Daily technical highlights – (MCEMENT, HUMEIND)

kiasutrader

Publish date: Tue, 05 Apr 2022, 09:09 AM

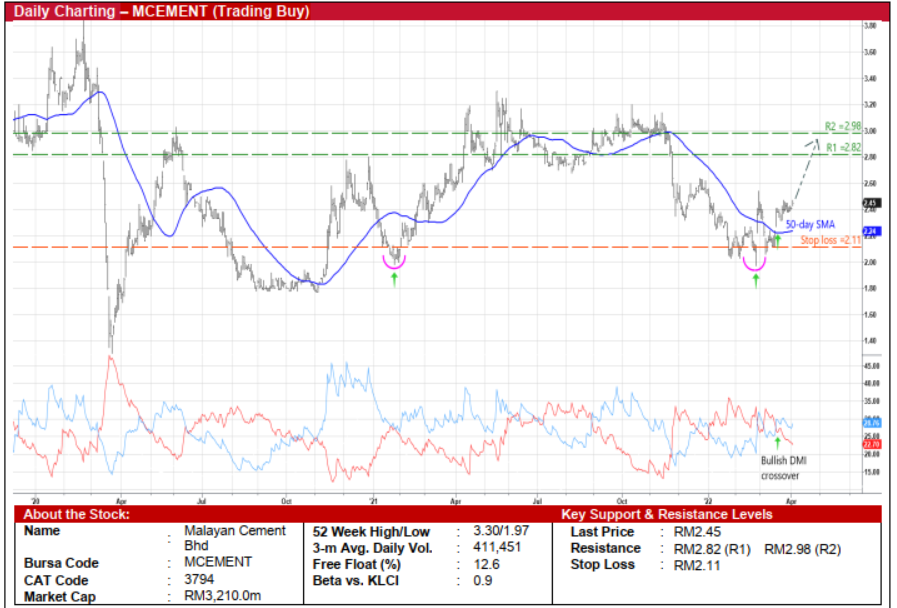

Malayan Cement Bhd (Trading Buy)

• MCEMENT – which is the largest cement manufacturer in Malaysia following the completion of its acquisition of YTL Cement’s entire cement and ready-mixed concrete businesses in September 2021 – stands to benefit from rising cement demand (amid a pick-up in property and infrastructure activities) and higher cement selling prices (which have increased by an average of 19% over the last two years according to a recent REHDA industry survey).

• Reflecting its improved fundamentals, the enlarged group turned around with net profit of RM54.9m in 2QFY22 (versus net losses of RM4.9m in 2QFY21 and RM23.7m in 1QFY22). This brought 1HFY22’s bottomline to RM31.2m (compared with net loss of RM6.2m in 1HFY21).

• Going forward, consensus is forecasting MCEMENT to make net earnings of RM59.5m in FY June 2022 and RM125.4m in FY June 2023.

• Valuation-wise, based on its book value per share of RM4.37 as of end-December 2021, the stock is currently trading at an attractive Price/Book Value multiple of 0.56x (or approximately 2 SD below its historical mean).

• On the chart, after bouncing off from a double-bottom reversal pattern recently, MCEMENT shares are in the midst of plotting an upward trajectory.

• Riding on the technical strength that is backed by the double bullish crossovers of the share price beyond the 50–day SMA and the DMI Plus above the DMI Minus, the stock could advance towards our resistance targets of RM2.82 (R1) and RM2.98 (R2). This represents upside potentials of 15% and 22%, respectively.

• Our stop loss price level is pegged at RM2.11 (or a 14% downside risk from the last traded price of RM2.45).

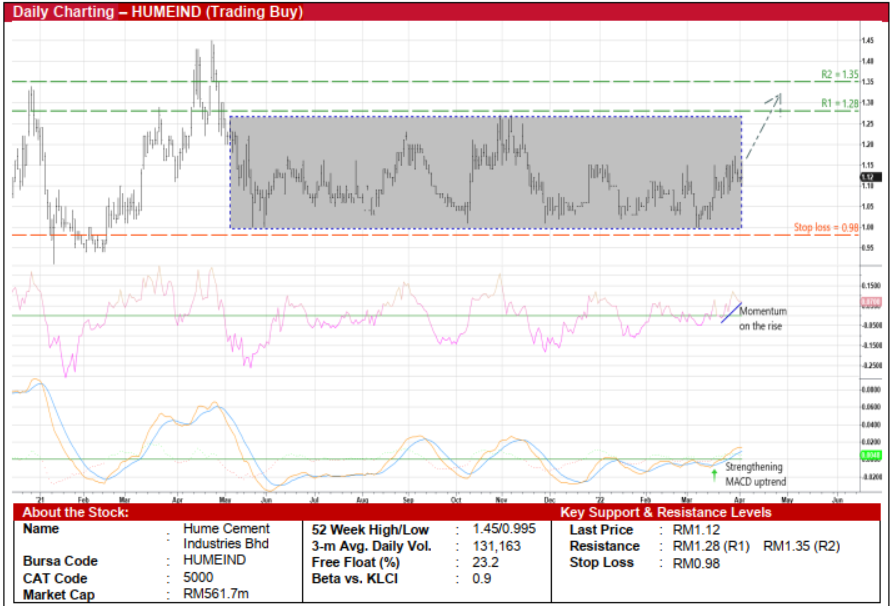

Hume Cement Industries Bhd (Trading Buy)

• HUMEIND is involved in the manufacturing and sale of: (i) cement & cement related products, and (ii) concrete & concrete related products.

• After seeing red in the preceding three quarters, the group staged a turnaround with net profit of RM7.6m in 2QFY22 (versus 2QFY21’s net profit of RM0.3m and 1QFY22’s net loss of RM11.3m), which took cumulative net loss to RM3.7m in 1HFY22 (versus 1HFY21’s net profit of RM1.9m).

• Forward earnings will likely be better as its fundamentals will be underpinned by rising cement demand (amid a pick-up in property and infrastructure activities) and higher cement selling prices (which have increased by an average of 19% over the last two years according to a recent REHDA industry survey).

• Based on its book value per share of RM0.72 as of end-December 2021, the stock is presently trading at a Price/Book Value multiple of 1.56x (or at 0.5SD above its historical mean).

• Technically speaking, HUMEIND shares may be on the way to reach the upper end of a rectangle formation, to be driven by the rising momentum indicator (which has cut above the zero-line) and the strengthening MACD signal.

• An ensuing breakout from the rectangle pattern could push the share price to challenge our resistance thresholds of RM1.28 (R1; 14% upside potential) and RM1.35 (R2; 21% upside potential).

• We have placed our stop loss price level at RM0.98 (representing a 12% downside risk).

Source: Kenanga Research - 5 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024