Kenanga Research & Investment

Daily Technical Highlights – (BONIA, RESINTC)

kiasutrader

Publish date: Fri, 01 Apr 2022, 09:47 AM

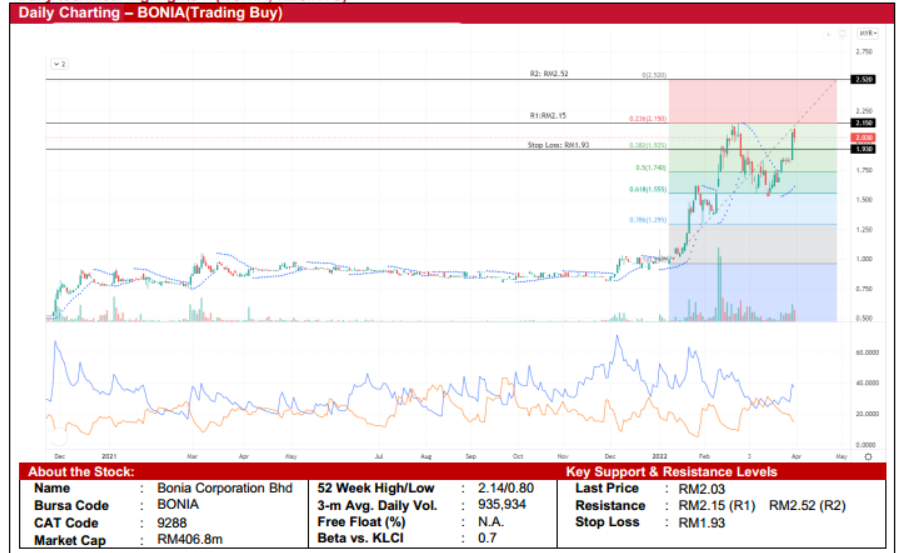

Bonia Corporation Bhd (Trading Buy)

- Chart-wise, Bonia’s shares were moving sideways pattern from April 2021 before plotting an uptrend. Recently, the stock hasformed higher highs, indicating continued buying interest for the stock.

- With the DMI Plus trending above the DMI Minus and given that the Parabolic SAR indicator is also heading upwards, theprice is expected to shift higher ahead.

- Based on the Fibonacci extension lines, the stock could rise to challenge our resistance levels of RM2.15 (R1; 6% upsidepotential) and RM2.52 (R2: 24% upside potential)

- On the downside, our stop loss has been set at RM1.93, which translates to a downside risk of 5%

- Business-wise, BONIA is involved in the retail of leatherwear, footwear, men’s apparel, and accessories.

- Earnings-wise, the group posted a core net profit of RM19.4m in 2QFY22 (vs. core net loss of RM4.8m) thanks to (i) strongrecovery of shopping malls traffic after the lockdown restriction lifted in Sept 2021 coupled with the year-end festive seasonsshopping, (ii) increase in e-commerce sales, (iii) investment on digital marketing to enhance their brand presence in socialmedia space

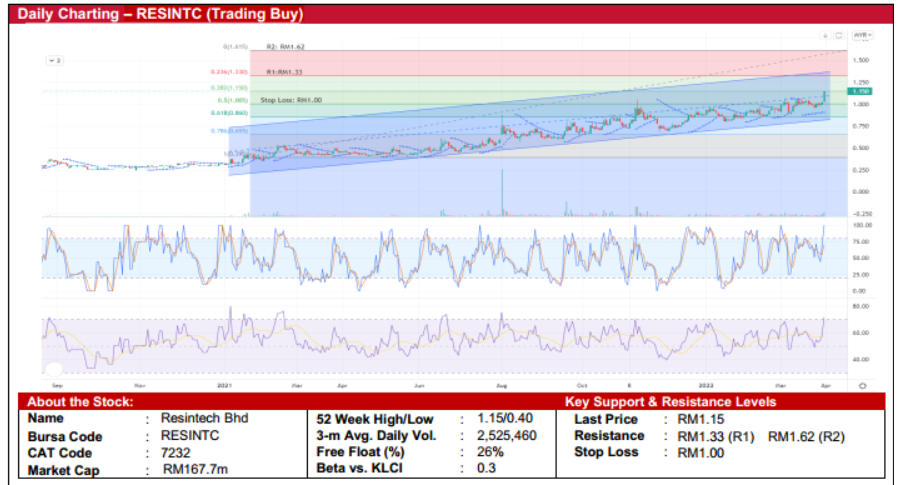

Resintech Bhd (Trading Buy)

- The formation of a long bullish candlestick showed a strong buying momentum in RESINTC shares as the bulls pushed theshare price up by 12.8% from RM1.03 the day before.

- The share prices have been trading at an ascending price channel that began in early Jan 2021 and had been forming higherhighs and higher lows recently.

- We believe the upward momentum is likely to continue as: (i) the Parabolic SAR is on an upward trend, (ii) thestochastic’s %K line has crossed over the %D line, and (iii) the RSI is heading upwards.

- • With that, RESINTC’s share price could climb towards our resistance threshold of RM1.33 (R1; 16% upside potential) andRM1.62 (R2; 41% upside potential).

- Our stop loss price level is set at RM1.00 (or a downside risk of 15%).

- RESINTC is engaged in the manufacturing and marketing of diversified plastic building materials.

- Earnings-wise, RESINTC reported revenue of RM21.5m (+10% QoQ) in 3QFY21, mainly driven by higher sales volume dueto the resumption of economic activities, while the group’s net profit rose by >100% to RM1.7m.

Source: Kenanga Research - 1 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments