Daily technical highlights – (CJCEN, KRETAM)

kiasutrader

Publish date: Thu, 21 Apr 2022, 08:50 AM

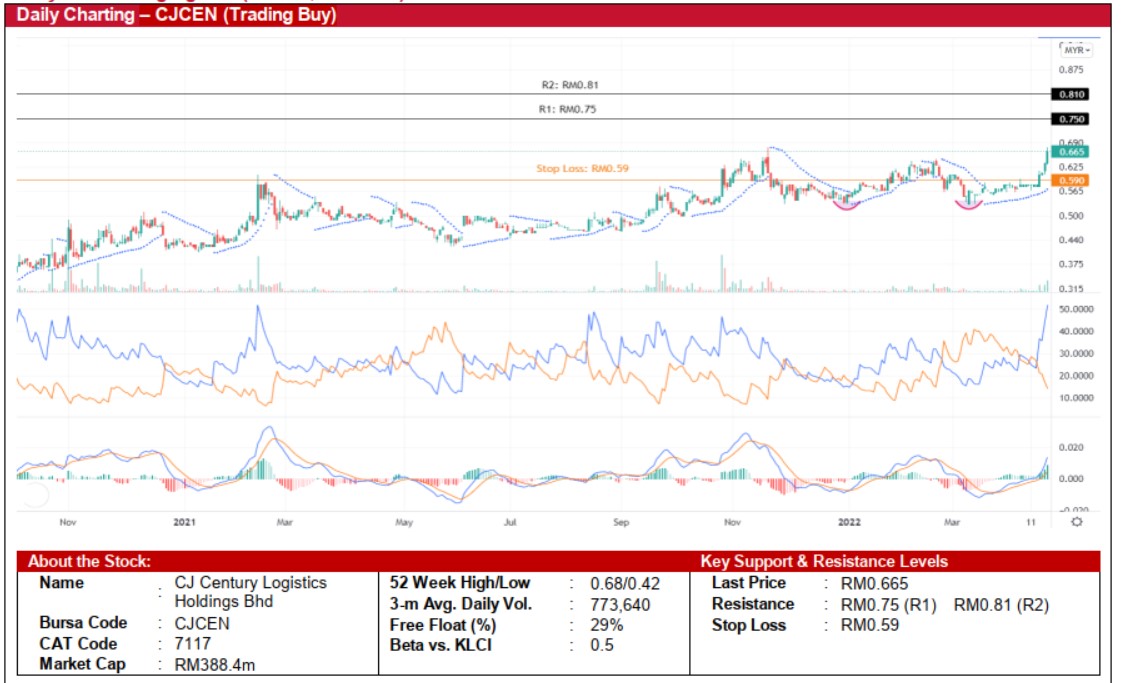

CJ Century Logistics Holdings Bhd (Trading Buy)

• Chart-wise, CJCEN’s share price has recently bounced off from a double-bottom pattern, reversing from a low of RM0.53 in early March 2022 (which mirrors its previous low at the end of December 2021).

• A recent breakout from an ensuing consolidation phase, by forming bullish long candlesticks amid strong buying interest, then lifted the shares to close at RM0.665 yesterday.

• We believe the stock will likely strengthen further on the back of positive technical signals arising from: (i) the ongoing Parabolic SAR uptrend, (ii) the DMI Plus hovering above the DMI Minus, and (iii) the bullish MACD indicator with a rising histogram.

• An upward movement in the share price could challenge our resistance levels of RM0.75 (R1; 13% upside potential) and RM0.81 (R2: 22% upside potential).

• We have pegged our stop loss at RM0.59, which represents a downside risk of 11%.

• Founded in 1970, CJCEN is engaged in the provision of supply chain solutions and logistic services.

• For the latest quarterly result in 4QFY21, CJCEN’s revenue rose by 19% QoQ to RM204.2m (vs. 3QFY21’s RM172.0m), bringing its full-year revenue to RM843.0m (+43% YoY), thanks to higher volumes handled by the Total Logistics Services segment. However, the group’s net profit dipped by 61% QoQ to RM6.1m, bringing its full-year net profit to RM18.9m (-43% YoY) despite the recognition of a RM8.2m gain on disposal of a subsidiary (which is involved in the courier services business).

• Nevertheless, forward earnings will likely improve in tandem with a pick-up in economic activities post the Covid-19 business disruptions.

Kretam Holdings Bhd (Trading Buy)

• After peaking at RM0.815 in early March 2022, KRETAM’s share price dipped by 30% to a low of RM0.57 in mid-March 2022, which was followed by a swift rebound to close at RM0.68 yesterday.

• With the Parabolic SAR still showing an uptrend and coupled with the stochastic’s %K line’s recent crossover above the %D, we anticipate the stock will continue its upward momentum ahead.

• With that, the stock could be on its way to challenge our resistance targets of RM0.77 (R1: 13% upside potential) and RM0.82 (R2: 21% upside potential).

• We have pegged our stop loss price level at RM0.60 (or a 12% downside risk).

• Business-wise, KRETAM is involved in the provision of plantation and palm oil mill management, as well as stockbroking services.

• Earnings-wise, KRETAM reported a jump in net profit by 170% QoQ to RM83.5m in 4Q21 (vs. 3QFY21’s RM30.9m), which brought the full-year bottomline to RM149.4m (+196% YoY) for FY December 2021, lifted mainly by higher selling prices (in tandem with the surge in commodity prices) and higher production volumes. The strong earnings momentum is expected to sustain on account of the prevailing elevated CPO prices.

Source: Kenanga Research - 21 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024