Daily technical highlights – (ENGTEX, SALUTE)

kiasutrader

Publish date: Tue, 09 Nov 2021, 09:44 AM

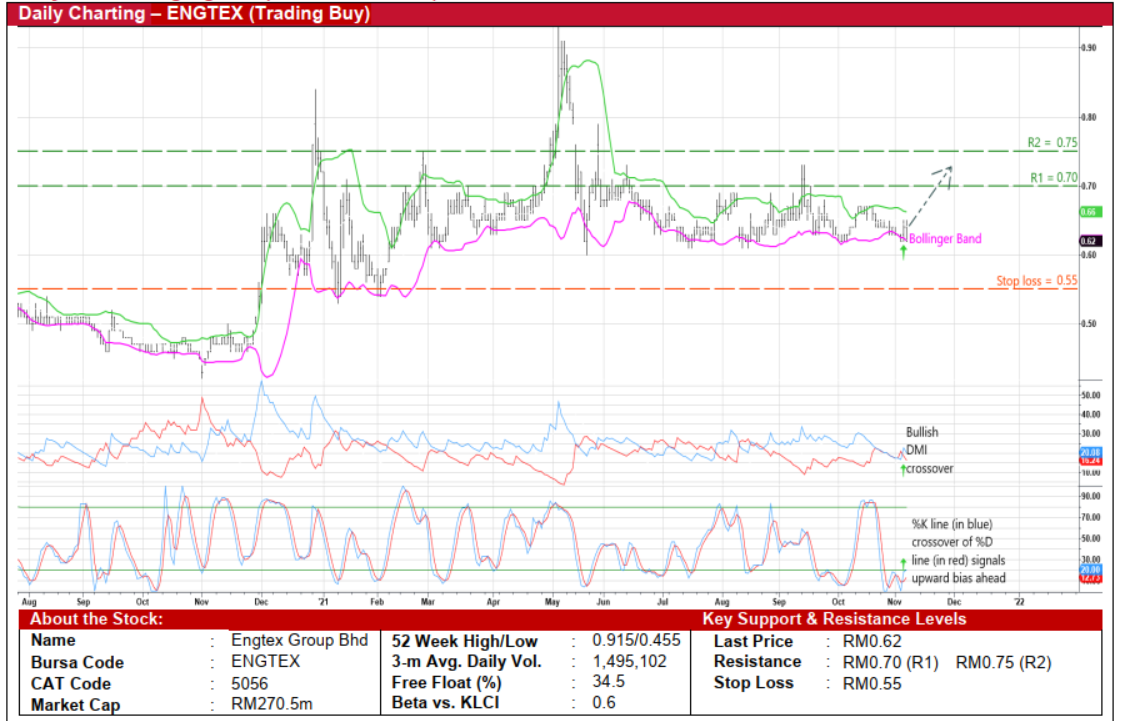

Engtex Group Bhd (Trading Buy)

• After swinging broadly sideways since early June this year, ENGTEX shares could be on the way to scale higher grounds ahead.

• In particular, the stock is poised to plot an upward bias following: (i) its crossing back above the lower Bollinger Band, (ii) a bullish DMI crossover, and (iii) the stochastic %K line cutting over the %D line in the oversold area.

• An anticipated rise in the share price will probably lift the stock towards our resistance thresholds of RM0.70 (R1; 13% upside potential) and RM0.75 (R2; 21% upside potential).

• We have pegged our stop loss price at RM0.55 (which represents a 11% downside risk from the last traded price of RM0.62).

• Fundamentally, with its main businesses in the: (i) manufacturing and sale of steel and ductile iron pipes and fittings, valves, welded wire mesh, hard-drawn wire and other steel-related products; and (ii) wholesale and distribution of pipes, valves, fittings, steel-related products and construction materials, ENGTEX stands to benefit from the government’s water-related infrastructure spending particularly on pipes replacement projects going forward.

• Earnings-wise, after turning around from a net loss of RM0.9m in FY19 to a net profit of RM15.4m in FY December 2020, the group’s bottom line continued to improve with reported earnings of RM33.3m in 1HFY21 (versus 1HFY20’s net loss of RM4.9m) as its overall performance was boosted mainly by stronger demand and higher average selling prices.

