Kenanga Research & Investment

Daily technical highlights – (CYL, KAB)

kiasutrader

Publish date: Tue, 26 Oct 2021, 09:35 AM

CYL Corporation Bhd (Trading Buy)

- CYL is a manufacturer of a wide spectrum of blow moulded plastic products (bottles and containers) that are often used by a diverse range of customers, spanning across the: (i) automotive lubricant industry, (ii) detergent manufacturers, (iii) food processing industries and (iv) pharmaceutical packaging industries.

- In addition, CYL’s experiences of over 30 years in the industry has enabled the group to further leverage on their capabilities and provide additional value-added services such as: (i) silk screen printing, (ii) labelling of bottles and (iii) shrink tunnel sleeving, thus positioning themselves as a preferred choice for customers that are opting for plastic packaging sources.

- Chart-wise, after peaking at a high of RM0.87 (end-March 2021), the stock steadily declined 47.1% to reach a low of RM0.46 (mid-July 2021). Thereafter, the stock partially recovered its losses as it hit RM0.67 (end- July 2021) before rallying to a high of RM0.76 (beginning August 2021).

- Then, the stock once again declined to a low of RM0.465 (end- August 2021) before trading sideways to close at RM0.49 yesterday.

- Technically speaking, an upward shift in CYL’s stock price is expected based on 2 reasons: (i) the shorter-term moving average cutting above the longer-term moving average – which generates a buying signal coupled with the (ii) upward trending Parabolic SAR indicator.

- In the event CYL moves in our projected direction, the stock could advance towards our resistance thresholds of RM0.55 (R1; 12% upside potential) and RM0.58 (R2; 18% upside potential).

- Our stop loss price is placed at RM0.44 (representing a downside risk of 10% from the last traded price of RM0.49).

Kejuruteraan Asastera Berhad (Trading Buy)

- KAB - has positioned itself strategically as: (i) an electrical and mechanical engineering service provider – high & low voltage electrical installation, ventilation and air-conditioning systems and (ii) provides maintenance & other services, and (iii) EPCC services – that are geared towards energy efficiency and minimizing mechanical interruptions.

- Despite the challenging industry landscape thus far, KAB reported net earnings of RM1.4m (+1300% YoY) in 2QFY21, driven mainly by robust growth in revenues, taking the half-year net profit to RM2.6m (+72.2% YoY).

- In terms of corporate development, KAB has recently raised funds via an Islamic Borrowing Facility to fund its future energy related acquisitions & developments.

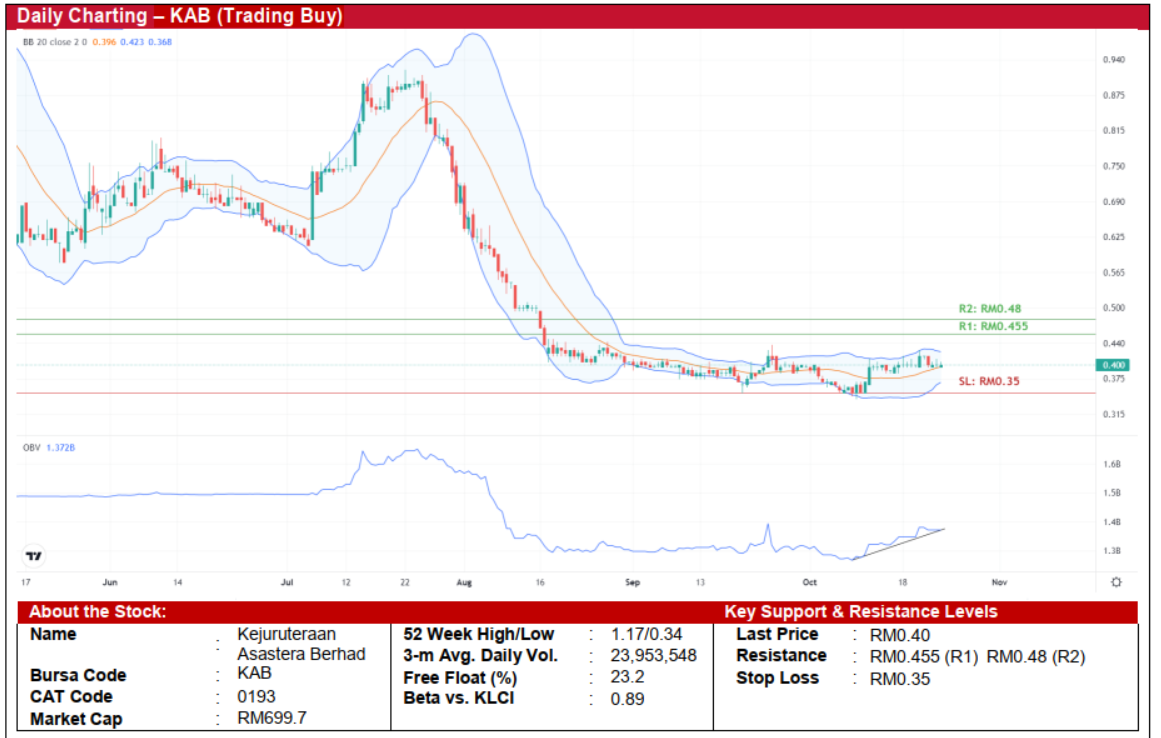

- Chart-wise, after trading in a range from the middle of May to the beginning of July, the stock spiked to a high of RM0.92 around the end of July on the back of renewed buying interest. Thereafter the stock plunged 62% to a low of RM0.35 before recovering partially to close at RM0.40 yesterday, registering a decline of 30% YTD.

- Following which, an upward trajectory in the stock price could continue as: (i) the stock has been trading above the middle band of the Bollinger Band (signifying steady buying interest), (ii) the narrowing of the Bollinger Band (potentially predicting a significant move in the share price) and (iii) the rising OBV indicator (reflecting positive volume pressure)

- This could set the stage for the share price to rise and challenge our resistance targets of RM0.455 (R1) and RM0.48 (R2), which represent upside potentials of 14% and 20%, respectively.

- Our stop loss price has been set at RM0.35, which represents a downside risk of 12%.

Source: Kenanga Research - 26 Oct 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments