Daily technical highlights – (PTRANS, PERDANA)

kiasutrader

Publish date: Tue, 12 Oct 2021, 10:22 AM

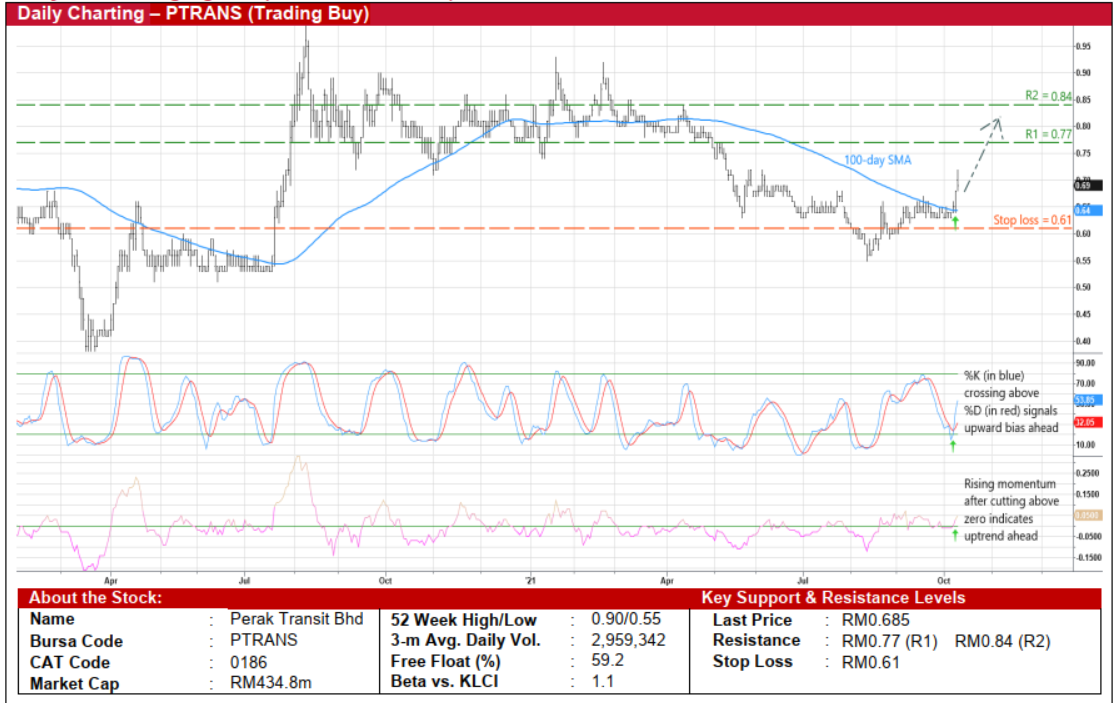

Perak Transit Bhd (Trading Buy)

• PTRANS’ prospects are brightening following the reopening of state borders for travelling across the country. This is expected to boost the Perak-based group’s income from its: (i) integrated public transportation terminal operations (via the rental of advertising and promotional spaces, rental of shops and kiosks, project facilitation fee and other miscellaneous incomes), (ii) the provision of public stage bus and express bus services and bus charter services, and (iii) petrol stations operations.

• PTRANS has registered increasing year-on-year earnings in the last five years with net profit growing at CAGR of 17% from RM19.2m in FY15 to RM42.0m in FY20. And the rising earnings trend has continued this year amid the business disruptions triggered by the Covid-19 movement restrictions when the group’s bottomline came in at RM26.9m (+61% YoY) in the first half ended June 2021.

• Going forward, consensus is forecasting PTRANS to log net profit of RM51.0m (+21% YoY) in FY Dec 2021 and RM54.0m (+6% YoY) in FY Dec 2022, translating to undemanding forward PERs of 8.5x this year and 8.1x next year, respectively.

• An added positive is the stock’s offering of dividend yields of 4.2% - 4.7% based on consensus DPS estimates of 2.9 sen for FY21 and 3.2 sen for FY22, respectively.

• Technically speaking, after bouncing up from a recent trough of RM0.55 in mid-August this year, PTRANS shares – which saw strong trading interest in the past two market days before closing at RM0.685 yesterday – could be on the way to plot higher highs ahead.

• On the back of the prevailing share price strength, PTRANS has overcome the 100-day SMA with the simultaneous bullish crossovers by the stochastics and momentum indicators signalling a likely extension in the upward trajectory.

