Daily technical highlights – (EKOVEST, OVH)

kiasutrader

Publish date: Thu, 20 Jan 2022, 09:14 AM

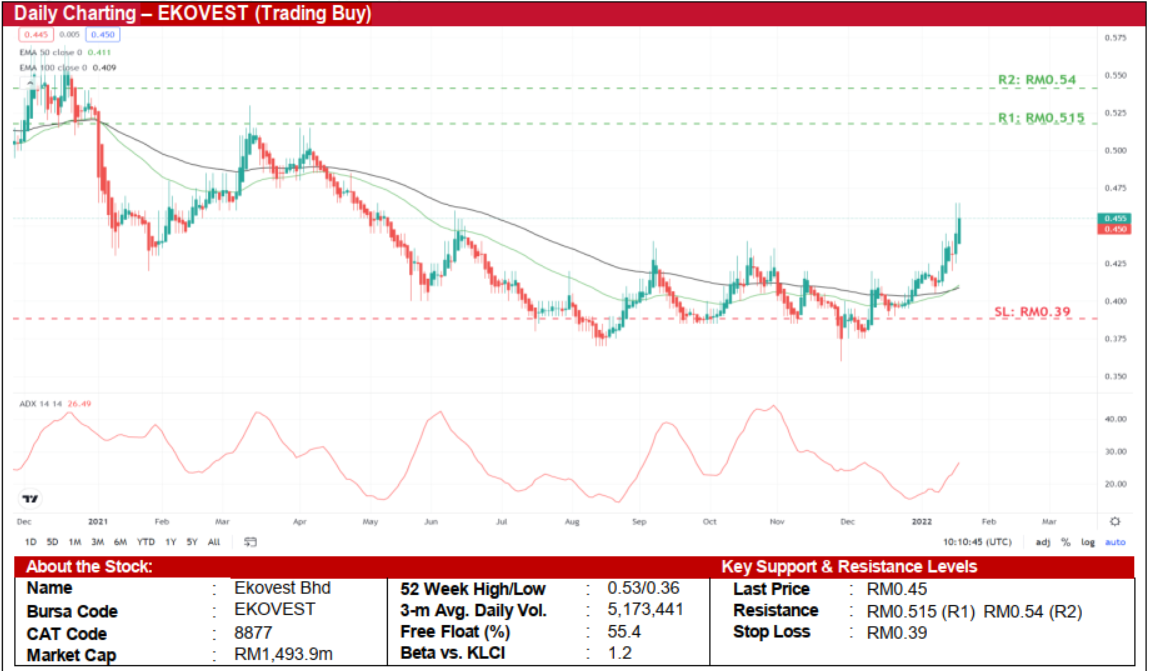

Ekovest Bhd (Trading Buy)

• EKOVEST’s core businesses involve the undertaking of civil engineering works as well as construction activities.

• For the latest reporting period of 1QFY22, EKOVEST’s financials were impacted as their top line declined to RM179.9m (- 43% YoY) while their bottom line saw a net loss of RM6.1m (versus a net profit of RM10.9m in the preceding quarter) hit by reduced business activities due to the movement control measures imposed by the government.

• Going forward, with the reopening of most economic sectors, EKOVEST stands to benefit from the resumption of construction activities in full scale in tandem with the government’s efforts to rejuvenate the economy.

• Chart-wise, after sliding from a high of RM0.57 (in the beginning of December 2020), the stock might have hit a bottom at RM0.36 (in end-November 2021) following a subsequent 25% rebound from the low to close at RM0.45 yesterday.

• With the 50-day EMA piercing above the 100-day EMA, and coupled with the ADX indicator signaling an ongoing uptrend, the stock could continue its uptick to challenge our resistance targets of RM0.515 (R1; 14% upside potential) and RM0.54 (R2: 20% upside potential).

• We have pegged our stop loss at RM0.39, which represents a downside risk of 13%.

Ocean Vantage Holdings Bhd (Trading Buy)

• OVH operates in the oil and gas sector, providing a spectrum of support services such as repair services (rig repairs & maintenance, rig stacking and reactivation services), cleaning services (tank cleaning, blasting and painting services), rental services (equipment and machineries) and many other specialized services.

• In its most recent reporting period (3QFY21), OVH registered a net profit of RM3.8m (+660%% YoY) driven by increased revenue and the absence of listing expenses that were incurred in the preceding period.

• An indirect proxy to the rising crude oil prices (with the Brent oil price currently hovering at a 21-month high of USD87.94 per barrel), OVH’s share price offers a trading buy opportunity based on the positive technical signals triggered by: (i) the shorter term moving average crossing above the longer term moving average, and (ii) an upward trend of the Parabolic SAR indicator.

• On the way up, the stock could advance to challenge our resistance levels of RM0.305 (R1) and RM0.32 (R2), which translate to upside potentials of 13% and 19%, respectively from yesterday’s closing price of RM0.27.

• On the downside, our stop loss has been set at RM0.24, which translates to a downside risk of 11%.

Source: Kenanga Research - 20 Jan 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024