Daily technical highlights – (OPENSYS, XINHWA)

kiasutrader

Publish date: Wed, 06 Apr 2022, 08:41 AM

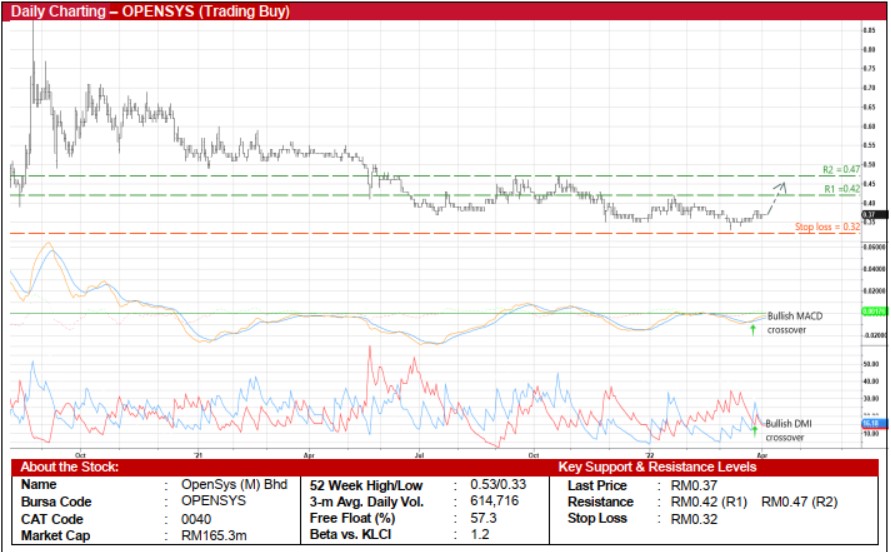

OpenSys (M) Bhd (Trading Buy)

• After sliding from a peak of RM0.85 in late August 2020 to a trough of RM0.33 early last month, a technical rebound could be forthcoming for OPENSYS shares (which closed at RM0.37 amid higher-than-average trading volume yesterday).

• An upward shift in the share price is now anticipated following the bullish crossings by the MACD over the signal line and the DMI Plus above the DMI Minus recently.

• With that, the stock is expected to advance towards our resistance thresholds of RM0.42 (R1; 14% upside potential) and RM0.47 (R2; 27% upside potential).

• We have set our stop loss price level at RM0.32 (or a 14% downside risk).

• Business-wise, OPENSYS derives its income from four revenue models: (i) outright sales of cash recycling machines and cheque deposit machines to financial institutions, (ii) software development services, (iii) outsourcing services via the deployment of bill payment kiosks to utility, insurance and telecommunication companies, and (iv) maintenance services of the machines. The group also operates a dedicated online solar energy platform (buySolar), which is an online marketplace for renewable energy focussing on solar solutions and financing.

• The group made net profit of RM3.4m (-10% YoY) in 4QFY21, which took its full-year net earnings to RM11.0m (flat YoY) for FY December 2021.

• A key investment merit is OPENSYS’ financially strong position, backed by net cash & short-term investments of RM41.0m (or 9.2 sen per share) as of end-December last year.

• In terms of recent corporate development, OPENSYS will be transferring its listing to the Main Board (likely by end-3Q22), which is expected to boost its appeal to a wider group of investors going forward.

Xin Hwa Holdings Bhd (Trading Buy)

• After bouncing off from a recent trough of RM0.25 in mid-March this year (which coincided with a previous low in mid-August 2019), a double-bottom reversal formation could be in the making for XINHWA shares.

• With the Parabolic SAR in an uptrend mode and the MACD crossing over the signal line, the share price will probably continue its upward trajectory ahead.

• The strengthening technical momentum may then push the stock towards our resistance thresholds of RM0.32 (R1; 14% upside potential) and RM0.36 (R2; 29% upside potential).

• Our stop loss price level is placed at RM0.24 (representing a 14% downside risk from yesterday’s close of RM0.28).

• A proxy to the transportation and warehousing & distribution industry, XINHWA is an integrated logistics player offering a wide array of logistics solutions via the provision of: (i) land transport services (comprising cargo transportation and container haulage), (ii) warehouse & distribution services, and (iii) manufacturing & fabrication of trailers.

• It has recently completed building an e-fulfilment centre in Shah Alam, Selangor, adding approximately 300,000 sq ft to boost its total warehousing space by 46% to 954,000 sq ft. In the longer term, there are plans to construct an integrated logistics solutions hub on a 44-acre land in Pasir Gudang, Johor.

• Earnings-wise, the group reported net profit of RM2.2m (-1% YoY) in 3QFY22, lifting its 9MFY22’s bottomline to RM1.9m (+28% YoY).

Source: Kenanga Research - 6 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024