Daily technical highlights – (LIONIND, MASTEEL)

kiasutrader

Publish date: Tue, 12 Apr 2022, 09:14 AM

Lion Industries Corporation Bhd (Trading Buy)

• LIONIND’s business outlook is expected to strengthen following the completion (on 10 December 2021) of its disposal of an entire 100% stake in Antara Steel Mills (which produces hot-briquetted iron) for USD165.6m (or approximately RM697.7m).

• The group plans to utilise the bulk of the cash proceeds: (i) to expand into the flat steel business (RM212m), (ii) to fund new investment/business ventures (RM231m), and (iii) for working capital requirements (RM250m).

• Thereafter, LIONIND could emerge as a stronger niche player in the steel industry with exposure in both the long steel products (catering mainly to the construction sector) and the flat steel products (used mostly by the manufacturing and engineering industries).

• For the 18-month period ended December 2021, LIONIND (which is changing its financial year-end to 31 December) reported net profit of RM490.3m, lifted predominantly by exceptional gains totalling RM587.2m.

• Forward earnings will be underpinned by an anticipated pick-up in construction and manufacturing activities post the Covid- 19 pandemic as well as elevated steel prices (up 38% over the last two years according to a recent REHDA industry survey).

• A key investment merit is the group’s sound balance sheet backed by net cash holdings of RM508.8m (74.7 sen per share, which is more than its existing share price of 61 sen) as of end-2021.

• Valuation-wise, based on its book value per share of RM2.66 as of end-December last year, the shares are currently trading at a Price/Book Value multiple of 0.23x (or at 0.5 SD below its historical mean).

• Technically speaking, in view of the bullish DMI crossover and strengthening MACD signal, LIONIND’s share price will probably be making its way to the upper range of a rectangle formation.

• An ensuing breakout from the rectangle pattern – which may be forthcoming when the 50-day SMA overcomes the 100-day SMA – could propel the stock towards our resistance thresholds of RM0.71 (R1; 16% upside potential) and RM0.77 (R2; 26% upside potential).

• We have placed our stop loss price level at RM0.52 (or 15% downside risk from yesterday’s closing price of RM0.61).

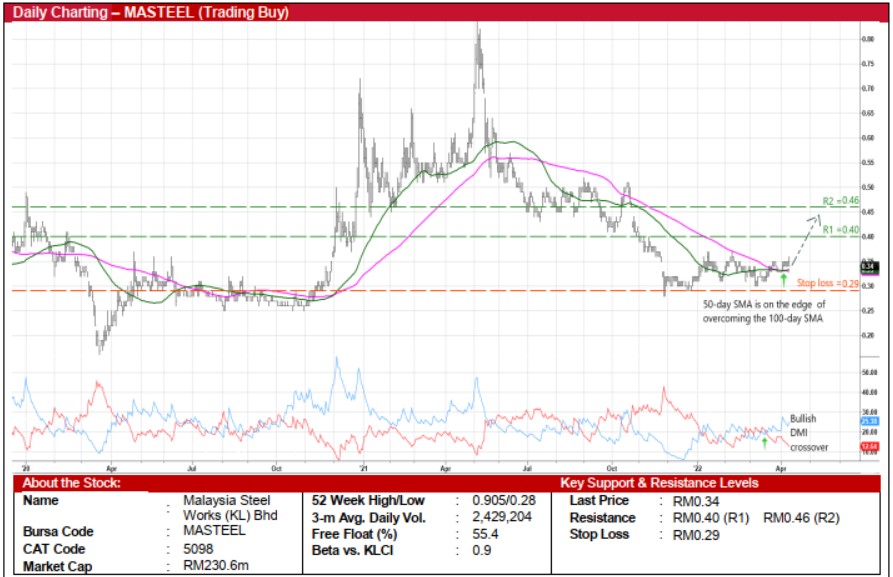

Malaysia Steel Works (KL) Bhd (Trading Buy)

• After swinging sideways since end-November last year, MASTEEL shares may be in a position to shift higher ahead.

• A technical breakout for the share price – riding on the recent bullish crossover by the DMI Plus above the DMI Minus – is likely when the 50-day SMA cuts above the 100-day SMA anytime soon.

• With that, the stock could advance towards our resistance targets of RM0.40 (R1) and RM0.46 (R2), translating to upside potentials of 18% and 35%, respectively.

• We have set our stop loss price level at RM0.29 (or a 15% downside risk).

• An integrated steel manufacturer focusing on the production of high-tensile deformed steel bars, mild steel round bars and steel billets (which are mostly used in the construction and infrastructure sectors), MASTEEL is a proxy to rising construction activities amid higher steel prices (up 38% over the last two years based on a recent REHDA industry survey) as the economy recovers from the Covid-19 pandemic.

• Earnings-wise, the group posted net profit of RM12.0m (+47% YoY) in 4QFY21, taking its full-year bottomline to RM32.5m for FY December 2021 (versus FY20’s net loss of RM14.7m), as overall performance was boosted mainly by a recovery in the selling prices of steel products in the local and international markets.

• In terms of valuation, based on its book value per share of RM1.24 as of end-December 2021, the stock is currently trading at a Price/Book Value multiple of 0.27x (or at 0.5 SD below its historical mean).

Source: Kenanga Research - 12 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024