Daily technical highlights – (OPCOM, BINACOM)

kiasutrader

Publish date: Tue, 04 Jan 2022, 08:46 AM

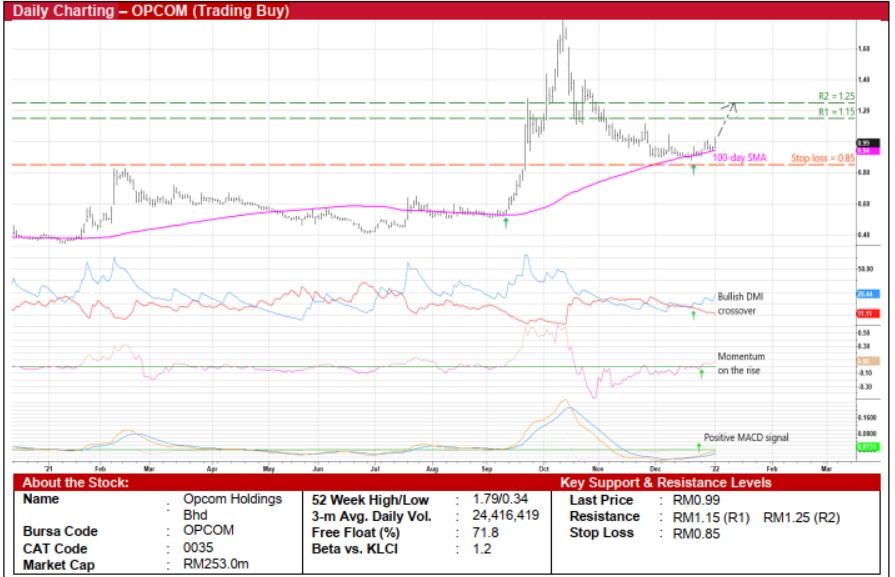

Opcom Holdings Bhd (Trading Buy)

• After sliding from a peak of RM1.79 around mid-October last year, OPCOM shares might have hit a bottom already as the stock has climbed from a trough of RM0.88 in the second half of December.

• Following a recent bounce-up from the 100-day SMA, the share price is expected to continue its upward trajectory based on the bullish technical signals triggered by: (i) the DMI Plus crossing over the DMI Minus, (ii) the rising momentum indicator (after cutting above the zero-line), and (iii) the MACD crossing above the signal line in an oversold zone.

• On the way up, the stock – which jumped 3.7% amid heavy trading volume to close at RM0.99 yesterday – could advance towards our resistance targets of RM1.15 (R1; 16% upside potential) and RM1.25 (R2; 26% upside potential).

• Our stop loss price level is pegged at RM0.85 (or a 14% downside risk).

• OPCOM is presently the largest manufacturer of fibre optic cables in Malaysia. It also manufactures components used in the fibre optic cables manufacturing such as thixotropic compounds, High Density Polyethylene (HDPE) tubes & pipes and fibre reinforced plastic rods.

• The group is a proxy to an anticipated increase in demand for fibre optic cables in Malaysia with the impending implementation of JENDELA (the country’s national digital infrastructure plan to provide greater digital connectivity) and the 5G telecommunications network rollouts.

• In terms of earnings performance, OPCOM posted net profit of RM2.5m (+247% YoY) in 2QFY22, taking its bottomline to RM5.2m for the 6-month period ended September 2021 (which is an improvement from 1HFY21’s breakeven position).

• The group is financially healthy with a balance sheet that is backed by cash holdings of RM60.4m (translating to 23.6 sen per share or nearly a quarter of the existing share price) as of end-September last year.

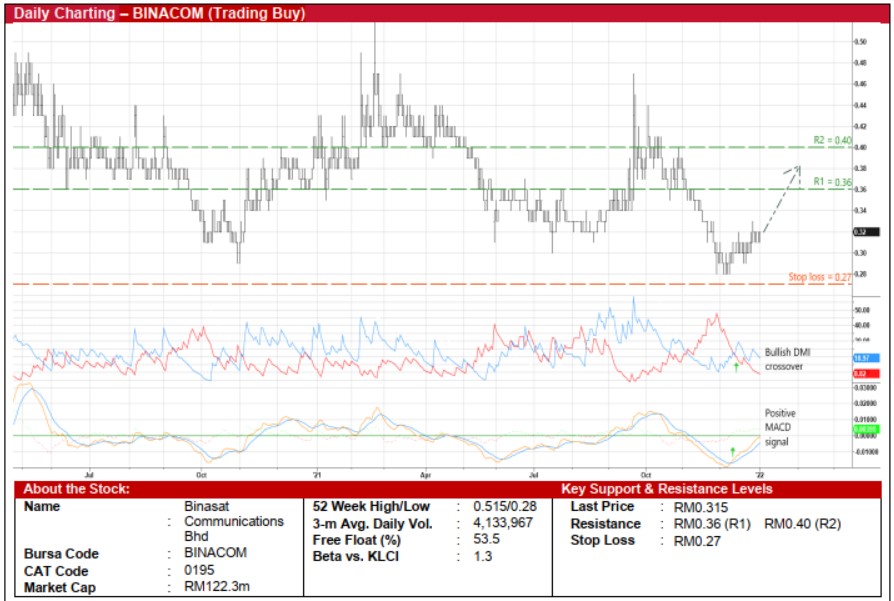

Binasat Communications Bhd (Trading Buy)

• A technical rebound may be currently underway as BINACOM’s share price has reversed from a low of RM0.28 in early December last year after tumbling earlier from a high of RM0.465 in the second half of September.

• The stock – which saw active trading before settling unchanged at RM0.315 yesterday – will likely extend its run-up following the recent bullish crossovers by: (i) the DMI Plus above the DMI Minus, and (ii) the MACD above the signal line in an oversold zone.

• Riding on the renewed strength, BINACOM shares could climb towards our resistance thresholds of RM0.36 (R1; 14% upside potential) and RM0.40 (R2; 27% upside potential).

• We have placed our stop loss price level at RM0.27 (which represents a downside risk of 14%).

• Fundamentally, BINACOM – which provides support services for satellite, mobile and fibre optic telecommunications networks in Malaysia to major telecommunication companies (either directly or indirectly through equipment suppliers) – stands to benefit from the upcoming implementation of the government’s JENDELA initiative and the 5G telecommunications network rollouts.

• After posting net profit of RM2.4m (-19% YoY) in FY June 2021, the group reported net earnings of RM1.0m (-15% YoY) in 1QFY22.

• The group is currently sitting on net cash & short-term investments of RM16.4m (or 4.2 sen per share) as of end-September last year.

Source: Kenanga Research - 4 Jan 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024