Daily technical highlights – (OPTIMAX, PRLEXUS)

kiasutrader

Publish date: Wed, 13 Oct 2021, 09:08 AM

Optimax Holdings Bhd (Trading Buy)

• OPTIMAX – which is primarily involved in the provision of eye specialist services and related products – has been delivering resilient quarterly earnings since its listing on the ACE Market in mid-August 2020.

• For the most recent quarter ended June 2021, the group logged net profit of RM2.0m, taking its 1HFY21’s bottom line to RM3.3m as the group (which is in the business of providing essential services) was able to continue its operations during the Covid-19-triggered movement control orders imposed by the government to curb the pandemic.

• In terms of corporate development, OPTIMAX is in the midst of implementing a proposed bonus issue on the basis of 1 warrant for every 4 existing shares held (with the entitlement date to be announced later).

• From a technical perspective, after recently bouncing off an ascending trendline that stretches back to January this year, OPTIMAX shares will probably ride on the strengthening momentum to trend higher ahead.

• And with the stochastics indicator – which saw the %K line crossing over the %D line in the oversold area – signalling an upward bias too, the share price may be on the way to reverse the decline from its post-listing high of RM1.87 in late March this year.

• On the way up, we have set our resistance targets at RM1.48 (R1) and RM1.57 (R2) for the stock to challenge going forward. This represents upside potentials of 12% and 19%, respectively.

• Our stop loss price is pegged at RM1.17 (or 11% downside risk from the last traded price of RM1.32).

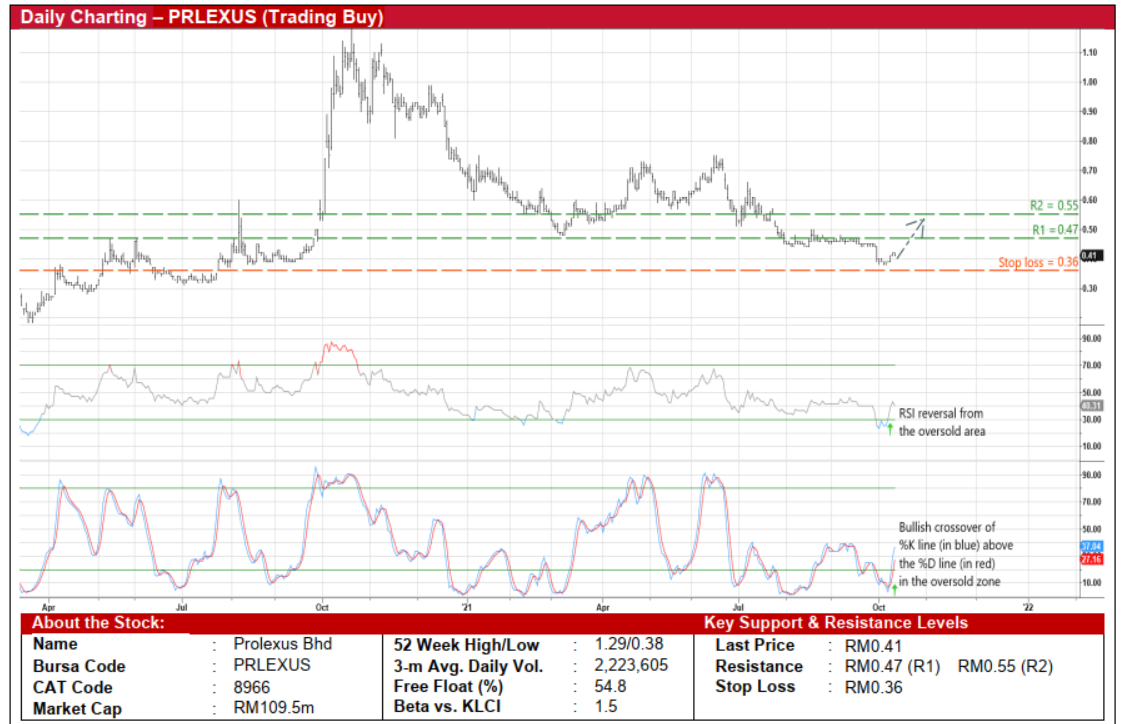

Prolexus Bhd (Trading Buy)

• A technical rebound could be in the offing for PRLEXUS shares following a price slump to a 15-month low of RM0.38 early this month.

• This comes as both the RSI and stochastics indicators are in the midst of climbing out from their oversold territories, thus setting the stage for the stock to reverse the downtrend that started initially from the peak of RM1.18 in October last year.

• On the chart, an anticipated share price reversal will likely lift PRLEXUS towards our resistance thresholds of RM0.47 (R1; 15% upside potential) and RM0.55 (R2; 34% upside potential).

• We have placed our stop loss price at RM0.36 (translating to a downside risk of 12%).

• Earnings-wise, PRLEXUS – which is in the business of manufacturing sportswear apparels and reusable fabric face masks – posted net profit of RM16.9m in FY ended July 2021 (versus FY20’s net profit of RM17.6m) as its business operations (which are categorised as non-essential services) were negatively impacted by the Covid-19-related movement restrictions imposed by the government to control the outbreak.

• Nonetheless, with a healthy balance sheet that is backed by net cash holdings of RM40.6m (or 15.2 sen per share representing more than one-third of the existing share price) as of end-July this year, the group is in a financially steady position to weather through the prevailing challenging economic environment.

Source: Kenanga Research - 13 Oct 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 28, 2024