Daily technical highlights – (MBSB, ULICORP)

kiasutrader

Publish date: Fri, 18 Feb 2022, 09:12 AM

Malaysia Building Society Bhd (Trading Buy)

• Chart-wise, MBSB shares were moving in a sideways pattern from mid-November 2021 before sliding to a low of RM0.52 in mid-December 2021. After which, the stock saw a reversal to climb within an ascending price channel.

• The ascending price channel is likely to continue as the stock has bounced off the lower boundary, indicating continued buying interest for the stock.

• With the DMI Plus trending above the DMI Minus and given that the Parabolic SAR indicator is also heading upwards, the price uptrend is expected to continue, which could lift the stock to challenge our resistance levels of RM0.69 (R1; 12% upside potential) and RM0.74 (R2; 20% upside potential).

• We have pegged our stop loss at RM0.545, which represents a downside risk of 11%.

• Business-wise, MBSB has been granted a license to undertake Islamic banking activities. The group offers a wide range of financial products and services such as consumer banking, business banking and trade financing. Through its subsidiaries, the group is also involved in property development and leasing of real property.

• In the latest results, the group’s total income jumped by 31% YoY to RM1.1b in 9MFY21 from RM0.8b in 9MFY20 mainly due to lower modification loss impact amid a lower take-up during the moratorium period in CY2021. Consequently, 9MFY21 core net profit rose to RM362.3m from RM172.5m in 9MFY20 (+110% YoY).

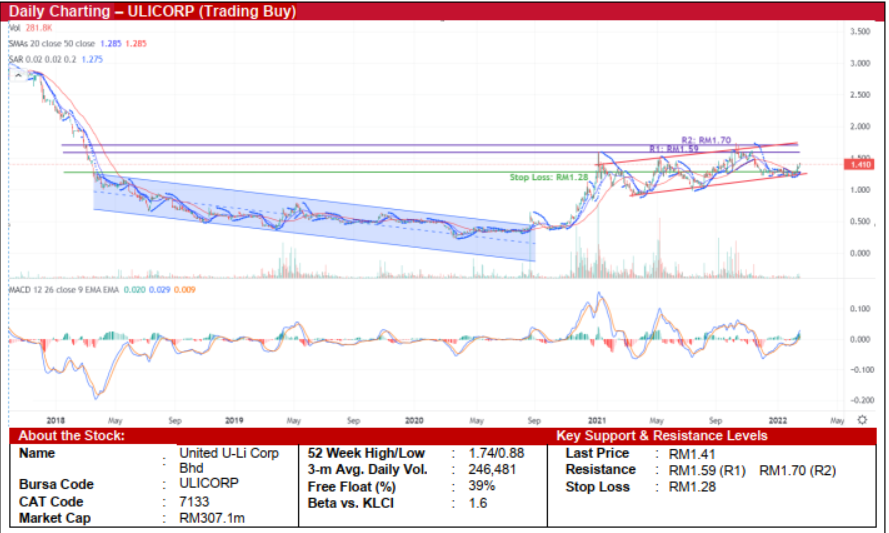

United U-Li Corporation Bhd (Trading Buy)

• Chart-wise, following a downtrend that saw the share price plunging from a high of RM2.80 in November 2017 to a low of RM0.49 in August 2020, ULICORP staged a subsequent rebound to partially recoup the earlier losses suffered during the 34- month decline.

• The stock is currently moving in an ascending price channel with the lower trendline providing steady support after a recent bounce-up.

• The upward momentum is likely to continue, underpinned by: (i) the 20-day SMA on the verge of crossing above the 50-day SMA, (ii) the Parabolic SAR indicator trending upwards,. and (iii) the MACD histogram showing bullish momentum.

• That said, the stock will likely climb to challenge our resistance levels of RM1.59 (R1; 13% upside potential) and RM1.70 (R2; 21% upside potential).

• On the downside, our stop loss has been set at RM1.28, which translates to a downside risk of 9%.

• Business-wise, ULICORP is an investment holding company with subsidiaries involving in downstream steel products manufacturing activities.

• Earnings-wise, the group posted a core net profit of RM27.0m in 9MFY21 compared to only RM0.1m in 9MFY20 thanks to higher revenue and better profit margins.

• Going forward, consensus is predicting the group to report a core net profit of RM41.3m in FY December 21 and RM40.6m in FY December 22, which translate to PER of 7.4x for both the financial years.

Source: Kenanga Research - 18 Feb 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024