Daily technical highlights – (XINHWA, REVENUE)

kiasutrader

Publish date: Fri, 05 Nov 2021, 09:35 AM

Xin Hwa Holdings Bhd (Trading Buy)

• As an integrated logistics player offering a wide array of logistics solutions via the provision of: (i) land transport services (comprising cargo transportation and container haulage), (ii) warehouse & distribution services, and (iii) manufacturing & fabrication of trailers, XINHWA is a proxy to the fast-growing transportation and warehousing & distribution industry.

• To cater to its clients’ requirements, XINHWA has built an e-fulfilment centre in Shah Alam, Selangor (just completed in September this year), adding approximately 300,000 sq ft to boost its total warehousing space by 46% to 954,000 sq ft. In the longer term, it is also planning to construct an integrated logistics solutions hub on a 44-acre land in Pasir Gudang, Johor.

• Earnings-wise, after reporting net profit of RM3.0m in FY March 2021 (up from FY20’s RM1.1m), the group’s bottomline came in at a slight net loss of RM0.2m in 1QFY22 (versus 1QFY21’s breakeven position) mainly dragged down by a higher effective tax rate.

• Technically speaking, after sliding from a recent high of RM0.475 in late July this year to close at RM0.345 on Wednesday, an upward shift in share price could be forthcoming for XINHWA.

• In essence, the stock is anticipated to bounce up following: (i) its price crossing back above the lower Bollinger Band, (ii) the stochastic %K line cutting over the %D line in the oversold zone, and (iii) the emergence of bullish dragonfly doji candlesticks in the past two trading days.

• Riding on the positive momentum, XINHWA shares will probably advance towards our resistance thresholds of RM0.39 (R1; 13% upside potential) and RM0.43 (R2; 25% upside potential).

• Our stop loss price is pegged at RM0.31 (or 10% downside risk).

Revenue Group Bhd (Trading Buy)

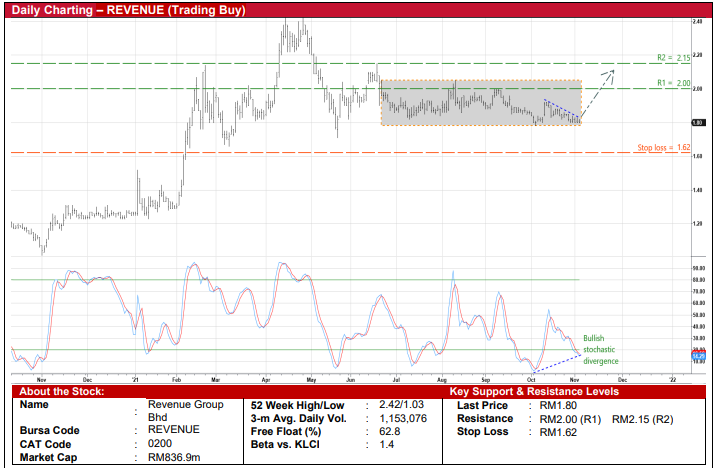

• After being boxed inside a rectangle pattern since late June this year, REVENUE shares may attempt to stage an uptrend reversal based on fresh technical signals.

• With the stock currently treading near the bottom of the rectangle box, a simultaneous occurrence of the bullish stochastic divergence pattern (as illustrated by the %D line forming two rising bottoms in the oversold area while the share price was flattish) suggests that the share price will likely plot an upward bias going forward.

• If so, then the stock could initially climb towards our immediate resistance threshold of RM2.00 (R1) before a probable subsequent breakout lift the shares to challenge our next resistance level of RM2.15 (R2). This translates to upside potentials of 11% and 19%, respectively.

• We have placed our stop loss price at RM1.62 (which represents downside risk of 10% from the last traded price of RM1.80).

• A proxy to the e-commerce theme, REVENUE is a cashless payment solutions provider in Malaysia offering a single platform (revPAY) that provides multi-channel payment solutions to different customers.

• The group – which derives its income from the deployment of Electronic Data Capture (EDC) terminals, electronic transaction processing and solutions & services related to payments infrastructure – made a net profit of RM11.2m (+46% YoY) for FY June 2021.

• Its balance sheet is financially steady backed by a net cash position of RM92.2m (or 19.8 sen per share) as of end-June 2021.

• In terms of corporate development, REVENUE is in the midst of transferring its listing status from the ACE Market to the Main Market as soon as this year, which is expected to boost its investment appeal to a wider group of investors going forward.

Source: Kenanga Research - 5 Nov 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024