• That being the case, the stock could advance to challenge our resistance targets of RM0.77 (R1; 12% upside potential) and RM0.84 (R2; 23% upside potential).

• We have placed our stop loss price at RM0.61 (representing an 11% downside risk).

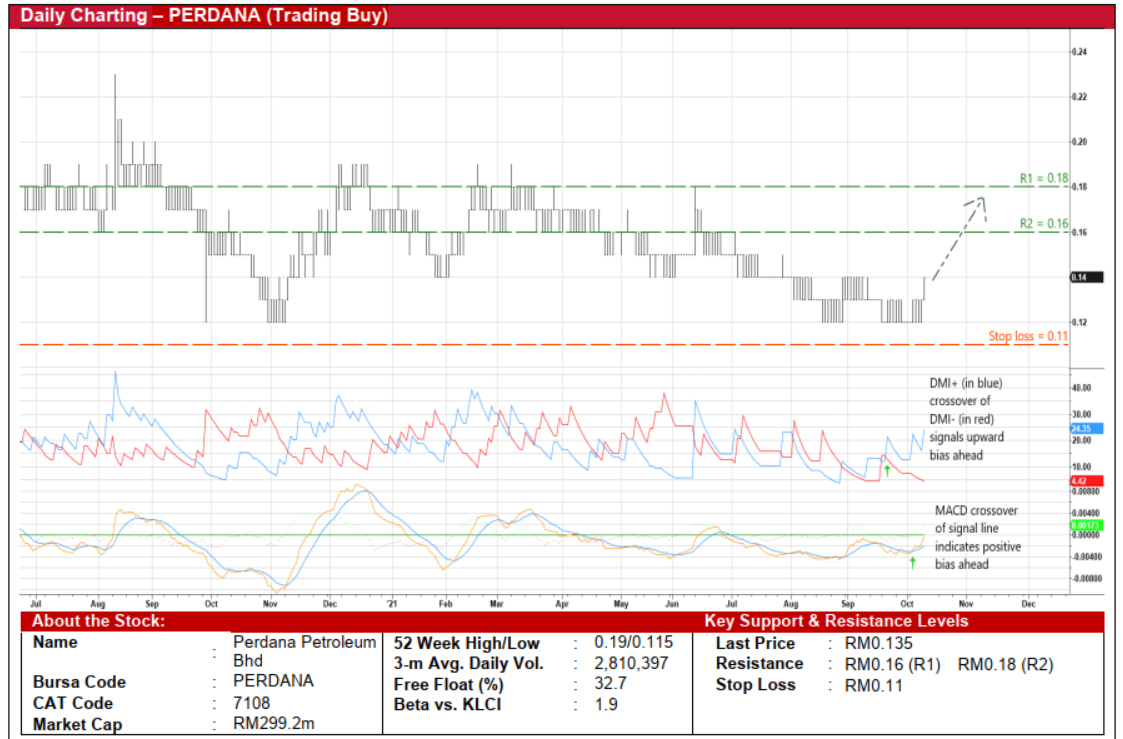

Perdana Petroleum Bhd (Trading Buy)

• On the back of improved sentiment in the oil & gas sector following the soaring crude oil price (with the Brent crude oil currently hovering at USD85 per barrel or near its 3-year high), PERDANA shares (up 12% since 20 September versus the Bursa Malaysia Energy Index’s 20% gain during the same period) may play catch-up with its peers.

• PERDANA – which is involved in the provision of offshore marine support services for the upstream oil and gas industry in the domestic and regional markets – has been loss-making with the most recent quarterly results showing net loss of RM39.1m, bringing cumulative net loss to RM66.6m in 1H ended June 2021 (including an impairment loss on property, plant & equipment amounting to RM30m).

• Nonetheless, with the elevated oil price levels expected to incentivise oil majors to carry out their planned capital expenditure going forward, the worst may be over for the group as business activity is poised to pick up.

• On the chart, after a jump in price yesterday, a technical rebound could be in the making following: (i) the DMI Plus’ crossing above the DMI Minus, and (ii) the MACD cutting over the signal line, thus setting the stage for PERDANA’s share price to shift higher ahead.

• With that, the stock will probably climb towards our resistance thresholds of RM0.16 (R1; 19% upside potential) and RM0.18 (R2; 33% upside potential).

• Our stop loss price is pegged at RM0.11 (or 19% downside risk from yesterday’s close of RM0.135).

Source: Kenanga Research - 12 Oct 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024