Daily Technical Highlights – (MEDIA, TALIWRK)

kiasutrader

Publish date: Fri, 25 Feb 2022, 10:01 AM

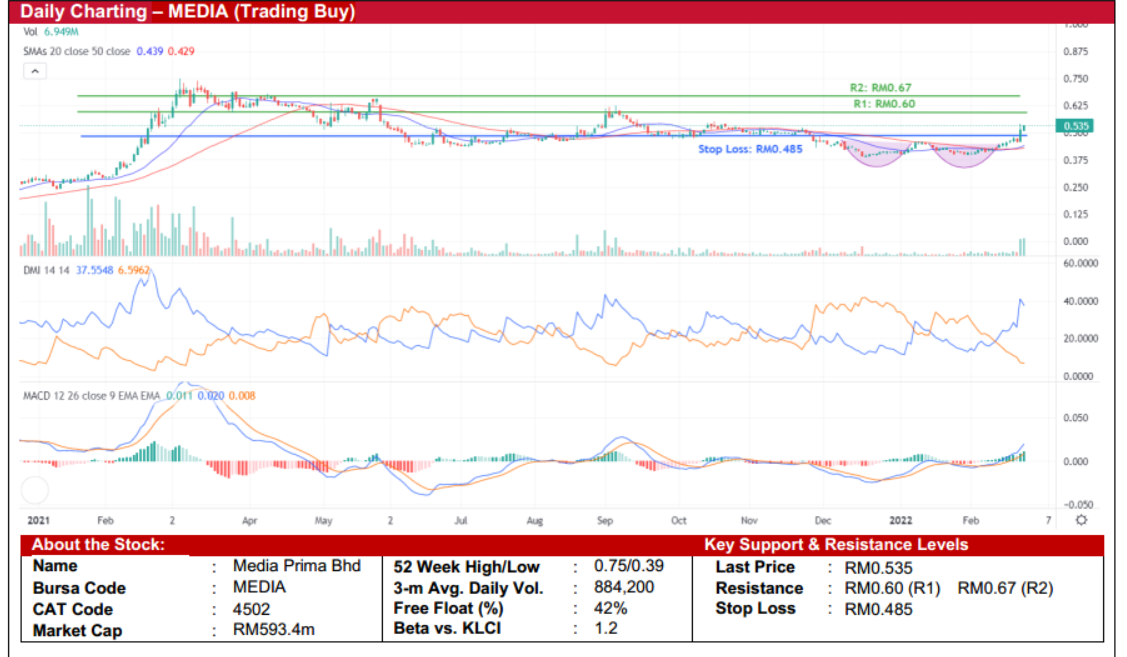

Media Prima Bhd (Trading Buy)

• Chart-wise, from a peak of RM0.70 in March 2021, MEDIA shares trended downwards before recently forming a doublebottom reversal pattern in a span of 2 months (mid-December 2021 – mid-February 2022). Following which, the stockclimbed further to end yesterday with a Marubo candlestick that was backed by stronger-than-average trading volume.

• The uptrend is likely to continue as: (i) the DMI Plus is trending above the DMI Minus, (ii) the MACD histogram is gainingmomentum, and (iii) the 20-day SMA has recently crossed over the 50-day SMA to form a golden cross.

• Thus, the stock could rise to challenge our resistance levels of RM0.60 (R1; 12% upside potential) and RM0.67 (R2; 25%upside potential).

• We have pegged our stop loss at RM0.485, which represents a downside risk of 9%.

• Business-wise, post its launch of the Omnia segment (an integration of multiple advertising platforms such as broadcasting,publishing and more in 2QFY20), the new initiative has led its advertising revenue to grow (up by 16% YoY from FY20 toFY21), thus making this segment the largest contributor to the group’s revenue.

• For FYE 21, the group’s core PATAMI of RM55.2m soared by more than 100% from a core LATAMI of RM4.7m in FY20,thanks to higher advertising revenue and continuous cost saving initiatives undertaken.

• Kenanga’s research team is projecting that the group will post a core PATAMI of RM71.0m in FY22 and RM89.0m in FY23,which translates to forward PERs of 8.1x and 6.4x, respectively.

