Daily technical highlights – (DIALOG, MSM)

kiasutrader

Publish date: Wed, 09 Feb 2022, 09:47 AM

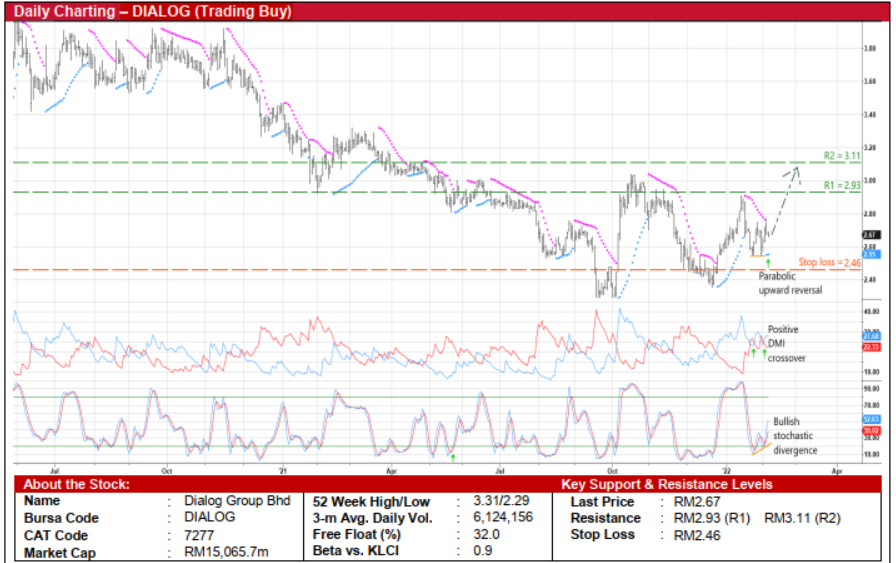

Dialog Group Bhd (Trading Buy)

• After rebounding from a trough of RM2.36 in second half of December last year, DIALOG’s share price – which ended at RM2.67 yesterday – could continue its upward trajectory ahead.

• In essence, the stock is expected to climb further following: (i) the emergence of a Parabolic uptrend reversal signal; (ii) the positive crossover by the DMI Plus above the DMI Minus; and (iii) the existence of a bullish stochastic divergence (which saw the forming of two rising bottoms amid a flattish price performance).

• With that, DIALOG shares will probably scale towards our resistance thresholds of RM2.93 (R1; 10% upside potential) and RM3.11 (R2; 16% upside potential).

• We have pegged our stop price loss level at RM2.46 (or an 8% downside risk).

• An integrated technical service provider to the upstream, mid-stream and downstream segments in the oil & gas and petrochemical industry, DIALOG posted net profit of RM543.1m (-14% YoY) in FY June 2021 that was followed by RM128.8m (-12% YoY) in 1QFY22.

• Going forward, consensus is expecting the group to show net earnings of RM574.1m in FY June 2022 and RM642.9m in FY June 2023. This translates to forward PERs of 26.2x this year and 23.4x next year, respectively.

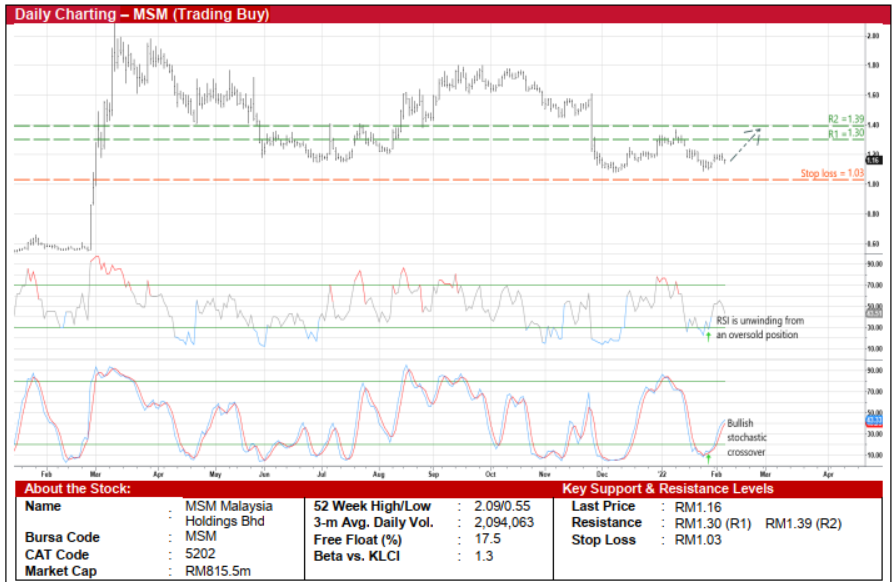

MSM Malaysia Holdings Bhd (Trading Buy)

• Following a sharp drop from RM1.61 in late November to as low as RM1.08 in early December last year, MSM shares (which closed at RM1.16 yesterday) may be in the midst of staging a technical rebound.

• This comes as the occurrence of a reversal by the RSI indicator from an oversold position and a bullish stochastic crossover (with the %K line cutting over the %D line in the oversold zone) are signalling a probable run-up in the stock.

• With that, MSM’s share price could climb towards our resistance thresholds of RM1.30 (R1) and RM1.39 (R2). This represents upside potentials of 12% and 20%, respectively.

• Our stop loss price level is set at RM1.03 (or an 11% downside risk).

• Earnings-wise, MSM – which is involved the business of sugar refining, sales and marketing of refined sugar and trading of sugar (after recently exiting the rubber, palm oil & mango businesses) – has remained profitable throughout last year. The group reported net profit of RM31.2m in 1QFY21, RM13.5m in 2QFY21 and RM96.9m in 3QFY21. This brought 9MFY21’s bottomline to RM141.5m (versus 9MFY20’s net loss of RM127.5m), partly lifted by an exceptional gain from the disposal of a subsidiary (amounting to RM91.8m).

• Based on consensus estimates, MSM is forecasted to register net profit of RM75.2m for FY December 2021, RM94.7m for FY December 2022 and RM120.4m for FY December 2023. This translates to forward PERs of 8.6x this year and 6.8x next year, respectively.

Source: Kenanga Research - 9 Feb 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

DIALOG2024-11-23

MSM2024-11-23

MSM2024-11-22

DIALOG2024-11-22

DIALOG2024-11-22

MSM2024-11-22

MSM2024-11-22

MSM2024-11-22

MSM2024-11-22

MSM2024-11-21

DIALOG2024-11-21

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-20

DIALOG2024-11-19

DIALOG2024-11-18

DIALOGMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024