Daily technical highlights – (GHLSYS, RHONEMA)

kiasutrader

Publish date: Tue, 22 Mar 2022, 09:08 AM

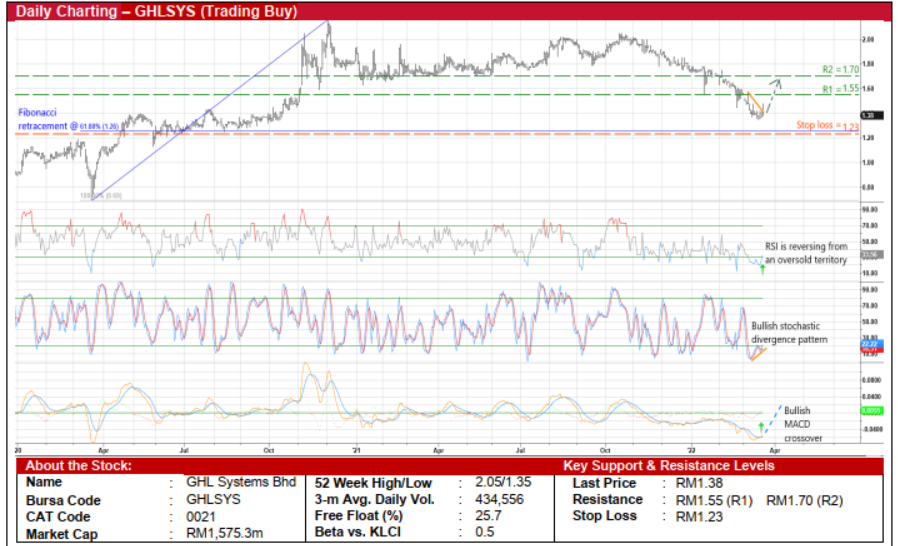

GHL Systems Bhd (Trading Buy)

• A leading ASEAN payment solutions provider, GHLSYS is a proxy to the regional economy re-opening theme, offering multiple payment services (physical, e-commerce and QR pay) to capture a revival of consumer spending via its footprint of more than 380,000 payment touchpoints across Malaysia, Philippines, Thailand, Indonesia, Singapore and Australia.

• On the back of its portfolio of credit/debit card, e-wallets, contactless payment, loyalty, prepaid credit top-up and bill collection payment services, the group posted net profit of RM8.7m (+45% YoY / +57% QoQ) in 4QFY21, bringing its full-year bottomline to RM28.2m (+108% YoY).

• Going forward, consensus is forecasting GHLSYS to register stronger net earnings of RM38.8m in FY December 2022 and RM51.2m in FY December 2023. This translates to forward PERs of 40.6x this year and 30.8 next year, respectively (which range between +0.5 SD and -0.5SD from its historical mean).

• An added appeal is the group’s healthy balance sheet that is backed by net cash holdings & other short-term investments of RM229.0m (or 20.1 sen per share) as of end-December 2021.

• From a charting perspective, after sliding from a high of RM2.05 in mid-October last year to a low of RM1.35 middle of this month (or back to where it was in October 2020), GHLSYS shares could stage a technical rebound as: (i) the RSI indicator climbs out from an oversold position, (ii) the stochastic indicator (which has formed two rising bottoms in the oversold area while the price was drifting lower) is showing a bullish divergence pattern, and (iii) the MACD indicator has crossed over the signal line in the oversold zone.

• On the way up, the stock – which saw active trading interest before closing at RM1.38 yesterday – is expected to advance towards our resistance thresholds of RM1.55 (R1; 12% upside potential) and RM1.70 (R2; 23% upside potential).

• Our stop loss price level is pegged at RM1.23 (representing an 11% downside risk), which is placed slightly below the 61.8% Fibonacci retracement level.

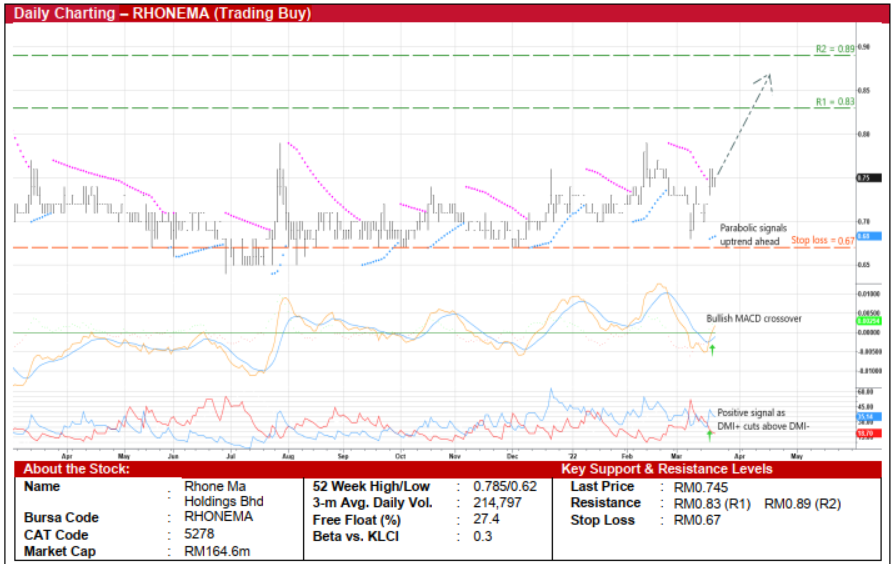

Rhone Ma Holdings Bhd (Trading Buy)

• An end-to-end animal health solutions provider, RHONEMA is engaged in the provision of animal health services and the manufacturing & distribution of animal health products (focussing mainly on the livestock industry). The group has also ventured into dairy farming (with upcoming plans to be involved in the production of fresh milk) via an acquisition exercise that was completed in mid-2020.

• Contributions from the dairy farming operation has been on the rise (albeit from a small base), up from approximately RM0.4m in FY20 to RM4.6m in FY21 in terms of revenue.

• Earnings-wise, the group posted net profit of RM3.1m (+19% YoY) in 4QFY21, taking its full-year performance to RM11.3m (+55% YoY) in FY December 2021, implying a historical PER of 14.6x.

• Meanwhile, a new listing on the Main Board today by Farm Fresh – which is in the integrated business of farming, manufacturing and distribution of various dairy products and plant-based products (with a market cap of RM2.51b based on an IPO offer price of RM1.35 per share) and is trading at a PER of 30x on its annualised 9MFY22 net earnings of RM83m – may set a valuation reference for the growing dairy farming business of RHONEMA (notwithstanding its relatively smaller market cap size of RM164.6m).

• On the chart, an upward shift in the share price is anticipated as: (i) the Parabolic SAR indicator is signalling an uptrend, (ii) the MACD indicator has crossed above the signal line in an oversold area, and (iii) the DMI Plus has cut over the DMI Minus.

• With that, the stock could climb towards our resistance thresholds of RM0.83 (R1; 11% upside potential) and RM0.89 (R2; 19% upside potential).

• We have set our stop loss price level at RM0.67 (or a 10% downside risk from yesterday’s closing price of RM0.745).

Source: Kenanga Research - 22 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024