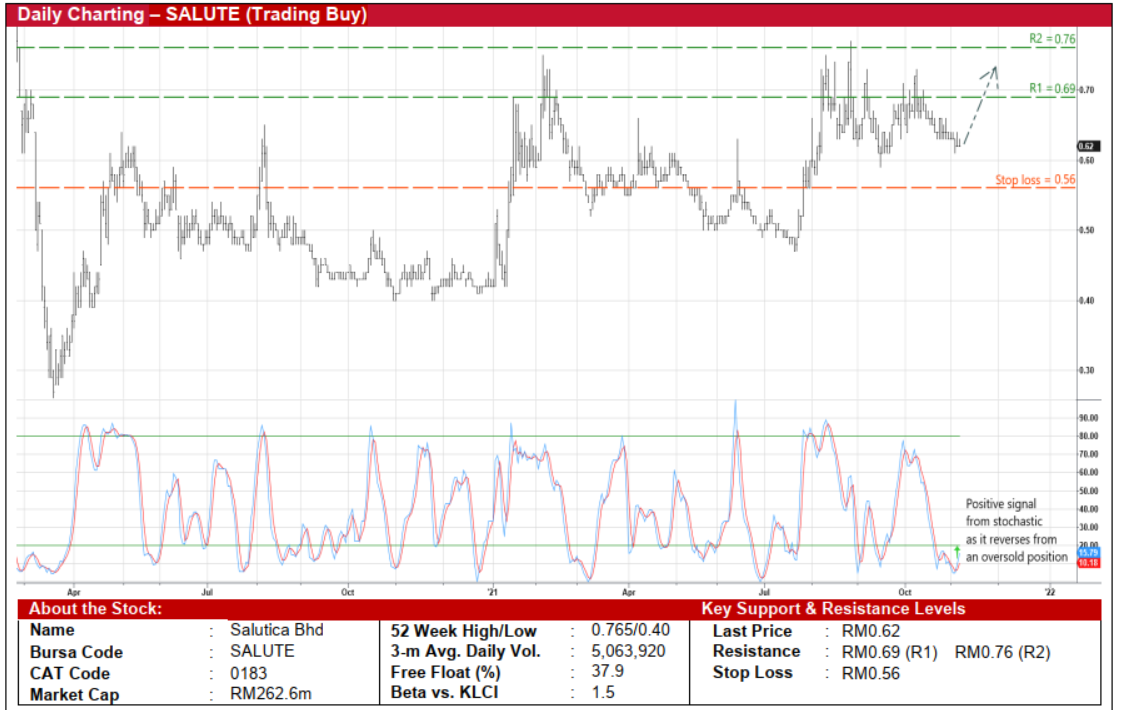

Salutica Bhd (Trading Buy)

• A manufacturer of Bluetooth wireless headsets (which is also involved in the sale of computer peripherals products, tire pressure monitoring systems and other non-Bluetooth products such as smart home sensors/controllers, light guides and camera sub-parts), SALUTE has recently turned around with a first quarterly net profit of RM1.7m in 4QFY21 after making losses in the preceding nine straight quarters.

• This brought its cumulative net loss to RM9.7m for FY June 2021 versus FY20’s net loss of RM8.1m, as the group’s full-year performance was dragged by weaker margins and business disruptions arising from the Covid-19-related movement restrictions.

• Nonetheless, its balance sheet is financially strong, backed by net cash holdings & short-term investments of RM5.9m (or 1.5 sen per share) as of end-June this year.

• From a technical perspective, following a pullback from a recent high of RM0.73 one month ago to close at RM0.62 yesterday, SALUTE’s share price – which is currently hovering not too far away from a recent low of RM0.59 in mid September this year – is in a position to shift higher ahead.

• With the stochastic indicator showing the %K line crossing over the %D line in an oversold territory, riding on the positive momentum, the stock could climb to challenge our resistance targets of RM0.69 (R1; 11% upside potential) and RM0.76 (R2; 23% upside potential).

• Our stop loss price is set at RM0.56 (or 10% downside risk).

Source: Kenanga Research - 9 Nov 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 28, 2024