Daily technical highlights – (ACME, HPPHB)

kiasutrader

Publish date: Fri, 08 Apr 2022, 09:14 AM

ACME Holdings Bhd (Trading Buy)

• Following its sideway movements from mid-April 2021 until September 2021, ACME’s share price plunged to a trough of RM0.155 in mid-December 2021 before reversing direction to form higher lows thereafter.

• Yesterday, the stock plotted a long bullish candlestick to pull away from the positive sloping trendline.

• The rising momentum is expected to persist following: (i) the recent formation of a golden crossover by the 20-day SMA above the 50-day SMA, and (ii) the upward trend shown by the A/D and OBV indicators.

• With that, the stock could rise to challenge our resistance levels of RM0.285 (R1; 12% upside potential) and RM0.31 (R2; 22% upside potential).

• We have pegged our stop loss at RM0.23, which represents a downside risk of 10%.

• Business-wise, the group is involved in the manufacturing of plastic components and property development.

• For its latest results, the group’s revenue dropped by 50% YoY to RM9.2m in 9MFY22 from RM18.3m in 9MFY21, which was adversely affected by the movement control order (re-implemented from 1 June 2021 to 11 October 2021). As a result, core net earnings plunged from RM0.7m in 9MFY21 to a core net loss of RM2.3m in 9MFY22. Still, with the resumption of economic activities since then, its bottom-line may improve in the coming quarters.

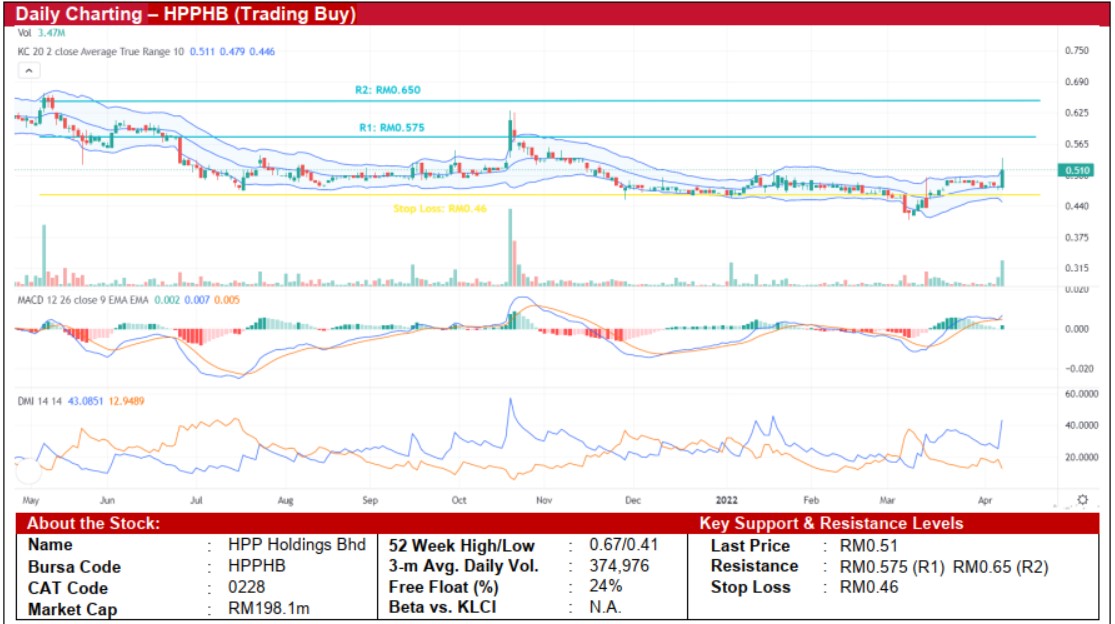

HPP Holdings Bhd (Trading Buy)

• Chart-wise, HPPHB’s share price has formed a long bullish candlestick yesterday, which then lifted it from the mid-line to the upper boundary of the Keltner Channel, indicating bullish momentum.

• We believe the stock will likely strengthen further on the back of positive technical signals from the: (i) rising MACD histogram, and (ii) the widening gap between the DMI Plus and DMI Minus.

• Thus, the stock could rise further and challenge our resistance levels of RM0.575 (R1; 13% upside potential) and RM0.65 (R2; 27% upside potential).

• On the downside, our stop loss price has been set at RM0.46, which translates to a downside risk of 10%.

• Business-wise, HPPHB – which was listed in January 2021 – is engaged in the provision of packaging services (ranging from corrugated/non-corrugated packaging to production of rigid boxes).

• For 1HFY22 ended November 2021, the group’s revenue dropped by 24% YoY from RM57.9m previously to RM43.8m mainly due to lower contribution from the trading of rigid boxes and paper-based packaging. In line with the lower revenue, the group’s core net profit reduced by 59% YoY from RM8.0 to RM3.2m. The weaker bottom-line was also due to higher expenses such as staff cost resulting from the granting of employees’ share option scheme (ESOS).

Source: Kenanga Research - 8 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024