Kenanga Research & Investment

Daily technical highlights – (DIALOG, OWG)

kiasutrader

Publish date: Tue, 29 Mar 2022, 11:03 AM

Dialog Group Bhd (Trading Buy)

- Chart-wise, the stock began trending downwards beginning November 2020 from RM3.95 to a low of RM2.31 in September2021 before rising by 32% to move in a symmetrical triangle pattern.

- The stock is likely to breakout above the symmetrical triangle pattern on the back of rising Parabolic SAR couple with theMACD line trending above the signal line.

- With that, the stock could rise to challenge our resistance levels of RM3.07 (R1; 11% upside potential) and RM3.33 (R2; 20%upside potential).

- We have pegged our stop loss at RM2.54, which represents a downside risk of 8%.

- DIALOG provides technical services to the upstream, midstream and downstream sectors in the oil, petrochemical and gasindustry. The group generates majority of its revenue from the Malaysian segment as the segment contributes c.50% to thegroup’s revenue.

- For 1HFY22, the group’s revenue rose by 54% from RM0.7b in 1HFY21 to RM1.1b in 1HFY22 thanks to the increasedactivities in the upstream, midstream and downstream activities in the Malaysian segment. Despite the higher revenue, thegroup’s core PATAMI remained flattish – RM256.7m (1HFY22) vs. RM256.4m (1HFY21) - due to poorer project mix coupledwith higher project costs resulting in poorer margins.

- Going forward, consensus is predicting the group to report a core net profit of RM571.1m in FY22 and RM637.6m in FY23,which translates to PER of 28.0 and 24.3x for FY22 and FY23, respectively.

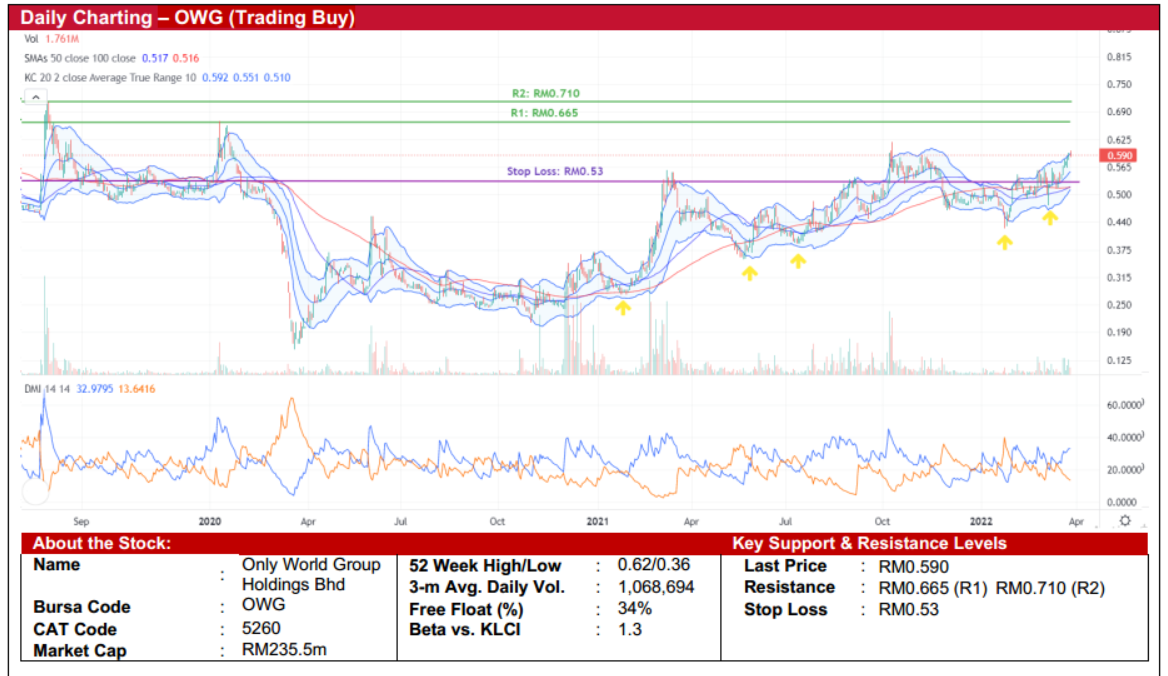

Only World Group Holdings Bhd (Trading Buy)

- Chart-wise, the stock has been trending higher from January 2021 onwards as indicated by the formation of higher lows.

- The 50-day SMA has crossed over the 100-day SMA, forming a golden cross, thus, suggesting the long-term uptrendmomentum is likely to continue.

- We believe the stock’s momentum will remain bullish as: (i) the gap between the DMI Plus and DMI Minus has widened, and(ii) the stock is hovering around the upper boundary of the Keltner Channel.

- Thus, the stock will likely rise further and challenge our resistance levels of RM0.665 (R1; 13% upside potential) andRM0.710 (R2; 20% upside potential).

- On the downside, our stop loss price has been set at RM0.53, which translates to a downside risk of 10%.

- Business-wise, the group is engaged in providing leisure and hospitality services and thereby have three key segments: - (i)food service, (ii) amusement and (iii) recreation operations and other service segment.

- For the group’s latest results, the group’s revenue dropped by 5% from RM19.0m in 6MFY20 to RM18.1m in FY21 which wasmainly dragged down by the food service segment as the total lockdown implemented from 1 June 2021 and 10 October2021 restricted businesses from operating. Despite the drop in revenue, core LATAMI decreased by 40% to RM11.2m fromRM18.1m in 6MFY20, thanks to improved performance in Q2FY21 due to the lifting of interstate travel and the strict costinitiatives taken by the group.

- Moving forward, we believe the group stands to benefit from the reopening of borders in 2QCY22 as the nation transitions tothe endemic phase of covid-19.

Source: Kenanga Research - 29 Mar 202

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments