Daily technical highlights – (EVERGRN, OFI)

kiasutrader

Publish date: Thu, 07 Apr 2022, 09:14 AM

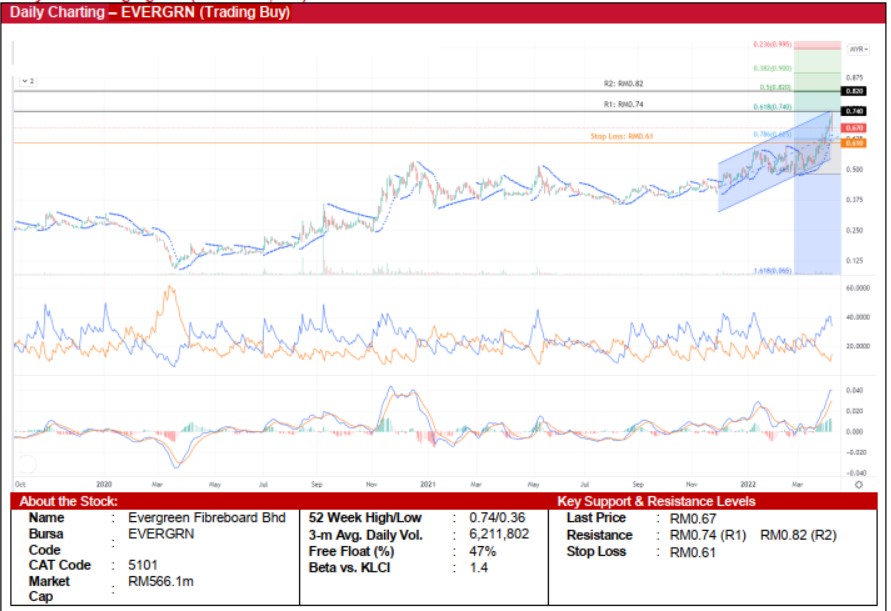

Evergreen Fibreboard Bhd (Trading Buy)

• After treading sideways from Jul 2021 until late Nov 2021, EVERGRN’s share price broke away to form an ascending price channel. It recently overcame a resistance level at RM0.58 (which was previously tested in mid-Jan and mid-Feb 2022) to extend the upward trajectory.

• With the Parabolic SAR showing an uptrend and the DMI Plus trending above the DMI Minus, the share price is expected to shift higher ahead.

• Based on the Fibonacci extension lines, the stock could rise to challenge our resistance levels of RM0.74 (R1: 10% upside potential) and RM0.82 (R2: 22% upside potential).

• We have pegged our stop loss price at RM0.61, representing a 9% downside risk.

• Business-wise, EVERGRN is engaged in the manufacturing and sale of medium-density fibreboard and knock-down wooden furniture.

• EVERGRN returned to the black with a net profit of RM35.7m in FY21 (vs. a net loss of RM102.8m previously), mainly due to higher average selling prices and better productivity arising from its process reengineering initiative.

• Based on consensus forecasts, the group is expected to record a net profit of RM66.3m in FY December 2022 and RM85.2m in FY December 2023, translating to forward PERs of 8.6x and 6.7x, respectively.

Oriental Food Industries Holdings Bhd (Trading Buy)

• Chart-wise, after falling from a double-top reversal pattern to a low of RM0.88 in end-Dec 2021, OFI shares have since rebounded to form higher highs recently.

• With the Parabolic SAR trending upwards and coupled with a bullish MACD signal, the stock is expected to climb further towards our resistance targets of RM1.14 (R1: 11% upside potential) and RM1.23 (R2: 19% upside potential).

• On the downside, our stop loss price has been set at RM0.94 (or a downside risk of 9%).

• Business-wise, OFI is involved in the manufacturing and sale of snack food, confectionery and biscuit products.

• Following a 47% QoQ increase in revenue to RM88.3m in 3QFY22 (vs. 2QFY22’s RM59.9m), thanks to higher sales volume in the local and export markets, the group’s net profit jumped by 72% QoQ from RM4.4m to RM7.6m in 3QFY22. This brought 9MFY22’s bottomline to RM13m (+15% YoY).

Source: Kenanga Research - 7 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024