Daily technical highlights – (OMESTI, FPGROUP)

kiasutrader

Publish date: Wed, 03 Nov 2021, 09:43 AM

Omesti Bhd (Trading Buy)

• OMESTI’s share price could be on the verge of plotting a trend reversal after falling from a recent high of RM0.515 in endJuly this year amid light trading volume to close at RM0.425 yesterday.

• On the back of the Parabolic SAR’s acceleration signal, the stage is now set for the stock to ride on the momentum and shift higher ahead.

• An anticipated breakout from the negative sloping trendline (that stretches back to February this year) will probably lift the shares towards our resistance thresholds of RM0.48 (R1; 13% upside potential) and RM0.53 (R2; 25% upside potential).

• We have pegged our stop loss price at RM0.38 (or 11% downside risk).

• Business-wise, OMESTI comprises a grouping of ICT companies with business activities that are focused on the development and delivery of solutions to assist clients achieve their digital transformation strategies.

• As its overall performance was badly affected by the Covid-19-triggered business disruptions, the group turned in a net loss of RM3.1m in FY March 21 (versus a net profit of RM24.0m previously), which was followed by a quarterly net loss of RM1.4m in 1QFY22 (down from 1QFY21’s net profit of RM0.1m). Nonetheless, with the re-opening of the economy since October, the worst is probably over for OMESTI.

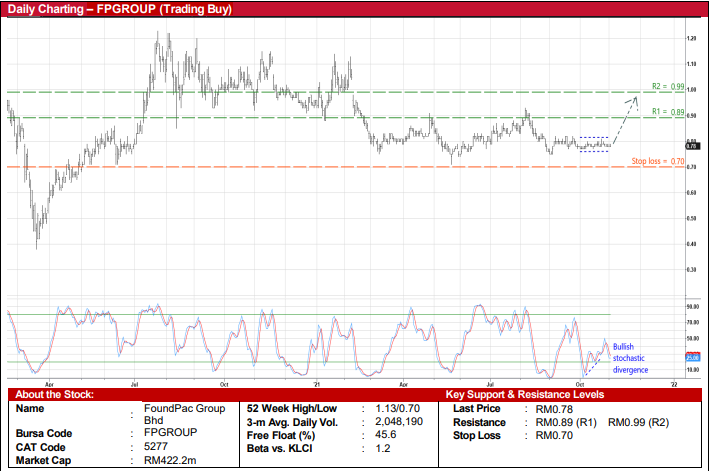

FoundPac Group Bhd (Trading Buy)

• From a charting perspective, after oscillating within a narrow price range since early September this year, FPGROUP shares may attempt to stage a technical rally to break out from the consolidation pattern soon.

• In essence, the stock is expected to find renewed strength to show an upward bias following the emergence of a bullish stochastic divergence (whereby the %D line has formed two rising bottoms while the shares were drifting listlessly).

• That being the case, the share price could shift higher to challenge our resistance thresholds of RM0.89 (R1) and RM0.99 (R2). This represents upside potentials of 14% and 27%, respectively.

• Our stop loss price is pegged at RM0.70 (translating to a 10% downside risk).

• Fundamentally, FPGROUP – which is involved in the manufacturing and sale of precision engineering parts (namely stiffeners, test sockets, hand lids & related accessories) and laser stencils – offers exposure to the high-growth technology industry. Its customers comprise primarily large multinational semiconductor manufacturers, outsourced semiconductor assembly and test companies (OSATs) and printed circuit board (PCB) design houses.

• Over the years, the group has been profitable with its bottomline fluctuating between RM7.5m and RM16.4m from FY16 to FY20. In the latest FY ended June 2021, its net profit stood at RM11.6m (-27% YoY).

• Of added financial attraction too is FPGROUP’s debt-free balance sheet that is backed by cash holdings of RM56.2m (or 10.4 sen per share) as of end-June this year.

Source: Kenanga Research - 3 Nov 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024