnings to RM822.3m (versus 1HFY20’s net loss of RM81.3m) as the buoyant performance was mainly fuelled by higher product average selling prices relative to the increased naphtha feedstock costs.

• With its product margin spreads likely to stay elevated in tandem with the rising global Brent crude oil prices (which has extended its rally lately to chalk up gains of 54% YTD, hovering at USD80 per barrel currently), consensus is projecting LCTITAN to post net profit of RM1,062m for FY December 2021 and RM546.7m for FY December 2022. This translates to forward PERs of 5.6x this year and 10.8x next year, respectively.

• An added positive is the group’s debt-free balance sheet, which is backed by cash holdings, short-term deposits & fund placements amounting to RM5,004.1m (RM2.20 per share or 85% of its existing share price) as of end-June this year.

Source: Kenanga Research - 29 Sept 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024