Daily technical highlights – (MAYBULK, PWROOT)

kiasutrader

Publish date: Tue, 14 Dec 2021, 08:57 AM

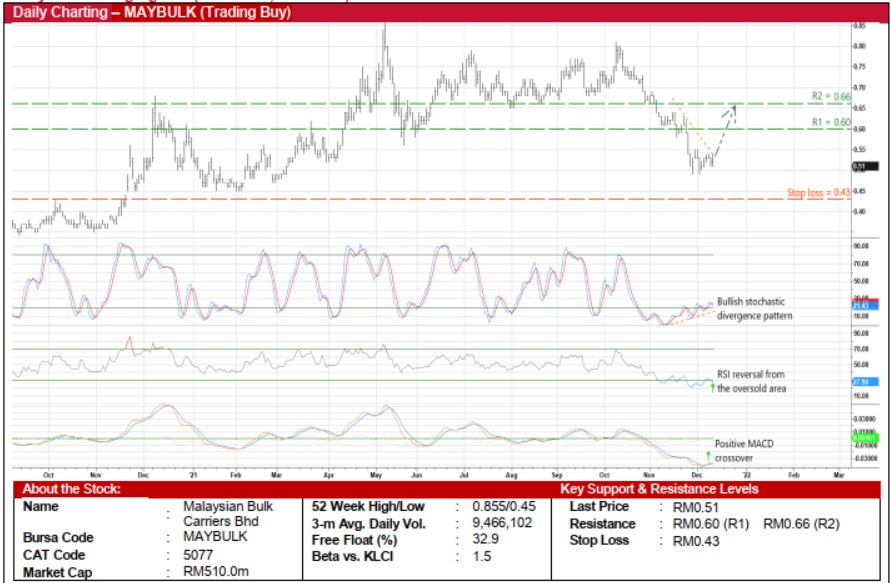

Malaysian Bulk Carriers Bhd (Trading Buy)

• A technical rebound could be on the cards for MAYBULK shares after pulling back from a high of RM0.81 in early October 2021 to settle at RM0.51 yesterday, near its recent trough of RM0.49 at the start of December.

• This follows a strengthening Baltic Dry Index (BDI) – a composite of dry bulk time charter averages to measure the cost of transporting major raw materials by sea – which has earlier slid from a peak of 5,650 in early October this year to a low of 2,430 in mid-November before staging a rapid recovery of 35% to 3,272 currently.

• On the chart, the stock is expected to shift higher based on the following triple technical signals: (i) a bullish stochastic divergence pattern (with the %D line forming three rising bottoms below the oversold line while the share price was drifting lower), (ii) the RSI indicator is in the midst of reversing from an oversold position, and (iii) the MACD line is crossing over the signal line from the oversold territory.

• A resumption of the price uptrend will probably lift the stock towards our resistance thresholds of RM0.60 (R1; 18% upside potential) and RM0.66 (R2; 29% upside potential).

• Our stop loss price level is set at RM0.43 (or a 16% downside risk).

• In terms of earnings performance, the group posted net profit of RM113.6m in 3QFY21 (versus net loss of RM6.0m previously), bringing its 9MFY21 net earnings to RM160.6m (+454% YoY), as average time charter equivalent came in at US$17,225 (up 114% YoY) during the nine-month period.

• Forward earnings for MAYBULK – which is principally involved in the provision of international dry bulk shipping services – is expected to be underpinned by elevated dry bulk charter rates as tracked by the rising Baltic Dry Index.

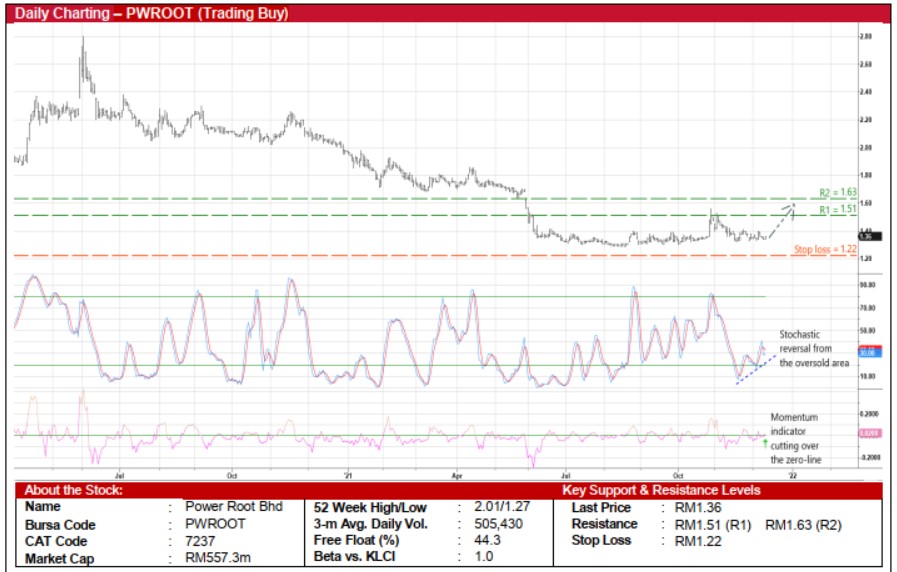

Power Root Bhd (Trading Buy)

• PWROOT’s share price may be nearing a bottom already after sliding from a high of RM2.63 at the start of June last year to close at RM1.36 yesterday.

• An ensuing technical rebound is likely as the stochastic indicator pulls away from an oversold area while the momentum indicator is in the midst of crossing above the zero-line.

• Riding on the positive signals, the stock could climb towards our resistance thresholds of RM1.51 (R1; 11% upside potential) and RM1.63 (R2; 20% upside potential).

• We have placed our stop loss price level at RM1.22 (representing a 10% downside risk).

• Earnings-wise, PWROOT – a manufacturer and distributor of beverages specialising in staple drinks (such as coffee, tea, chocolate malt drinks and herbal energy drinks) – registered net profit of RM7.6m (-60% YoY) in the first half ended September 2021.

• Going forward, based on consensus estimates, the group is forecasted to make net earnings of RM21.4m in FY March 2022 and RM37.0m in FY March 2023, which translate to forward PERs of 26.0x and 15.1x, respectively.

• Additionally, consensus is expecting PWROOT to pay out DPS of 3.7 sen for FY22 and 6.2 sen for FY23, which imply prospective dividend yields of 2.7%-4.6% respectively, amid a healthy balance sheet that is backed by net cash holdings of RM94.0m (or 23 sen per share) as of end-September this year.

Source: Kenanga Research - 14 Dec 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

MAYBULK2024-11-22

MAYBULK2024-11-22

MAYBULK2024-11-22

PWROOT2024-11-22

PWROOT2024-11-22

PWROOT2024-11-22

PWROOT2024-11-21

MAYBULK2024-11-20

MAYBULK2024-11-19

MAYBULK2024-11-18

MAYBULK2024-11-18

PWROOT2024-11-15

MAYBULK2024-11-15

MAYBULK2024-11-15

PWROOT2024-11-14

MAYBULK2024-11-14

PWROOT2024-11-13

MAYBULK2024-11-13

PWROOT2024-11-12

MAYBULKMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024