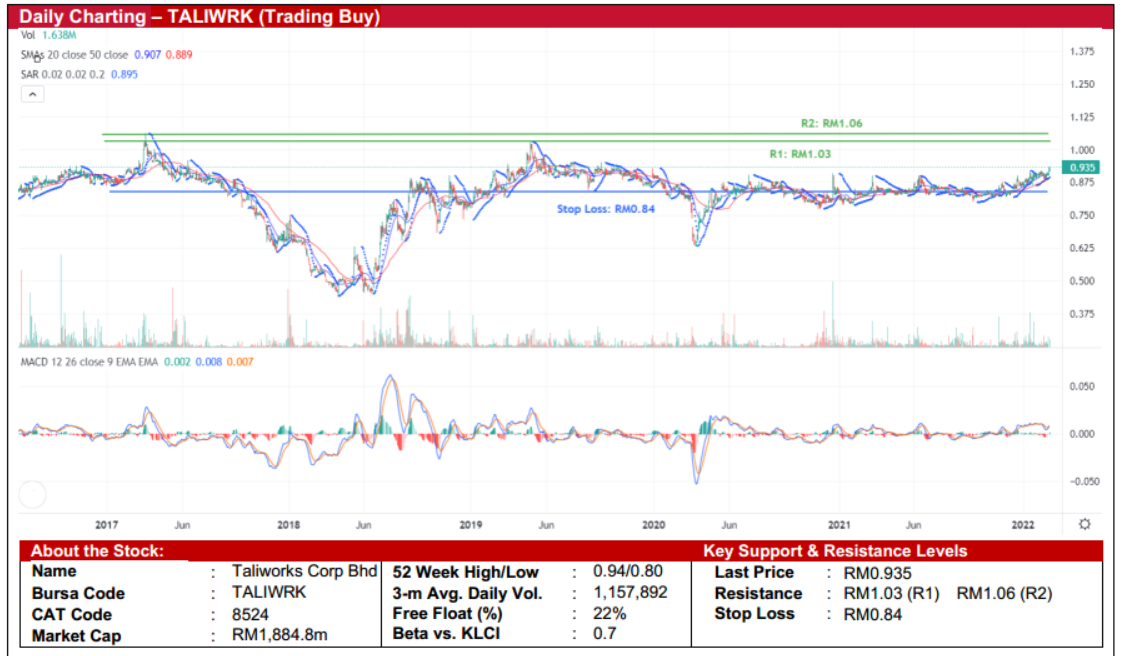

Taliworks Corporation Bhd (Trading Buy)

• Chart-wise, after staging a V-shaped recovery between 2017 and 2019, TALIWRK’s share price has been treading in asideways pattern from May-20 until Dec-21 before breaching its resistance level of RM0.88 recently.

• With the Parabolic SAR indicator trending upwards, coupled with the 20-day SMA hovering above the 50-day SMA and theMACD line crossing above the signal line, the stock is likely to continue its uptrend to challenge our resistance levels ofRM1.03 (R1; 10% upside potential) and RM1.06 (R2; 13% upside potential).

• On the downside, our stop loss has been set at RM0.84, which translates to a downside risk of 10%.

• Fundamentally speaking, the group’s core business is to manage, operate and maintain water treatment plants in Malaysia.The group has 4 business segments, namely: (i) water treatment, supply and distribution, (ii) construction, (iii) toll highway,and (iv) waste management.

• For FY21, despite the group’s revenue falling by 5% due to lower contribution from the water treatment, supply anddistribution segment, overall profit for the year jumped by 61% YoY to RM102.4m in FY21 from RM63.5m in FY20 mainlylifted by the receipt of toll compensation.

• Going forward, consensus is predicting the group to report a core net profit of RM75.6m in FY December 22 and RM86.2m inFY December 23, which translate to forward PERs of 24.6x and 22.3x, respectively.

• Based on consensus DPS estimates of 6.7 sen for both FY22 and FY23, the stock offers dividend yields of 7.2% for eachyear.

Source: Kenanga Research - 25 Feb 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024