Daily technical highlights – (MUHIBAH, MMSV)

kiasutrader

Publish date: Wed, 24 Nov 2021, 09:10 AM

Muhibbah Engineering (M) Bhd (Trading Buy)

• Presently hovering quite close to a strong support line (at RM0.87) that stretches back to March this year, MUHIBAH shares are poised to stage a rebound ahead.

• In particular, our positive technical stance is driven by: (i) an anticipated reversal from the oversold territory by the RSI indicator, (ii) the bullish stochastic divergence pattern (as the %D line plotted two rising bottoms in the oversold area while the stock was drifting lower), and (iii) the recent emergence of dragonfly doji and hammer candlesticks.

• A probable breakout from the prevailing consolidation phase could then push the share price towards our resistance thresholds of RM1.00 (R1; 12% upside potential) and RM1.12 (R2; 25% upside potential).

• Our stop loss level is placed at RM0.79 (or a 12% downside risk from yesterday’s closing price of RM0.895).

• Fundamentally, MUHIBAH – which owns an effective 21% stake in three airport concessions in Cambodia (namely in Phnom Penh, Siem Reap and Sihanoukville) – stands to benefit from a recovery in travelling demand following the reopening of international borders.

• An engineering construction company and integrated solutions provider for maritime, oil & gas and infrastructure projects, MUHIBAH is also the substantial shareholder of Main Market-listed Favelle Favco (a manufacturer of specialised offshore oil & gas pedestal cranes as well as tower cranes). Based on its 58.9% equity stake, MUHIBAH’s share of market cap in Favelle Favco (whose share price has risen 7.8% YTD to RM2.36 currently) works out to be RM309.8m. This represents slightly more than two-thirds of its existing market cap of RM432.7m.

• Earnings-wise, after posting net profit of RM6.5m in 1HFY21 (versus 1HFY20’s net loss of RM34.6m), consensus is projecting MUHIBAH’s bottomline to come in at RM7.4m in FY December 2021 before recovering further to RM34.2m in FY December 2022. This translates to forward PERs of 58.5x this year and 12.7x next year, respectively.

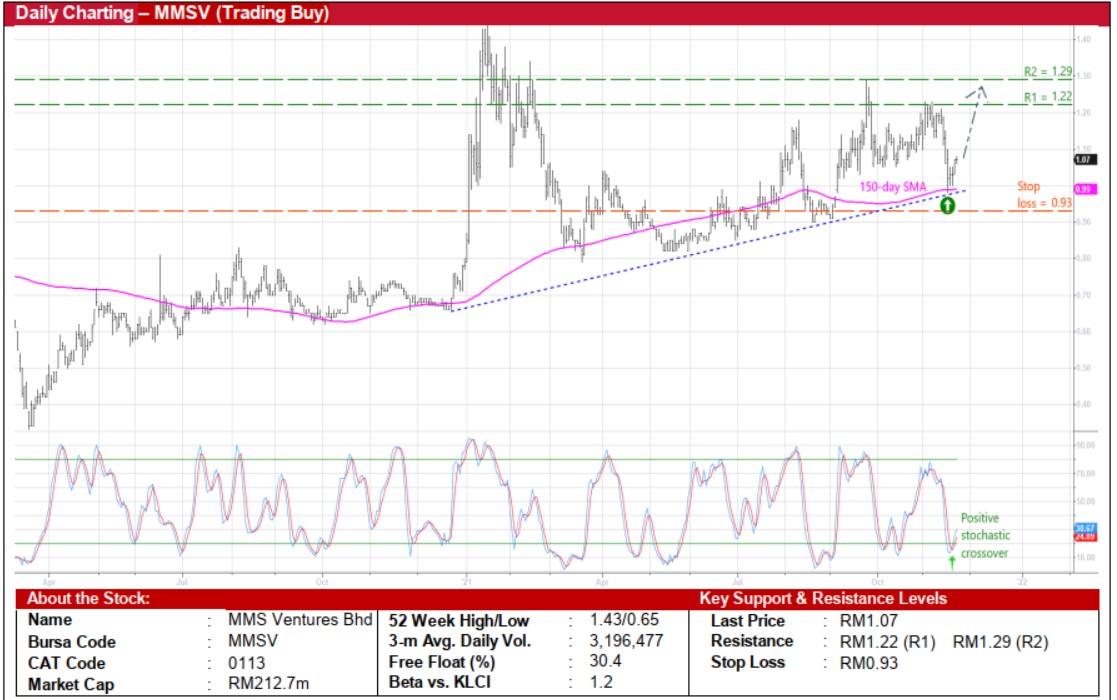

MMS Ventures Bhd (Trading Buy)

• MMSV’s share price will probably continue its rising trajectory after bouncing off from the 150-day SMA and an ascending trendline that stretches back to December last year.

• Furthermore, an upward shift in the stock is anticipated following the bullish stochastic crossover (which saw the %K line overcoming the %D line in the oversold zone).

• On the way up, MMSV shares could climb towards our resistance thresholds of RM1.22 (R1; 14% upside potential) and RM1.29 (R2; 21% upside potential).

• We have set our stop loss price at RM0.93 (or a 13% downside risk from the last traded price of RM1.07).

• A manufacturer of high-tech automation system (such as inspection and testing machines) with a customer base operating in the LED (for applications in smart phones and automotive), semiconductor and OEM/ODM segments, MMSV has just announced net profit of RM2.8m (+2,180% YoY) in 3QFY21, taking its cumulative net earnings to RM6.7m (+556% YoY) for the nine-month period ended September 2021.

• The group is also in a financially steady position with a zero-debt balance sheet that is backed by net cash & quoted investments of RM39.5m (or 20.0 sen per share) as of end-September 2021.

Source: Kenanga Research - 24 Nov 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024