Daily technical highlights – (MKH, TDM)

kiasutrader

Publish date: Wed, 16 Feb 2022, 08:47 AM

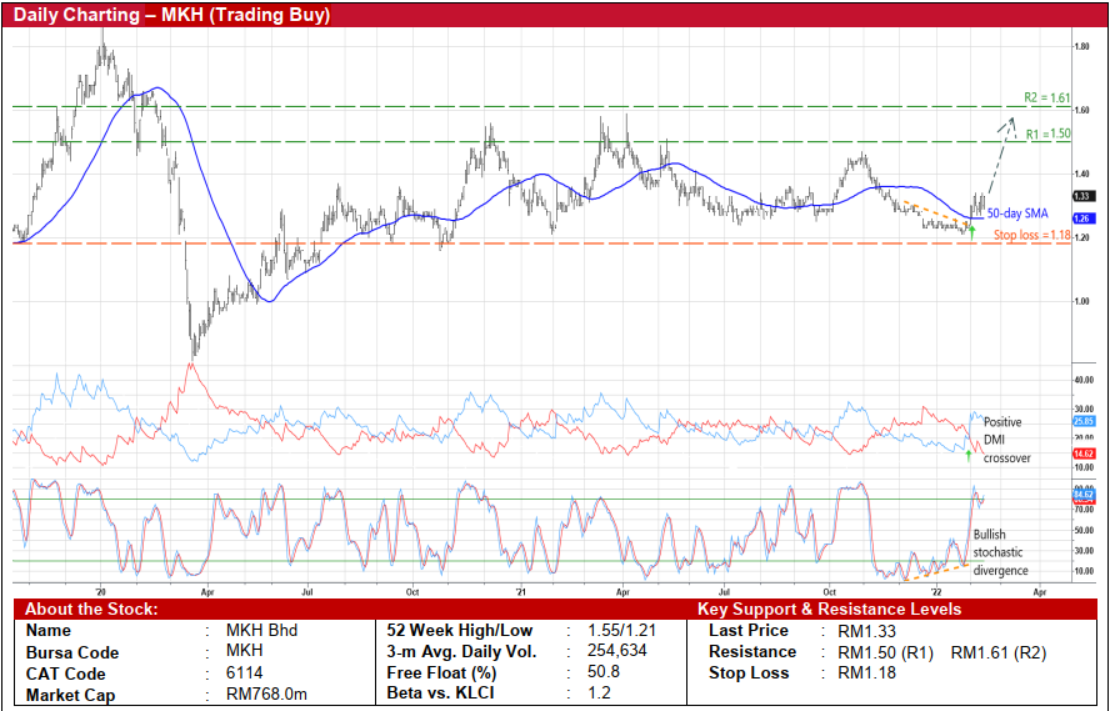

MKH Bhd (Trading Buy)

• MKH – whose forte is in property development with core projects located in the Klang Valley – stands to benefit from soaring CPO prices as the group also owns oil palm plantation estates measuring 18,338 hectares in Indonesia.

• For FY September 2021, its plantation earnings jumped 289% YoY to RM101.9m, accounting for 63% of overall PBT of RM161.1m. The property development & construction division contributed another 22% while the building materials trading & others (14%) and hotel & property investment (1%) segments made up the balance. Consequently, the group’s bottomline came in at RM80.4m (+93% YoY) in the latest financial year, implying a historical PER of 9.6x.

• With the current month CPO futures price now hovering at a record high of RM5,869 per MT (which is double its FY21’s average CPO price of RM2,945 per MT), the plantation business is set to contribute even more and drive overall earnings growth going forward.

• On the chart, MKH’s share price – which is up 10% from a recent low of RM1.21 in late January this year to close at RM1.33 amid strong trading interest yesterday – is expected to play catch-up with the ongoing rally of listed plantation peers.

• An upward shift in the stock is anticipated following the positive technical signals generated by: (i) the occurrence of a bullish divergence in the stochastic indicator (which has formed rising bottoms in the oversold area while the share price was declining); (ii) the DMI Plus crossover above the DMI Minus; and (iii) the price overcoming the 50-day SMA.

• Riding on the strengthening momentum, MKH shares could climb towards our resistance thresholds of RM1.50 (R1; 13% upside potential) and RM1.61 (R2; 21% upside potential).

• Our stop loss price level is pegged at RM1.18 (representing an 11% downside risk).

TDM Bhd (Trading Buy)

• TDM is involved in: (i) the oil palm plantation business (via the group’s 44,247 hectares of planted oil palm at its estates in Terengganu and Indonesia); and (ii) the healthcare sector (as the group owns and operates four specialist hospitals in Kuala Lumpur, Petaling Jaya, Kuala Terengganu and Kuantan).

• After posting net losses in the preceding two quarters, the group turned around with net profit of RM13.3m in 3QFY21, lifted mainly by stronger plantation contributions.

• For the 9MFY21 reporting period, TDM’s YTD net earnings stood at RM5.6m (versus net loss of RM2.2m previously). The plantation business logged a PBT contribution of RM34.5m (+55% YoY) while the healthcare division made a marginal PBT of RM1.2m, which combined to offset losses from the investment holding & others segment.

• With the current month CPO futures price now hovering at a record high of RM5,869 per MT vis-à-vis its YTD average CPO price of RM4,135 per MT, the plantation division is expected to show an even stronger earnings jump going forward.

• Technically speaking, TDM shares are currently on an uptrend after bouncing up from a recent low of RM0.225 in late January this year.

• And the upward trajectory will likely extend as the strengthening trend in the Parabolic SAR, MACD and momentum indicators are signalling a positive bias for the share price.

• On the chart, the stock could climb towards our resistance thresholds of RM0.33 (R1; 20% upside potential) and RM0.36 (R2; 31% upside potential).

• Our stop loss price level is pegged at RM0.225 (representing a downside risk of 18% from the last traded price of RM0.275).

Source: Kenanga Research - 16 Feb 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024