Daily technical highlights – (MSM, MYNEWS)

kiasutrader

Publish date: Tue, 23 Nov 2021, 10:19 AM

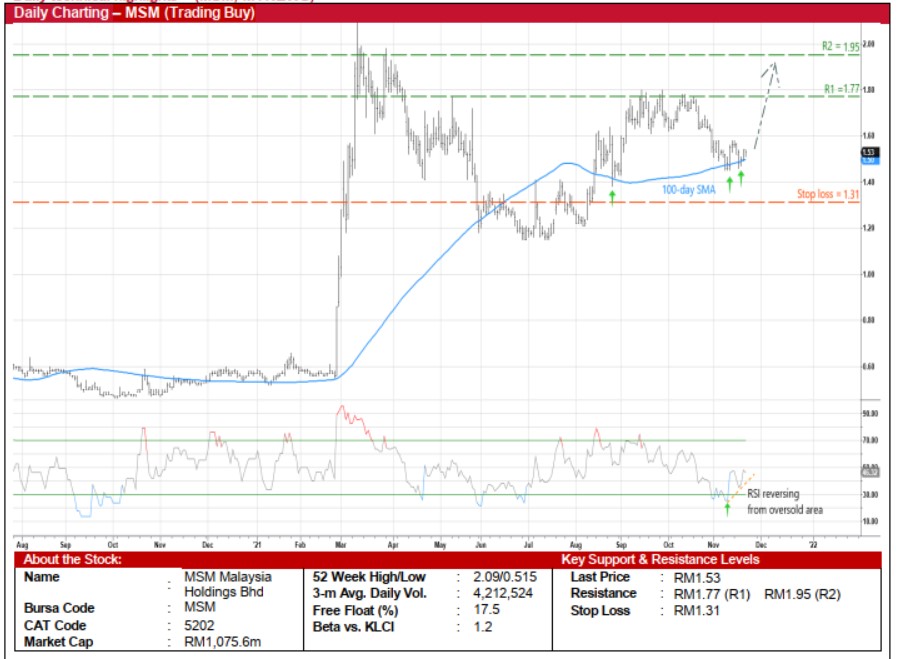

MSM Malaysia Holdings Bhd (Trading Buy)

• A technical rebound could be on the cards for MSM shares after a pullback from a recent high of RM1.77 in mid-October this year to close at RM1.53 yesterday.

• An upward shift in the share price is anticipated following its reversal from the RSI oversold territory while the stock is poised to bounce off from the 100-day SMA.

• Riding on the positive momentum, MSM’s share price will probably climb towards our resistance thresholds of RM1.77 (R1) and RM1.95 (R2), which represent upside potentials of 16% and 27%, respectively.

• We have placed our stop loss price at RM1.31 (or a 14% downside risk).

• Fundamental-wise, MSM – which is involved in the business of sugar refining, sales & marketing of refined sugar and trading of sugar – has remained profitable for the past three quarters. For the 2Q ended June 2021, the group reported net profit of RM13.5m (versus 2QFY20’s net loss of RM21.6m). This took 1HFY21’s bottomline to RM44.7m (versus 1HFY20’s net loss of RM56.3m), lifted by higher sales volume and improved margins from better average selling prices.

• Based on consensus estimates, MSM is expected to show net profit of RM102.5m in FY December 2021 and RM113.3m in FY December 2022. This translates to forward PERs of 10.5x this year and 9.5x next year, respectively.

Mynews Holdings Bhd (Trading Buy)

• A bullish symmetrical triangle pattern has emerged for MYNEWS shares following the plotting of a sequence of lower highs and higher lows since April this year.

• Additionally, with the existence of a bullish stochastic divergence formation (which saw the %D line charting two rising bottoms in the oversold area while the stock was drifting lower) and the appearance of dragonfly doji candlesticks of late, the share price is expected to show a positive bias ahead.

• On the way up, the stock could advance towards our immediate resistance target of RM1.03 (R1; 13% upside potential). Thereafter, a technical breakout from the symmetrical triangle pattern will probably propel the share price to challenge our next resistance level of RM1.12 (R2; 22% upside potential).

• Our stop loss price is set at RM0.80 (or a 13% downside risk).

• Business-wise, MYNEWS offers exposure to the retail convenience stores market in Malaysia, which includes its recent tie-up with BGF Retail (South Korea’s biggest convenience store operator and owner of the popular convenience store brand CU) to operate and sub-franchise CU outlets in Malaysia. It is also involved in the production of ready-to-eat food and bakery products to serve its retail chain.

• As its earnings were adversely affected by the movement restrictions imposed to control the Covid-19 outbreak, the group posted net loss of RM34.2m in the nine-month period ended July 2021 (compared to a net loss of RM4.1m in the same period the previous year).

• Nonetheless, the worst may be over already following the resumption of economic activities with consensus currently forecasting MYNEWS to log net loss of RM31.5m in FY October 2021 before rebounding to net earnings of RM20.2m in FY October 2022 and RM31.9m in FY October 2023. This translates to forward PERs of 30.9x and 19.6x, respectively.

Source: Kenanga Research - 23 Nov 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024